Contributors

Thomas Kennedy

Chief Investment Strategist, J.P. Morgan Private Bank

U.S. Head of Investment Strategy

Senior Markets Economist

Harry Downie

Global Investment Strategist

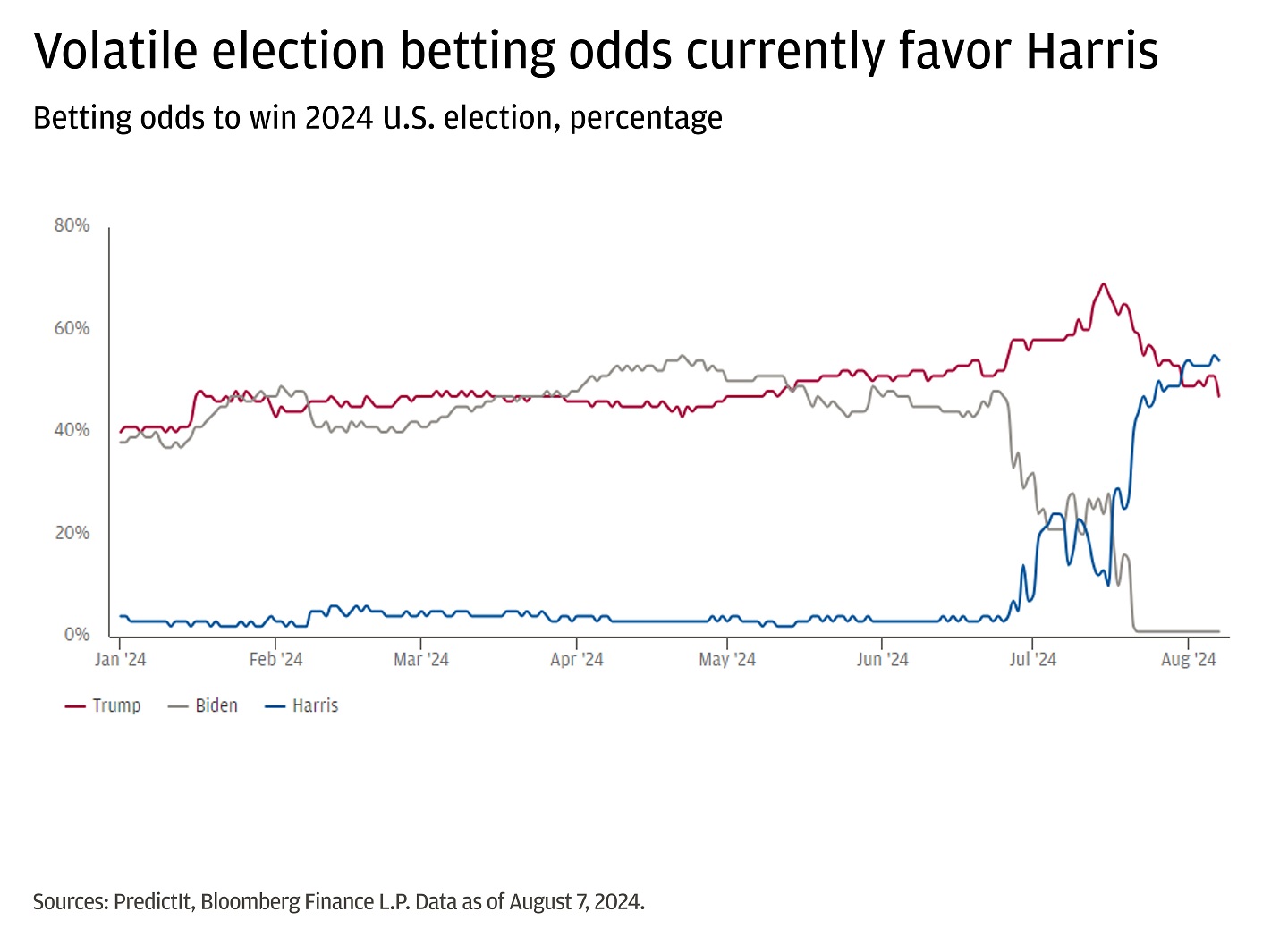

Investors have absorbed a flurry of election news in recent weeks – the assassination attempt on former President Donald Trump, President Joe Biden’s withdrawal from the race and Vice President Kamala Harris’s rapid ascension as the Democratic nominee. Election odds now favor a Harris victory, but with months to go to the election, it’s anyone’s race.

