Contributors

Head of Global FX Strategy, J.P. Morgan Private Bank

Paul Jacobson

Municipal Credit Analyst, J.P. Morgan

Global Investment Strategist, J.P. Morgan Wealth Management

Market update

U.S. consumers are not convinced about the prudence of the White House’s strategy. Consumer confidence fell to the lowest level in four years in March, largely due to concerns about higher prices and the economic outlook amid escalating trade policy uncertainty. Their expectations for the future also darkened. The expectations component of the index fell to the lowest level in 12 years. Equity investors looking for a silver lining should know that spikes in policy uncertainty and troughs in consumer sentiment counterintuitively augur stronger forward returns ahead. Sometimes, it really is the darkest before the dawn.

Economic data this week also signaled some reprieve. The Citi U.S. Economic Surprise Index (which measures how economic data is coming in relative to economist expectations) has increased from -16.5 in February to -4.6 now. Indeed, it seems like “hard” measures of economic data are holding up much better than the “soft” data derived from people’s perceptions.

Until we hit first-quarter earnings season (J.P. Morgan announces in just two weeks), Washington will likely continue to dominate the debate. We are focused on three risks: tariffs, municipal bond tax status and the Mar-a-Lago accord.

Three risks emanating from Washington

Trade uncertainty has reached the highest level on record, advisors to the administration have reignited a 15-year-old debate on municipal bond tax exemption and the White House could be looking for ways to weaken the dollar.

Here is our take on those three risks, listed in order of our assessment of most to least likely and impactful.

