After responding to the uncertainty brought on by COVID, healthcare companies now find themselves responding to economic uncertainty, rather than conducting business as usual. Now, only around half of healthcare executives are optimistic about the future of the national economy in the US.1 This divided outlook requires treasurers to balance goals for growth with the need to proceed cautiously.

While navigating uncertainty, digital transformation is simultaneously making an impact on the healthcare industry. New technology, like artificial intelligence and telehealth capabilities, along with innovative business models aim to solve a fundamental challenge: how to provide better care at lower costs for more people.

To thrive in this period of change and uncertainty, healthcare companies are using digital solutions as a springboard for opportunity. This requires an understanding of imminent challenges, an analysis of capability gaps, and an evaluation of merger and acquisition opportunities, while managing regulatory changes.

Navigating uncertainty for healthcare incumbents

Healthcare businesses, including both B2B and B2C businesses, will need to tackle pressing economic challenges in the short-term while establishing a foundation for future innovation and growth.

-

Inflation and supply chain challenges

Increased costs for labor and supplies are impacting day-to-day operations across industries, and healthcare is no exception. Businesses across the interconnected healthcare ecosystem are facing increased costs thanks to inflation. Despite the impact of higher prices for supplies and labor, 91% of healthcare leaders expect to maintain or increase revenue and sales, and 87% expect to maintain or increase profits.2 To do so, they will need to optimize working capital in order to retain liquidity and monetize inventory.