Elections (and other geopolitical events) do not typically have a lasting impact on equity markets.1 But short-term impacts can be meaningful, and you’d be forgiven if you thought this time might be different.

At this point, we mostly expect a continuation of the status quo under a Harris administration, though she has announced policy proposals for housing, taxes and other priorities in August. Meanwhile, the Republican party released its updated policy agenda during the Republican National Convention in July.2 Here, we analyze four key issues – trade policy, taxes, immigration and industrial spending – that could change the status quo should former President Trump be re-elected.

Trade policy: How might tariffs impact growth and inflation?

Trump and Biden have used tariffs (taxes paid by U.S. importers of foreign goods) to bolster national defense and increase the global competitiveness of domestic industries. Trump now advocates a 10% baseline tariff on all imported goods and a 60% (or higher) tariff on goods from China.3 But if Trump’s proposed tariffs were fully implemented, they could lower real U.S. gross domestic product (GDP) by 0.3% to 0.5% in 2025, according to our calculations.

Sweeping tariffs could also deliver a one-time shock to inflation, but this sharp immediate impact would likely fade over time. More – and faster – permitting and leasing in the oil and gas complex could also provide a disinflationary offset, possibly pushing oil prices down 10% to 15% if supply rises.

We estimate that the net impact of tariffs and lower energy prices could lead to a 1.5% to 2% jump in the Consumer Price Index (CPI) on a year-on-year basis.4 These reflationary expectations are likely one of the reasons that interest rates rose and the yield curve steepened when betting odds for a Trump presidency increased.

However, it’s worth noting that the final impact of tariffs could be more modest than our estimates suggest. The proposals could be narrowed, and will likely spark legal challenges, as they have previously. Further, the impact could lessen if the tariffs are staggered over time or if custom duties are recycled into targeted industry subsidies that help companies from passing on the costs to consumers.

Our analysis finds that if Trump’s proposals were fully implemented, the impact on major trading peers would be less inflationary than in the United States, but likely more detrimental to growth. Said differently, we expect tariffs to slow growth disproportionately for goods exporters and raise inflation disproportionately for goods importers. For example, we estimate a potential 0.7% hit to eurozone GDP, roughly twice as large as in the United States, but just a 0.2% (or less) increase in European inflation.5

Such divergence could have implications for the relative monetary policy stance in each region and thus, the euro-U.S. dollar exchange rate. In isolation, Trump’s tariff policy would likely continue to underpin U.S. dollar strength.6

Taxes: Which 2017 tax cuts might be extended?