1. What’s at stake with tariffs? April 2, ”Liberation Day,” is now less than one week away.

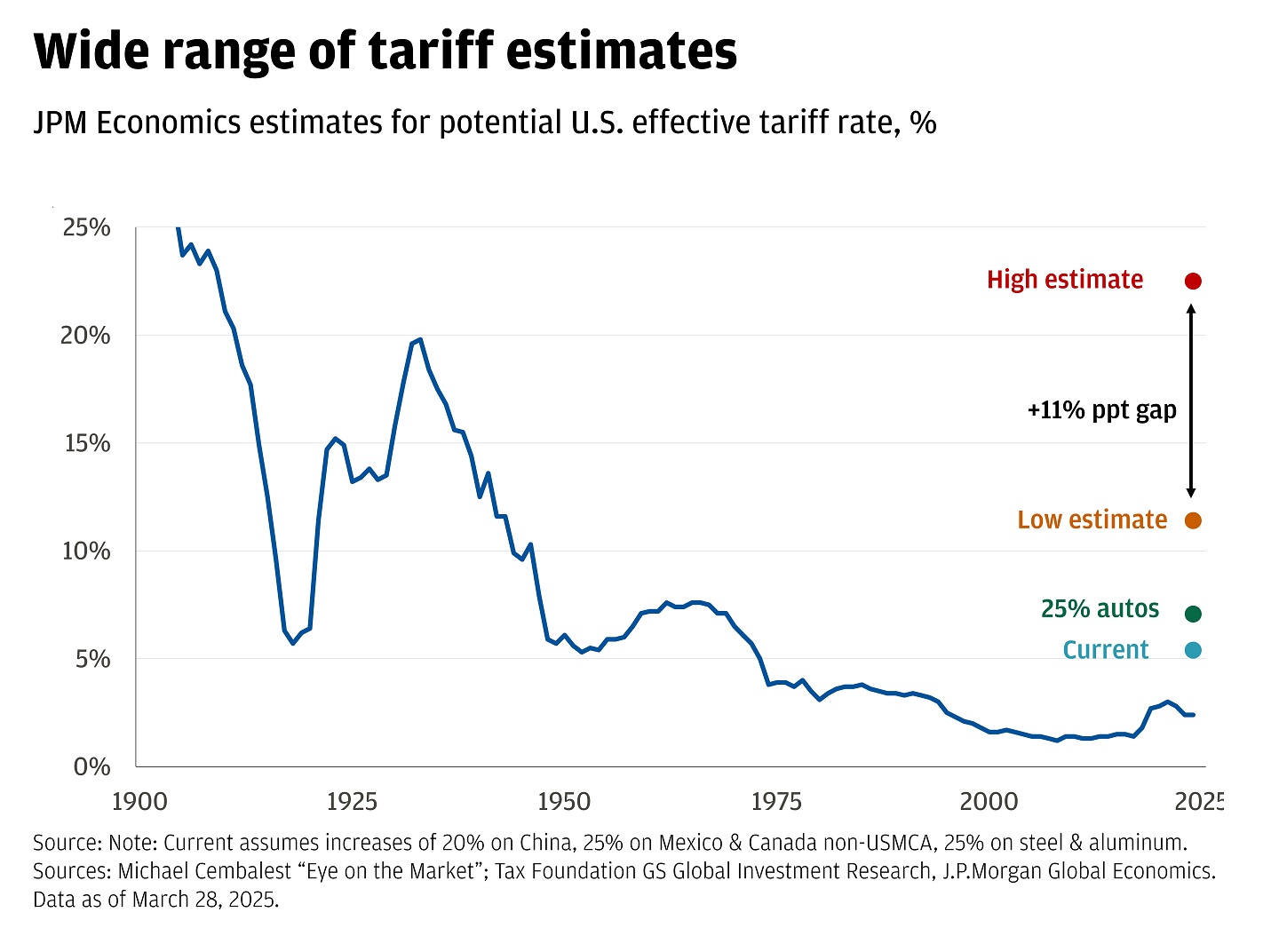

What’s at stake? The market agrees that tariff rates are heading higher, but there is tremendous uncertainty over just how high they will go. At over 10 percentage points, the range of estimates on where the U.S. effective tariff rate will land is wider than the overall tariff rate itself has ever been in post-war America.

There is a wide range of goals the administration appears to be trying to solve with tougher trade policies: remedying trade deficits, raising government revenue, ensuring reciprocity/fairness for U.S. business interests abroad, safeguarding national security-related supply chains and securing the border from immigrants and drugs. Crafting a single tariff strategy that encompasses all of these goals in such a short time will be challenging. During the 2018 trade war, it took officials 326 days to investigate and enact tariffs on Chinese imports.