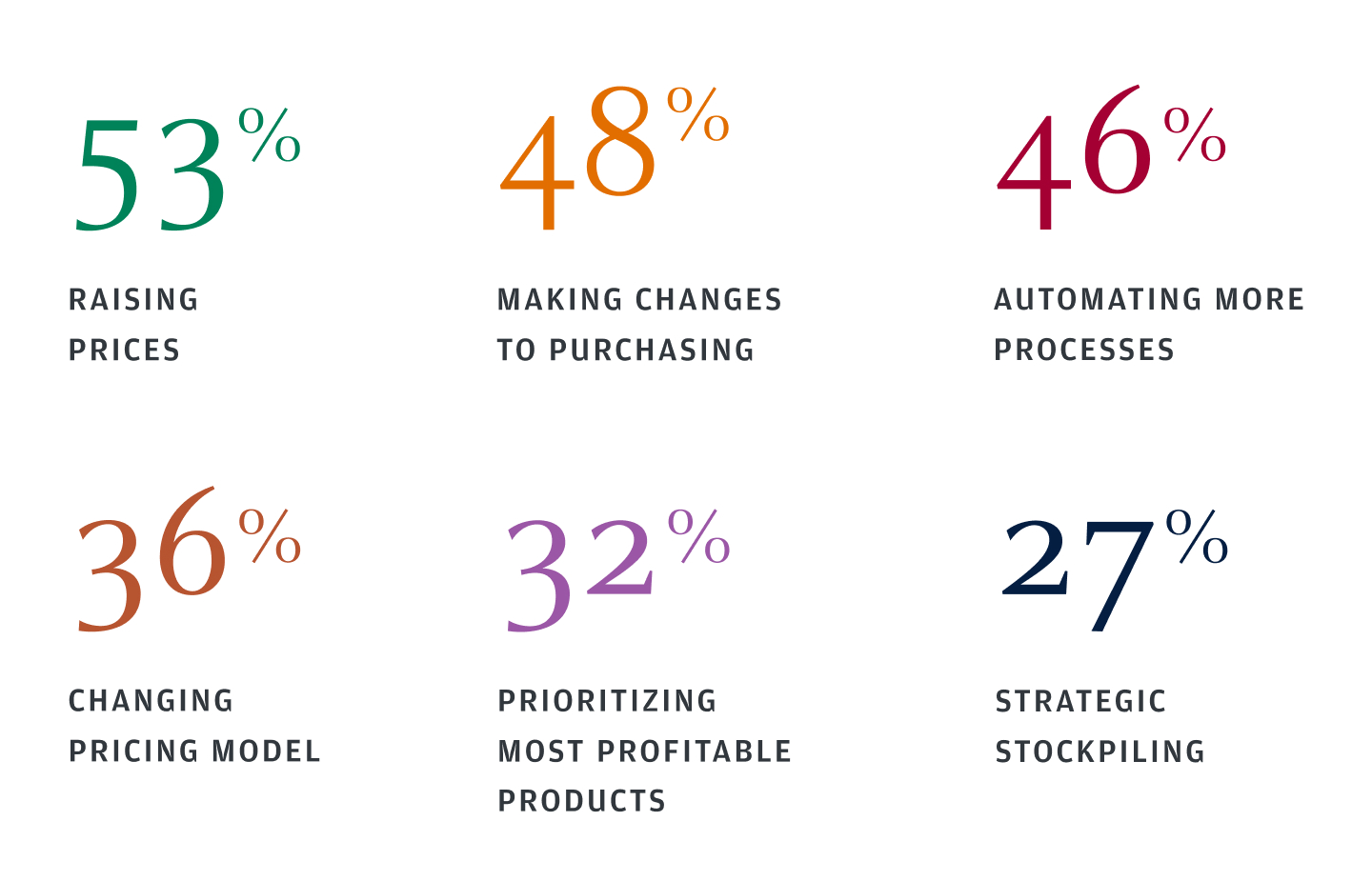

Top ways companies are adapting to inflation*

*Source: 2023 Business Leaders Outlook: Healthcare. https://www.jpmorgan.com/commercial-banking/insights/healthcare-business-leaders-outlook

Supply chain disruption, which has impacted manufacturers across industries in recent years, has underscored the importance of supply chain resiliency. Providers, pharmacies and even manufacturers have needed to strategically stockpile products that are the most profitable. Rather than leveraging just-in-time inventory management strategies, just-in-case strategies can increase resiliency by building a reserve of in-demand inventory to minimize possible supply chain disruption or shortages. Supply chain finance solutions can complement inventory restructuring efforts to offer dynamic discounting and scalability, making it easier to ensure long-term financial stability.

-

Expectations vs. uncertainty: impacting patient experience

The impact of economic uncertainty isn’t limited to B2B concerns. Higher costs have impacted consumer spending, leaving patients searching for lower-cost alternatives or avoiding care altogether. Patients that do seek care are expected to navigate the complex, fragmented healthcare ecosystem, which still relies heavily on in-person interactions. As a result, consumers may struggle to manage the multitude of care and payment interactions that can span across providers, healthcare operators, insurance, pharmacies and more.

In response to this fragmented experience, nine in 10 industry leaders identified at least one way they plan to evolve beyond traditional models of care.3 A majority are considering in-home care (52%) and virtual care (51%) as options to extend care beyond traditional methods of delivery.4 Others are leveraging technology in new ways, like using artificial intelligence to aid in health maintenance, problem diagnosis, drug discovery, clinical administration, and care.5 This shift can reduce costs and optimize resources as elements of caregiving shift from in-person to technology-enabled care. Similarly, the use of cloud services will likely help scale healthcare IT infrastructure, helping to reduce costs in the long-term.

This innovative thinking can extend into unique partnerships, inspiring new entrants to the healthcare space as industries converge. For example, grocery delivery company Instacart has started offering delivery for prescriptions in partnership with nearly 200 Costco pharmacy locations in the United States. By doing so, pharmacies can make it easier for consumers to manage and refill prescriptions, which can help populations manage health conditions more effectively.

Evolving business models in healthcare

Capability gaps may best be solved with merger and acquisition activity, including vertical integration or horizontal consolidation.

-

Vertical integration

In the past, healthcare businesses may have been limited to managing one isolated component of the healthcare ecosystem, focusing on a particular element of care. Through vertical integration, multiple elements of the ecosystem are consolidated under one brand. For example, CVS Health acquired Oak Street Health to broaden primary care capabilities with an emphasis on value-based care.