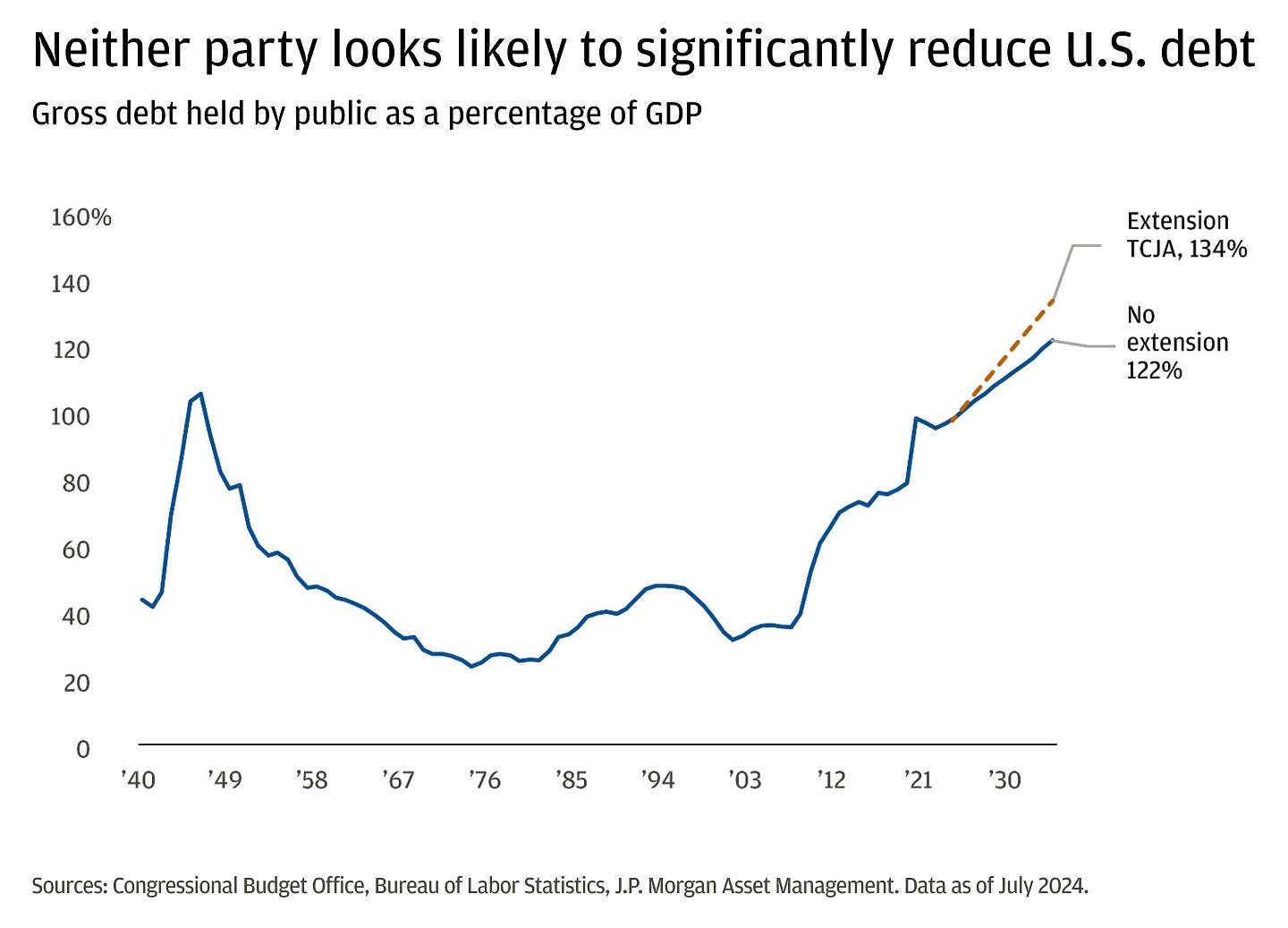

Whoever wins the November U.S. election, the individual provisions of the 2017 Tax Cut and Jobs Act (TCJA) will expire at the end of 2025.7 If they are not extended, tax rates for most individual taxpayers would rise between 1% and 4%.8 The law’s corporate tax cut, which lowered rates from 35% to 21%, has no sunset provision.

Trump has said that he would like to extend the law in its entirety, and has even proposed lowering the corporate rate further. Harris has said she would not raise taxes on individuals earning less than $400,000 a year.9

If all the TCJA’s provisions are extended, we would expect near-term growth expectations to rise as high as +0.7% of real GDP. Higher growth comes at the cost of an even higher fiscal deficit. The Congressional Budget Office estimates that the fiscal deficit would increase by nearly $5 trillion from fiscal years 2025 to 2034 (as a share of GDP, this would be equivalent to a roughly 1.4 percentage point sustained increase in the fiscal deficit).10 Of course, rising deficits would only exacerbate the U.S. government’s already elevated levels of federal debt.