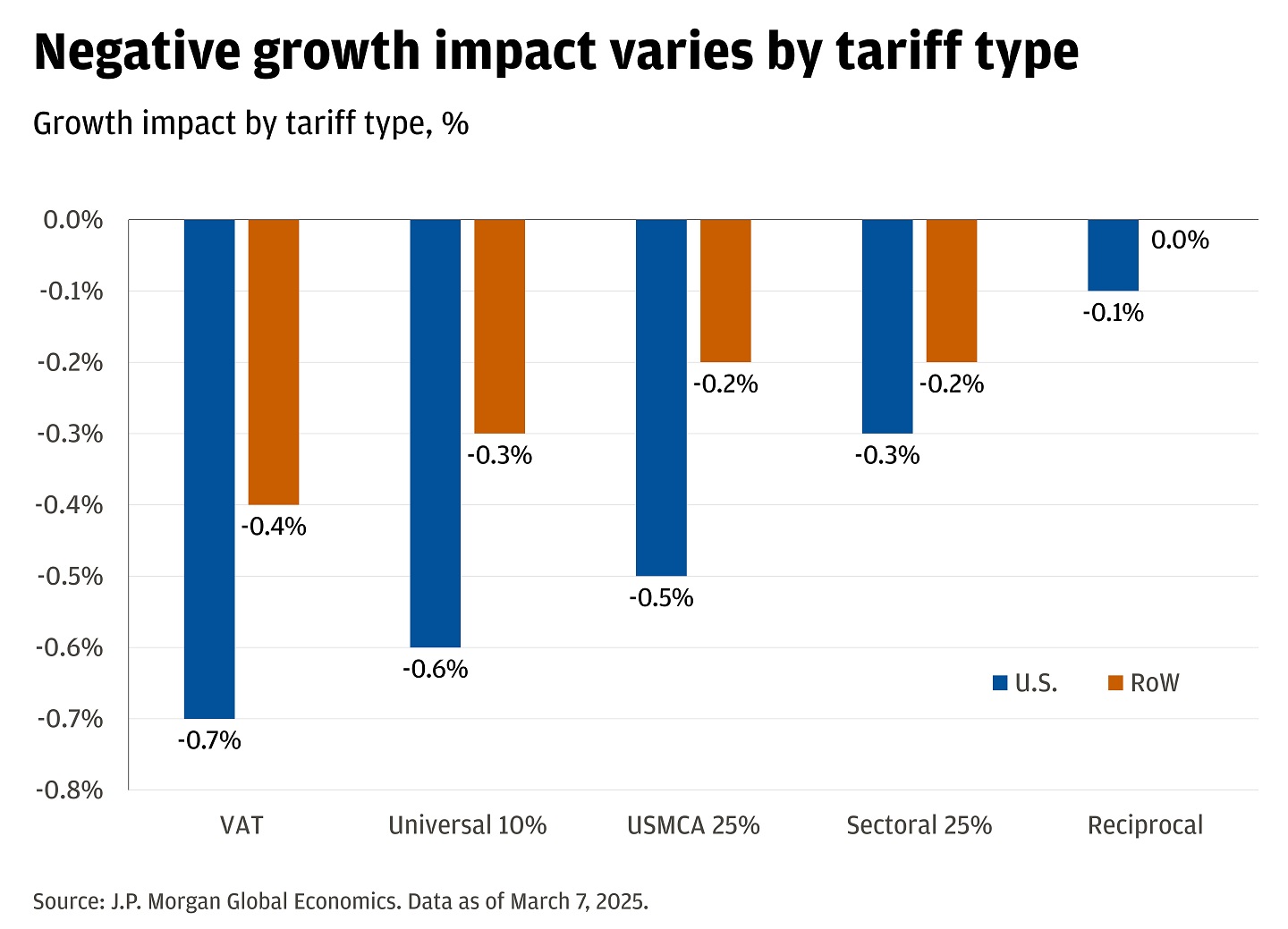

What is the effect on the U.S. economy? The higher tariff rates go, the larger the hit to growth is likely to be. The estimated impact on economic growth from the range of tariffs under consideration is between 0% to -0.7%. Notably, however, the potential hit to U.S. gross domestic product (GDP) could be larger than for the rest of the world, which is a stark contrast to the estimated impact of tighter trade policy coming into the year. After that, most forecasts were for higher tariff rates but primarily on China and a narrow set of national-security-related sectors. As the U.S. instigates trade wars with the rest of the world, they lose the advantage of size.

This week President Trump offered a teaser to April 2 by signing a proclamation to implement a 25% tariff on all auto imports, set to come into effect on April 3 and expand to auto parts by May 3. The 25% tariff rate on vehicles covered by the US-Mexico-Canada trade agreement will only apply to the value of non-U.S. components.

There is little consensus over what the U.S. tariff regime may look like, raising the likelihood of market volatility and downside risks to U.S. and global growth. However, any sort of clarity on tariff policy may allow the market to move on to other risks.