Vertical integration allows for greater efficiencies across consumer-facing and B2B processes. By consolidating groups, payment flows move from disjointed systems to one integrated payment ecosystem, which can contribute to faster pay-in and pay-out processes that benefit consumer and business alike.

-

Horizontal consolidation

For pharmaceutical businesses, horizontal consolidation via acquisition may make more sense. Expansion through acquisition can allow larger pharmaceutical companies to decrease the time and cost of research and development by acquiring businesses which have completed R&D for new drugs. For example, Pfizer has strategically acquired oncology-focused biotech firms to bolster their capabilities within the field. By acquiring another business after the R&D phase of drug production, larger pharmaceutical brands can focus on manufacturing and distribution to expedite time to market.

Horizontal integration can also help to simplify payment flows and increase efficiency and scale between disconnected groups. Handling payments to external groups like clinical trial participants and manufacturers through one payment platform can minimize friction in the payment process and provide a consolidated view of cash flows.

-

New entrants: Non-healthcare players

Mergers and acquisitions aren’t limited to businesses within the healthcare space. A number of non-healthcare businesses have explored acquisitions that complement their core capabilities, allowing them to use existing systems to support care delivery. In one such case, Amazon’s $3.9 billion acquisition of One Medical leveraged existing shipping and distribution capabilities to provide faster shipping for prescriptions.

Making the jump into healthcare can also serve as a strategic tactic for brick-and-mortar businesses looking to drive foot traffic. Walmart’s increased expansion for Walmart Health locations points to the success of the strategy, with locations offering a full suite of health services across primary care, vision, dental and more.

-

M&A considerations for healthcare

Prior to a merger or acquisition, healthcare brands should consider core business strategies for capability gaps across care, technology, distribution, and accessibility. Regulatory concerns like patient data security must remain top of mind to ensure a smooth integration between legacy systems.

To adhere to HIPAA compliance standards, prioritizing cybersecurity is crucial. In a recent study, more than two-thirds (71%) of those surveyed indicated they have been directly impacted by cyberattacks in the second half of 2022. As healthcare businesses continue to invest in digital transformation, incorporating cybersecurity and fraud prevention from the beginning can prevent security breaches down the line.

Cyberattacks can target more than sensitive medical data and can include consumer financial information. Healthcare businesses should look to established financial partners to have payment information stored securely, rather than storing that information themselves. This can minimize risk and simplify data storage and security.

Value-based care benefits

Regardless of the type of acquisition, the goal for healthcare businesses remains the same: deliver better care proactively and at a lower cost. Whether that means offering primary care services in a local Walmart or making it easier to get to a preventative care appointment with Uber Health, value-based care (VBC) is at the forefront of healthcare innovation. VBC works to prevent expensive treatment with proactive care and wellness strategies.

VBC distributes risks and rewards between payers and providers, and uses bundled pricing rather than a fee-for-service. It incentivizes managing health proactively with wellness programs, measured outcomes, and cost-effective care. This impacts existing payment flows and potential benefits from services such as programmable payments, structured trade and wallets.

Government healthcare programs like the National Health Service in the UK or the Centers for Medicare and Medicaid Services in the US are increasingly leveraging VBC models. Government-sponsored models set per-patient reimbursement maximums for providers, incentivizing lower-cost care to increase profitability. This, in turn, should drive prioritization of preventative care and holistic wellness to decrease cost, minimize emergency care and decrease symptomatic treatment.

Adapting to a complex macroeconomic environment

Thriving during economic headwinds isn’t the same for every business. Whether acquisition, supply chain finance solutions, or working capital optimization is the right solution, healthcare businesses will need the stability of a global bank with experience navigating uncertainty. J.P. Morgan Payments is here to help. Get in touch with your representative to learn more, or read about how payments power healthcare ecosystems here.