At the moment, neither party looks poised to dramatically reduce the U.S. debt burden. That dynamic, along with the potential for growth upside from even lower tax rates, could put further upward pressure on longer-dated yields and keep bond market volatility high into 2025.

Immigration: How would new restrictions affect labor markets?

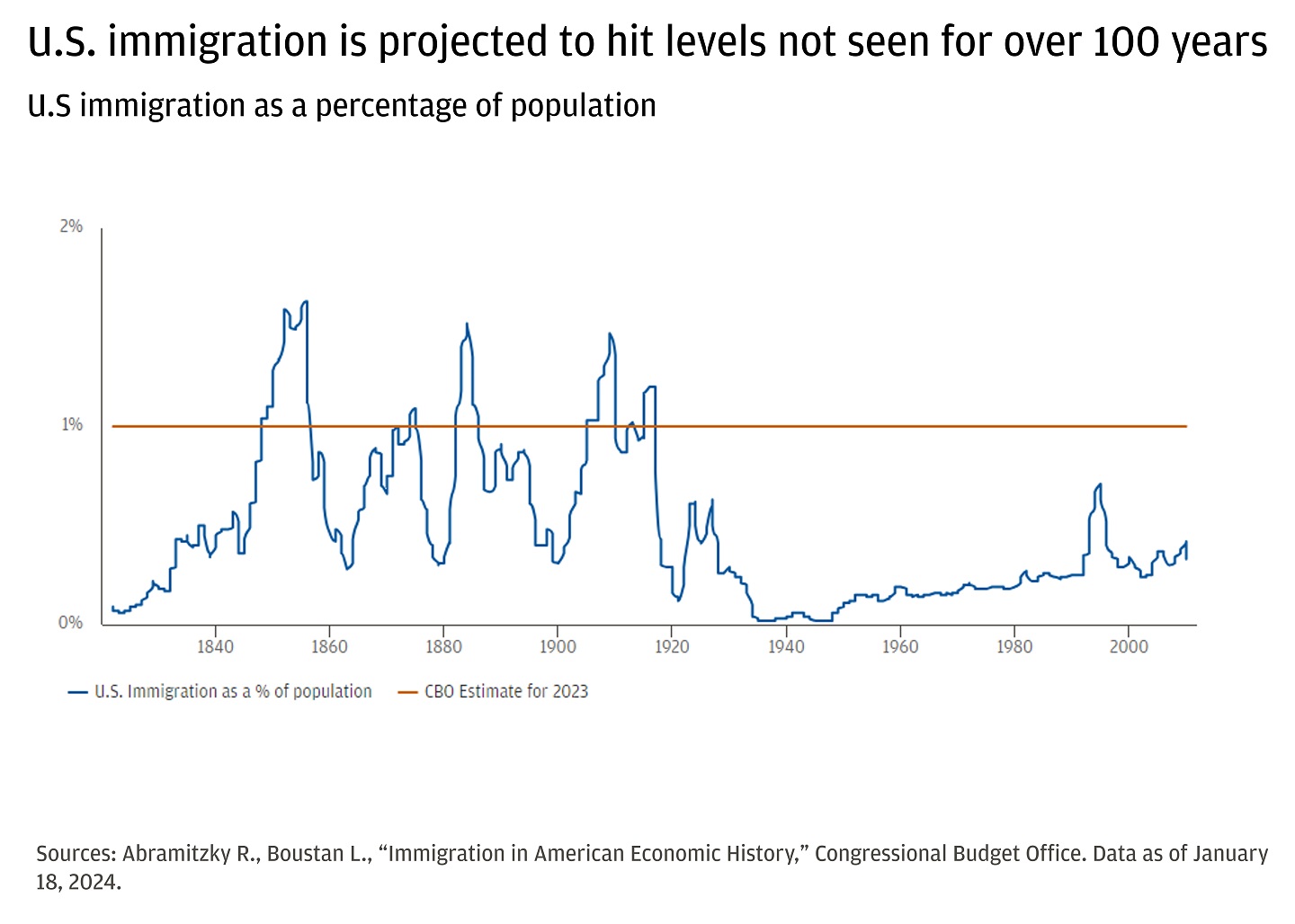

For many years, immigration has been a sensitive political issue in the United States (and many other developed economies). Since 1986, the U.S. Congress has enacted no new immigration laws. As a result, presidents of both parties have used executive orders to address the issue, though nearly all orders have faced legal challenges.