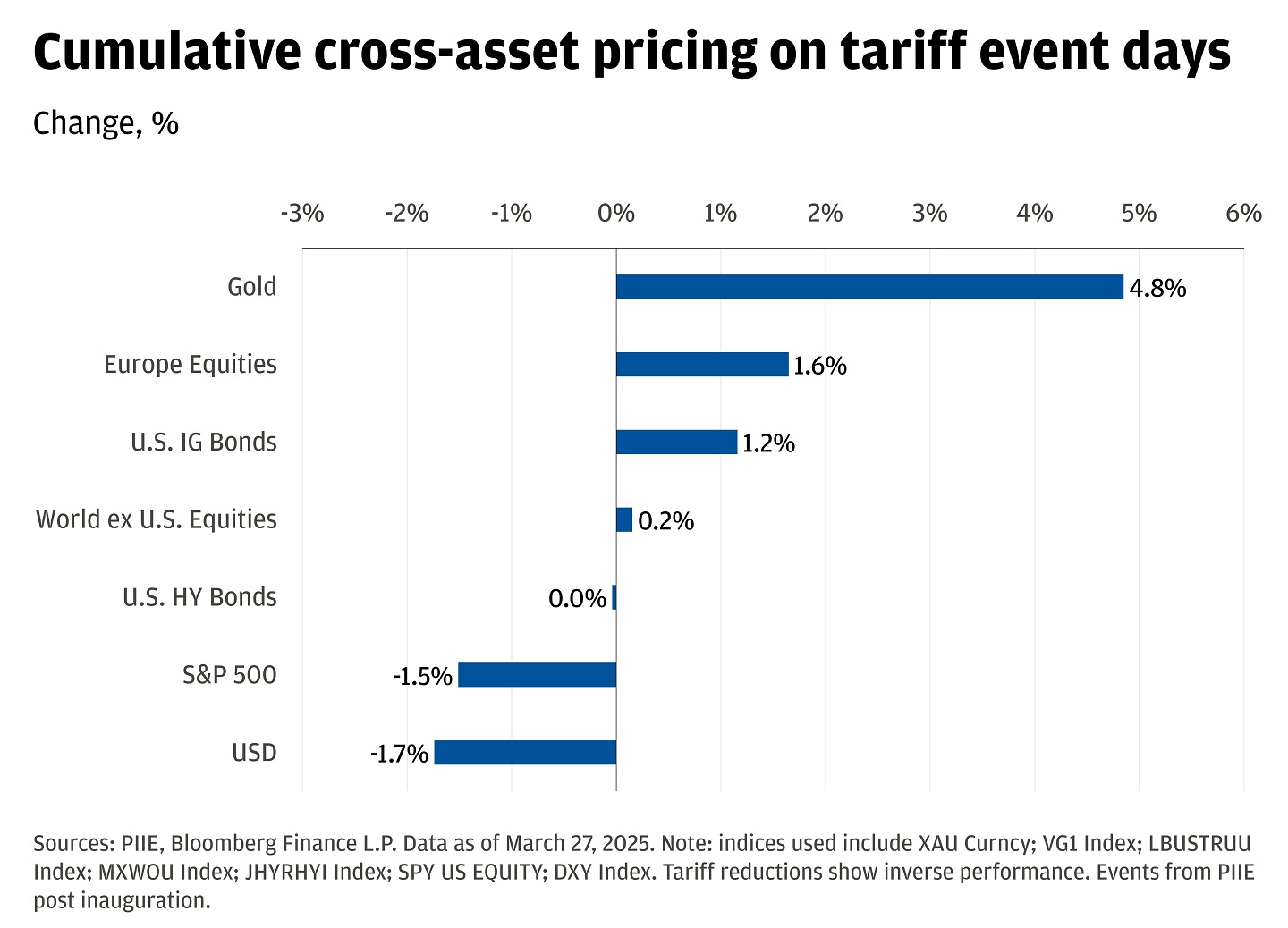

A key observation for investors is that gold has outperformed the USD and S&P 500 by >6% across the 11 days dominated by tariff announcements this year. We continue to think gold has a valuable role to play in portfolios, alongside diversification across asset classes and geographies.

2. Will municipal bond interest lose its tax-exempt status? Outside of trade, taxes are garnering market attention this week. The federal government forgoes approximately $30 billion annually by not taxing municipal bond interest. Stephen Moore, an informal Trump economic adviser, suggested modifying the tax exemption of municipal bond interest income to raise revenues.

We continue to think an elimination of the municipal bond tax exemption is unlikely, but some kind of modification to the tax exemption is possible.

The decision to tax municipal bond interest has been debated by Congress many times over the last 15 years. So far, the tweaks have been marginal. In 2017, the Tax Cut & Jobs Act (TCJA) eliminated the ability for municipalities to issue tax-exempt advance refunding bonds on a tax-free basis. Prior to the TCJA, municipalities could issue bonds to refinance existing debt at lower interest rates before the call date of the original bonds, allowing them to take advantage of favorable market conditions. The interest on these advance refunding bonds was exempt from federal income tax, which made them an attractive option for municipalities looking to reduce their borrowing costs. This provision was estimated to save $17 billion over ten years or $1.7 billion per year – a small amount.

We see four potential scenarios regarding taxation of the municipal market:

- Municipal market remains tax-exempt: Probability - High

- Municipal sector modification (e.g., higher education, health care or private activity bonds become taxable): Probability - Moderate

- Municipal Bond Tax-Exemption Cap initiated: Probability - Moderate

- Municipal market becomes taxable: Probability - Low

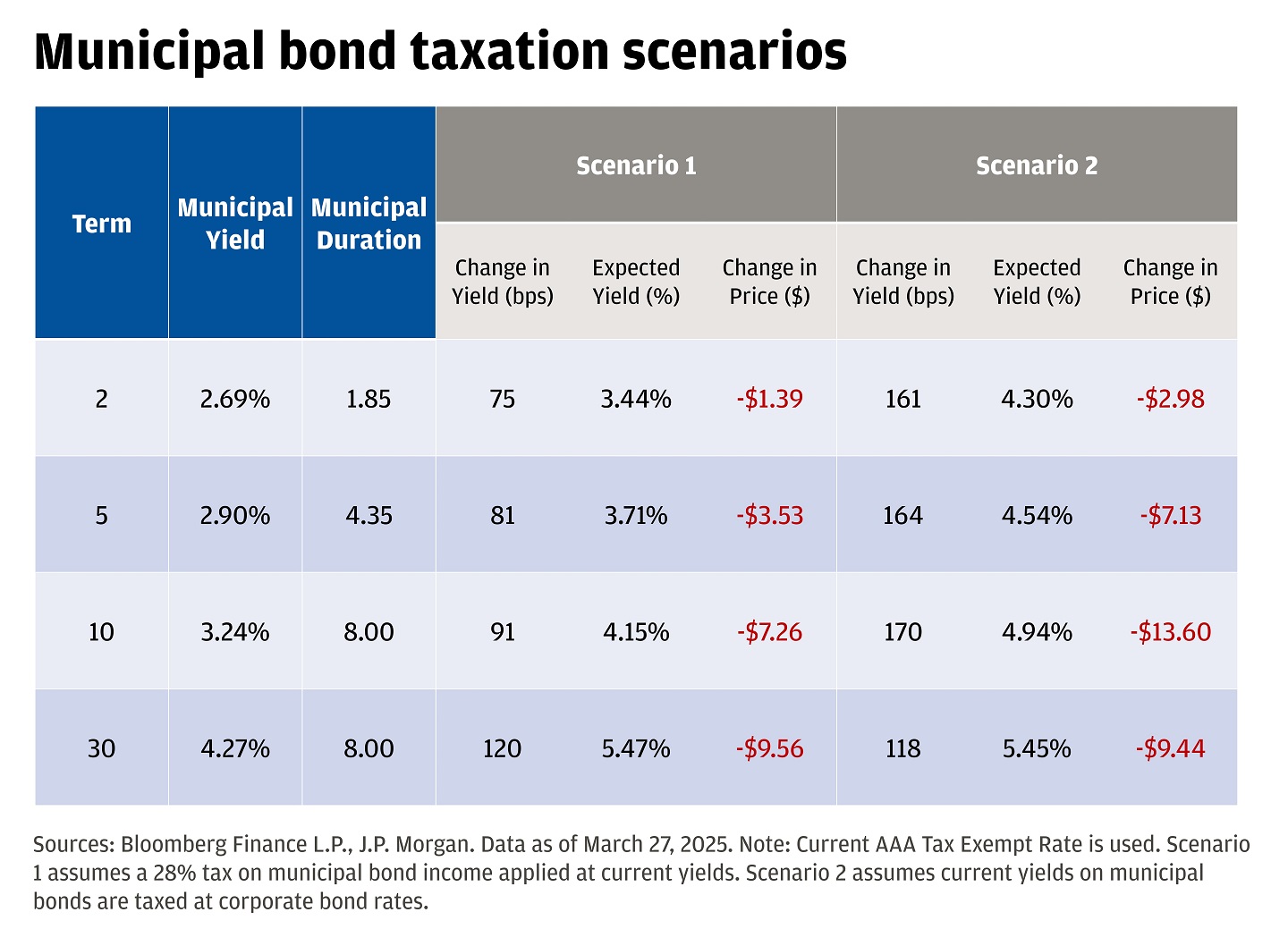

What if municipal bonds become taxable? Below we outline two potential scenarios that cover if municipal bonds are taxed. Keep in mind these cover the worst-case scenarios, are not our base case and result in just an approximate 10% maximum decline in price if not held to maturity.

Scenario 1: The first scenario illustrates taxing municipal bond interest at 28%, the rate that Stephen Moore and the 2011 American Jobs Act proposed. We estimate that a 28% tax on municipal bond income would cause an upward adjustment in interest rates by approximately 75–120 basis points (bps). This would cause a bond price erosion of approximately $1.40–$9.60.

Scenario 2: The second scenario depicts tax-exempt rates rising to levels consistent with the AA/Aa rated corporate bond market. In this case, tax-exempt rates could widen by 118–170bps. If this were to occur, once the market normalizes, bondholders would generically see price erosion of approximately $3.00–$13.60.

Both of these scenarios represent tail risks, and the bottom line for us is that the municipal market is likely to remain tax-exempt. Even if there were changes, it is more likely that they would happen on the periphery of the market, and that existing positions would be grandfathered into tax-exempt status. We are watching Washington closely for any signs that Congress is seriously considering changes.