According to recent Gallup Polls, Americans consider immigration to be one of the bigger issues facing the nation.11 The issue is now a focus of both Democrats and Republicans. In June, Biden signed an executive order to shut down the border under certain circumstances and to limit asylum protection. We expect more of the same under Harris.

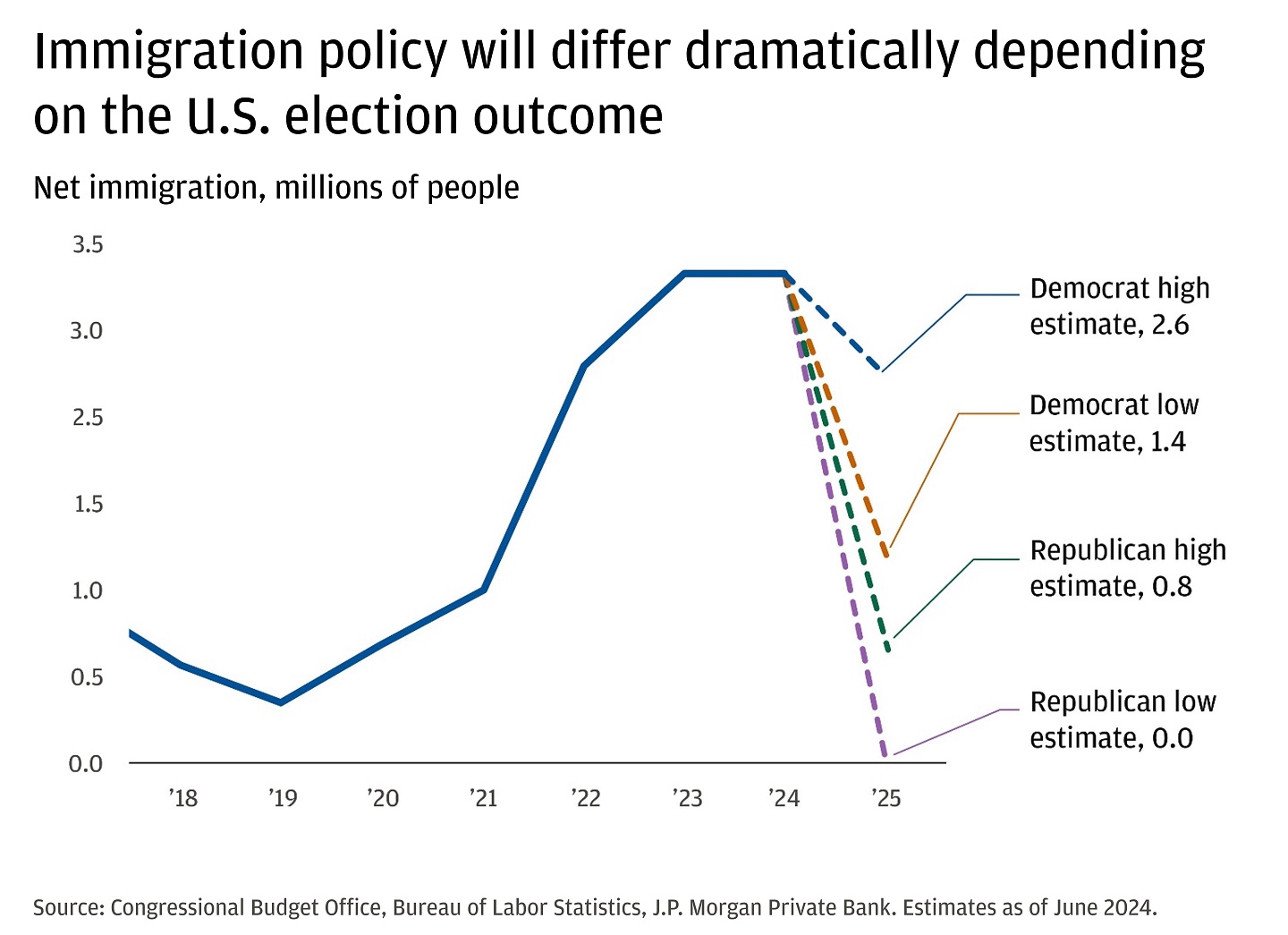

Trump has proposed mass deportations of undocumented immigrants should he win the 2024 election. It should be noted, though, that while Trump called for deporting 11 million migrants when he was president, deportations averaged only 300,000 per year between 2017 and 2020.12

What are the economic implications of changes to immigration policy?

Over the past two years, immigrants have significantly boosted the U.S. labor supply. This has supported economic growth and added to monthly payrolls gains without materially boosting inflation. Directionally, we would expect the reverse to happen were we to see a material drop in immigration. However, it’s important to differentiate between a reduction in the flow of immigrants entering the United States versus a large deportation of the number of existing immigrants in the country.

History suggests the deportation scenario is unlikely. The chart below shows plausible outcomes for immigration after the election, corresponding to an estimated impact on U.S. real GDP ranging from 0% to 0.6%.

Industrial policy: Where will the spending go?

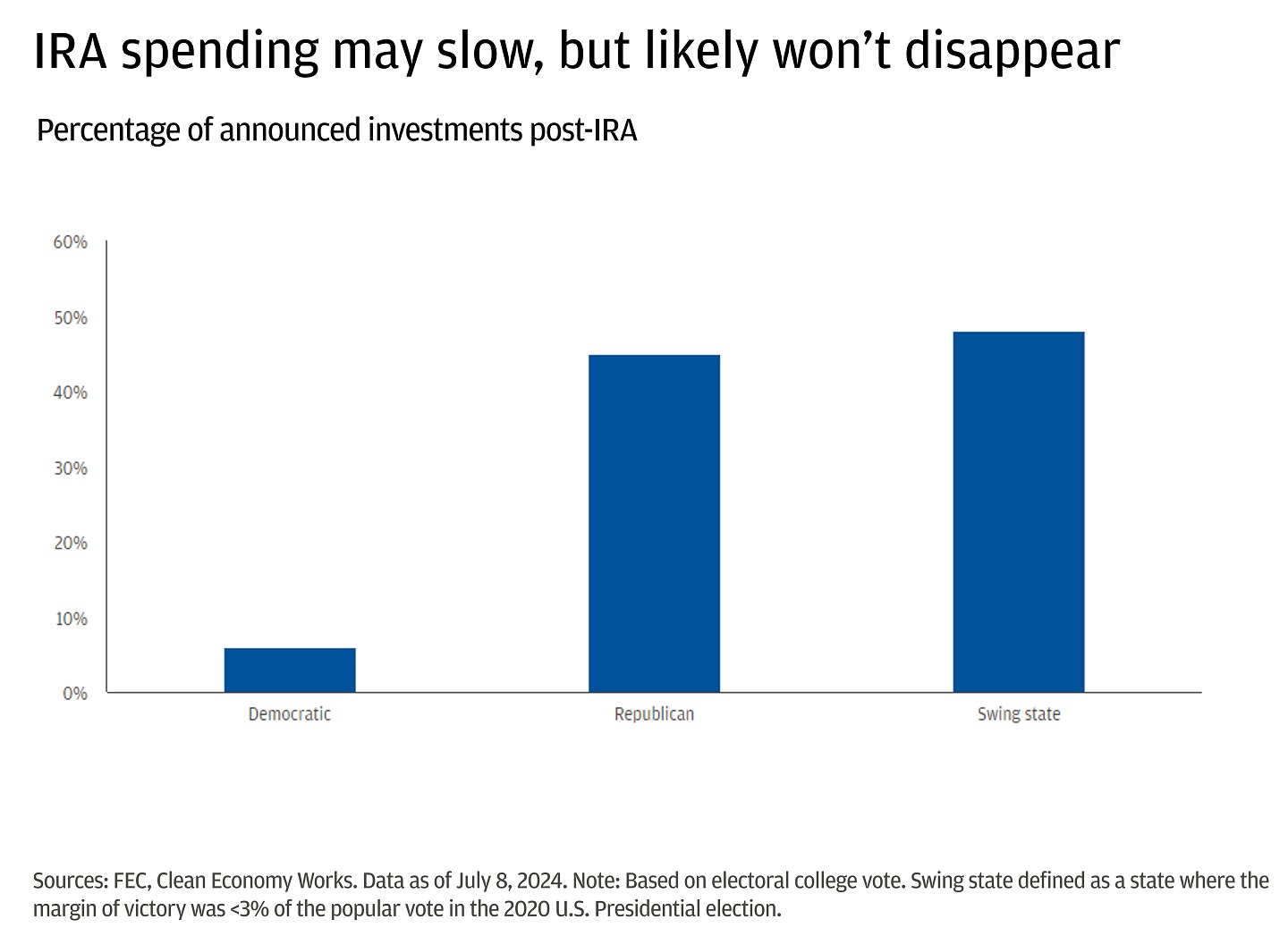

J.P. Morgan Investment Bank estimates that the Biden administration’s Inflation Reduction Act (IRA) and Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act have stimulated close to $500 billion in announced private investments in semiconductor and clean tech manufacturing facilities. This has been a crucial support to business investment outlays in what would otherwise be a capital investment environment challenged by high interest rates. We would expect the status quo to persist under a Harris administration.

Opposition to the green transition by Trump could pose a risk to parts of IRA and CHIPS act spending. Republicans could slow IRA-related lending by the Department of Energy and reduce some subsidies, but we’d expect that much of the IRA support would likely continue. The majority of IRA and CHIPS Act spending is occurring in traditionally Republican or swing states. Thus, even if Republicans take control of both the House and Senate, the party may soften its opposition to IRA and CHIPS Act spending to appeal to their constituents. In addition, while Republican policies would likely challenge capital investment in renewables, the party remains supportive of fossil fuel capital expenditures (capex).

Conclusion: Some macro risks, but cycle fundamentals are still solid

As we have noted, we currently expect a continuation of the status quo under a Harris administration. Our analysis suggests another Trump administration could be reflationary and a modest headwind to economic growth. However, increased energy supply and lower taxes could work to offset those dynamics.