3. What is the Mar-a-Lago accord and could it happen? A paper by Stephen Miran, Chair of the White House Council of Economic Advisers, has raised some radical ideas as to how the administration could weaken the dollar.

The U.S. dollar is 6% above its 10-year average and 16% above its 20-year average valuation when measured against a basket of other major world currencies. A stronger dollar tends to lead to more imports (international goods are relatively cheaper for U.S. consumers) and fewer exports (U.S. goods are relatively more expensive for international buyers), which directly opposes the administrations goals of balancing trade and revitalizing domestic manufacturing. The administration has a stated goal to increase manufacturing domestically.

Miran’s paper focuses on two ideas:

- A “Mar-a-Lago Accord” where countries/central bank reserve managers agree to swap their holdings of short-term U.S. Treasury securities for century (i.e., 100 year) bonds. If countries don’t agree to this, they would be subject to tariffs and have U.S. security guarantees removed.

- The U.S. could charge a “user fee” on reserve assets held by other countries – for example, a fee of 1% of coupons, which might increase to 2% if USD devaluation is insufficient. The paper also suggests differentiating between friends and foes: “Presumably, the Administration would want to withhold remittances to geopolitical adversaries like China more severely than to allies or to countries that engage in currency manipulation more severely than to those that do not.”

The persistent overvaluation of the USD poses a challenge, but the “Mar-a-Lago Accord” and user fees on reserve assets carry substantial risks. Most notably, these measures could undermine the dollar’s reserve status and lead to much higher long-term interest rates, which are also contrary to the administration’s goals. Further, it seems unlikely that other economic policymakers would agree readily to a scheme to weaken the dollar like they did in the 1980s. Our view is that the accord is very unlikely.

We’ve highlighted several risks which are growing out of Washington. Investors should think about how they can position portfolios to help protect from those risks. We believe investors should stick to their strategic asset allocations, using equity exposure for long-term capital appreciation and fixed income to hedge from growth scares. Additionally, we think tactically adding resilience (defined as income, diversification and inflation protection) to portfolios through gold and real assets like infrastructure can help insulate portfolios from existing risks. Limiting the severity of drawdowns is critical to long-term investment success.

For questions as to how to best position your portfolio, reach out to your J.P. Morgan advisor.

All market and economic data as of 03/28/25 are sourced from Bloomberg Finance L.P. and FactSet unless otherwise stated.

Connect with a Wealth Advisor

Reach out to your Wealth Advisor to discuss any considerations for your current portfolio. If you don’t have a Wealth Advisor, click here to tell us about your needs and we’ll reach out to you.

DISCLOSURES

The information presented is not intended to be making value judgments on the preferred outcome of any government decision or political election.

Investors should understand the potential tax liabilities surrounding a municipal bond purchase. Certain municipal bonds are federally taxed if the holder is subject to alternative minimum tax. Capital gains, if any, are federally taxable. The investor should note that the income from tax-free municipal bond funds may be subject to state and local taxation and the Alternative Minimum Tax (AMT).

Index definitions:

The Solactive United States 2000 Index intends to track the performance of the largest 1001 to 3000 companies from the United States stock market. Constituents are selected based on company market capitalization and weighted by free float market capitalization.

The Russell 3000 Index is a capitalization-weighted stock market index that seeks to be a benchmark of the entire U.S. stock market. It measures the performance of the largest 3,000 U.S. companies representing approximately 96% of the investable U.S. equity market.

The S&P 500 Equal Weight Index is the equal-weight version of the widely-used S&P 500. The index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 EWI is allocated a fixed weight of the index total at each quarterly rebalance.

The Bloomberg U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency).

The Magnificent Seven stocks are a group of influential companies in the U.S. stock market: Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla.

The Magnificent 7 Index is an equal-dollar weighted equity benchmark consisting of a fixed basket of 7 widely-traded companies (Microsoft, Apple, Nvidia, Alphabet, Amazon, Meta, Tesla) classified in the United States and representing the Communications, Consumer Discretionary and Technology sectors as defined by Bloomberg Industry Classification System (BICS).

The S&P Midcap 400 Index is a capitalization-weighted index which measures the performance of the mid-range sector of the U.S. stock market.