We can help

Your J.P. Morgan advisor is here to help you better understand the risks and opportunities of the upcoming U.S. election.

References

J.P. Morgan Private Bank, “How do geopolitical shocks impact markets?” (May 24, 2024).

American Presidency Project, “2024 Republican Party Platform.” (July 8, 2024).

Donald J. Trump Fox Business Interview as of August 23, 2023.

To arrive at this result, we utilize the Peterson Institute’s estimate of the tariff cost to middle-income families (equivalent to a tax increase of about $1,700 annually) and the FRB/US large-scale econometric model.

The reason for the muted impact on Eurozone inflation is that European imports from the United States account for a minimal (2% of) GDP share. This is also assuming Europe would retaliate to U.S. tariffs in kind.

There is a risk that a Trump-controlled U.S. Treasury could take a more activist approach intended to weaken the dollar in global markets. We acknowledge the uncertainty, but we are skeptical of what a unilateral effort to weaken the dollar might look like. Nevertheless, we will be watching for any concrete proposals.

Tax Foundation, “A Look Ahead at Expiring Tax Provisions.” (January 18, 2018).

Internal Revenue Service and J.P. Morgan. Data as of December 31, 2019.

Tax Policy Center. “Harris: No Tax Hikes For Those Making Under $400,000.” (July 29, 2024).

Congressional Budget Office, Bureau of Labor Statistics, J.P. Morgan Asset Management. Data as of July 2024.