The S&P 500 index is widely regarded as the best single gauge of large-cap U.S. equities and serves as the foundation for a wide range of investment products. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization.

Bonds are subject to interest rate risk, credit, call, liquidity and default risk of the issuer. Bond prices generally fall when interest rates rise.

Standard and Poor’s 500 Index is a capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index was developed with a base level of 10 for the 1941–43 base period.

The Bloomberg Eco Surprise Index shows the degree to which economic analysts under- or over-estimate the trends in the business cycle. The surprise element is defined as the percentage difference between analyst forecasts and the published value of economic data releases.

The MSCI World Index is a free float-adjusted market capitalization index that is designed to measure global developed market equity performance.

The NASDAQ 100 Index is a basket of the 100 largest, most actively traded U.S companies listed on the NASDAQ stock exchange. The index includes companies from various industries except for the financial industry, like commercial and investment banks. These non-financial sectors include retail, biotechnology, industrial, technology, health care, and others.

The Russell 2000 Index measures small company stock market performance. The index does not include fees or expenses.

We believe the information contained in this material to be reliable but do not warrant its accuracy or completeness. Opinions, estimates, and investment strategies and views expressed in this document constitute our judgment based on current market conditions and are subject to change without notice.

The views, opinions, estimates and strategies expressed herein constitutes the author's judgment based on current market conditions and are subject to change without notice, and may differ from those expressed by other areas of J.P. Morgan. This information in no way constitutes J.P. Morgan Research and should not be treated as such. You should carefully consider your needs and objectives before making any decisions. For additional guidance on how this information should be applied to your situation, you should consult your advisor.

All companies referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by J.P. Morgan in this context.

JPMorgan Chase & Co., its affiliates, and employees do not provide tax, legal or accounting advice. Information presented on these webpages is not intended to provide, and should not be relied on for tax, legal and accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any financial transaction.

RISK CONSIDERATIONS

- Past performance is not indicative of future results. You may not invest directly in an index.

- The price of equity securities may rise or fall due to the changes in the broad market or changes in a company's financial condition, sometimes rapidly or unpredictably. Equity securities are subject to 'stock market risk' meaning that stock prices in general may decline over short or extended periods of time.

- Investing in fixed income products is subject to certain risks, including interest rate, credit, inflation, call, prepayment and reinvestment risk. Any fixed income security sold or redeemed prior to maturity may be subject to substantial gain or loss.

- In general, the bond market is volatile and bond prices rise when interest rates fall and vice versa. Longer term securities are more prone to price fluctuation than shorter term securities. Any fixed income security sold or redeemed prior to maturity may be subject to substantial gain or loss. Dependable income is subject to the credit risk of the issuer of the bond. If an issuer defaults no future income payments will be made.

- When investing in mutual funds or exchange-traded and index funds, please consider the investment objectives, risks, charges, and expenses associated with the funds before investing. You may obtain a fund’s prospectus by contacting your investment professional. The prospectus contains information, which should be carefully read before investing.

- Investors should understand the potential tax liabilities surrounding a municipal bond purchase. Certain municipal bonds are federally taxed if the holder is subject to alternative minimum tax. Capital gains, if any, are federally taxable. The investor should note that the income from tax-free municipal bond funds may be subject to state and local taxation and the alternative minimum tax (amt).

- International investments may not be suitable for all investors. International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Some overseas markets may not be as politically and economically stable as the united states and other nations. Investments in international markets can be more volatile.

- Investments in emerging markets may not be suitable for all investors. Emerging markets involve a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Some overseas markets may not be as politically and economically stable as the united states and other nations. Investments in emerging markets can be more volatile.

- Investments in commodities may have greater volatility than investments in traditional securities, particularly if the instruments involve leverage. The value of commodity-linked derivative instruments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments. Use of leveraged commodity-linked derivatives creates an opportunity for increased return but, at the same time, creates the possibility for greater loss.

- Real estate investments trusts may be subject to a high degree of market risk because of concentration in a specific industry, sector or geographical sector. Real estate investments may be subject to risks including, but not limited to, declines in the value of real estate, risks related to general and economic conditions, changes in the value of the underlying property owned by the trust and defaults by borrower.

- Investment in alternative investment strategies is speculative, often involves a greater degree of risk than traditional investments including limited liquidity and limited transparency, among other factors and should only be considered by sophisticated investors with the financial capability to accept the loss of all or part of the assets devoted to such strategies.