Gallup. “Sharply More Americans Want to Curb Immigration to U.S.” (July 12, 2024).

Migration Policy Institute, “The Biden Administration Is on Pace to Match Trump Deportation Numbers – Focusing on the Border, Not the U.S. Interior.” (June 27, 2024).

Connect with a Wealth Advisor

Our Wealth Advisors begin by getting to know you personally. To get started, tell us about your needs and we’ll reach out to you.

IMPORTANT INFORMATION

The information presented is not intended to be making value judgments on the preferred outcome of any government decision or political election.

This material is for informational purposes only, and may inform you of certain products and services offered by J.P. Morgan’s wealth management businesses, part of JPMorgan Chase & Co. (“JPM”). Products and services described, as well as associated fees, charges and interest rates, are subject to change in accordance with the applicable account agreements and may differ among geographic locations. Not all products and services are offered at all locations. If you are a person with a disability and need additional support accessing this material, please contact your J.P. Morgan team or email us at accessibility.support@jpmorgan.com for assistance. Please read all Important Information.

GENERAL RISKS & CONSIDERATIONS. Any views, strategies or products discussed in this material may not be appropriate for all individuals and are subject to risks. Investors may get back less than they invested, and past performance is not a reliable indicator of future results. Asset allocation/diversification does not guarantee a profit or protect against loss. Nothing in this material should be relied upon in isolation for the purpose of making an investment decision. You are urged to consider carefully whether the services, products, asset classes (e.g. equities, fixed income, alternative investments, commodities, etc.) or strategies discussed are suitable to your needs. You must also consider the objectives, risks, charges, and expenses associated with an investment service, product or strategy prior to making an investment decision. For this and more complete information, including discussion of your goals/situation, contact your J.P. Morgan representative.

NON-RELIANCE. Certain information contained in this material is believed to be reliable; however, JPM does not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. No representation or warranty should be made with regard to any computations, graphs, tables, diagrams or commentary in this material, which are provided for illustration/reference purposes only. The views, opinions, estimates and strategies expressed in this material constitute our judgment based on current market conditions and are subject to change without notice. JPM assumes no duty to update any information in this material in the event that such information changes. Views, opinions, estimates and strategies expressed herein may differ from those expressed by other areas of JPM, views expressed for other purposes or in other contexts, and this material should not be regarded as a research report. Any projected results and risks are based solely on hypothetical examples cited, and actual results and risks will vary depending on specific circumstances. Forward-looking statements should not be considered as guarantees or predictions of future events.

Nothing in this document shall be construed as giving rise to any duty of care owed to, or advisory relationship with, you or any third party. Nothing in this document shall be regarded as an offer, solicitation, recommendation or advice (whether financial, accounting, legal, tax or other) given by J.P. Morgan and/or its officers or employees, irrespective of whether or not such communication was given at your request. J.P. Morgan and its affiliates and employees do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any financial transactions.

Legal Entity and Regulatory Information.

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

Bank deposit accounts and related services, such as checking, savings and bank lending, are offered by JPMorgan Chase Bank, N.A. Member FDIC.

This document may provide information about the brokerage and investment advisory services provided by J.P. Morgan Securities LLC (“JPMS”). The agreements entered into with JPMS, and corresponding disclosures provided with respect to the different products and services provided by JPMS (including our Form ADV disclosure brochure, if and when applicable), contain important information about the capacity in which we will be acting. You should read them all carefully. We encourage clients to speak to their JPMS representative regarding the nature of the products and services and to ask any questions they may have about the difference between brokerage and investment advisory services, including the obligation to disclose conflicts of interests and to act in the best interests of our clients.

J.P. Morgan may hold a position for itself or our other clients which may not be consistent with the information, opinions, estimates, investment strategies or views expressed in this document. JPMorgan Chase & Co. or its affiliates may hold a position or act as market maker in the financial instruments of any issuer discussed herein or act as an underwriter, placement agent, advisor or lender to such issuer.