- Structured products involve derivatives and risks that may not be suitable for all investors. The most common risks include, but are not limited to, risk of adverse or unanticipated market developments, issuer credit quality risk, risk of lack of uniform standard pricing, risk of adverse events involving any underlying reference obligations, risk of high volatility, risk of illiquidity/little to no secondary market, and conflicts of interest. Before investing in a structured product, investors should review the accompanying offering document, prospectus or prospectus supplement to understand the actual terms and key risks associated with the each individual structured product. Any payments on a structured product are subject to the credit risk of the issuer and/or guarantor. Investors may lose their entire investment, i.e., incur an unlimited loss. The risks listed above are not complete. For a more comprehensive list of the risks involved with this particular product, please speak to your J.P. Morgan team.

- As a reminder, hedge funds (or funds of hedge funds) often engage in leveraging and other speculative investment practices that may increase the risk of investment loss. These investments can be highly illiquid, and are not required to provide periodic pricing or valuation information to investors, and may involve complex tax structures and delays in distributing important tax information. These investments are not subject to the same regulatory requirements as mutual funds; and often charge high fees. Further, any number of conflicts of interest may exist in the context of the management and/or operation of any such fund. For complete information, please refer to the applicable offering memorandum.

- For informational purposes only -- J.P. Morgan Securities LLC does not endorse, advise on, transmit, sell or transact in any type of virtual currency. Please note: J.P. Morgan Securities LLC does not intermediate, mine, transmit, custody, store, sell, exchange, control, administer, or issue any type of virtual currency, which includes any type of digital unit used as a medium of exchange or a form of digitally stored value.

- The prices and rates of return are indicative, as they may vary over time based on market conditions.

- Additional risk considerations exist for all strategies.

- The information provided herein is not intended as a recommendation of or an offer or solicitation to purchase or sell any investment product or service.

- Opinions expressed herein may differ from the opinions expressed by other areas of J.P. Morgan. This material should not be regarded as investment research or a J.P. Morgan investment research report.

This material is for information purposes only, and may inform you of certain products and services offered by J.P. Morgan’s wealth management businesses, part of JPMorgan Chase & Co. (“JPM”). The views and strategies described in the material may not be suitable for all investors and are subject to investment risks. Please read all Important Information.

GENERAL RISKS & CONSIDERATIONS. Any views, strategies or products discussed in this material may not be appropriate for all individuals and are subject to risks. Investors may get back less than they invested, and past performance is not a reliable indicator of future results. Asset allocation/diversification does not guarantee a profit or protect against loss. Nothing in this material should be relied upon in isolation for the purpose of making an investment decision. You are urged to consider carefully whether the services, products, asset classes (e.g. equities, fixed income, alternative investments, commodities, etc.) or strategies discussed are suitable to your needs. You must also consider the objectives, risks, charges, and expenses associated with an investment service, product or strategy prior to making an investment decision. For this and more complete information, including discussion of your goals/situation, contact your J.P. Morgan team.

NON-RELIANCE. Certain information contained in this material is believed to be reliable; however, JPM does not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. No representation or warranty should be made with regard to any computations, graphs, tables, diagrams or commentary in this material, which are provided for illustration/reference purposes only. The views, opinions, estimates and strategies expressed in this material constitute our judgment based on current market conditions and are subject to change without notice. JPM assumes no duty to update any information in this material in the event that such information changes. Views, opinions, estimates and strategies expressed herein may differ from those expressed by other areas of JPM, views expressed for other purposes or in other contexts, and this material should not be regarded as a research report. Any projected results and risks are based solely on hypothetical examples cited, and actual results and risks will vary depending on specific circumstances. Forward-looking statements should not be considered as guarantees or predictions of future events.

Nothing in this document shall be construed as giving rise to any duty of care owed to, or advisory relationship with, you or any third party. Nothing in this document shall be regarded as an offer, solicitation, recommendation or advice (whether financial, accounting, legal, tax or other) given by J.P. Morgan and/or its officers or employees, irrespective of whether or not such communication was given at your request. J.P. Morgan and its affiliates and employees do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any financial transactions.

LEGAL ENTITY, BRAND & REGULATORY INFORMATION

In the United States, bank deposit accounts and related services, such as checking, savings and bank lending, are offered by JPMorgan Chase Bank, N.A. Member FDIC.

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

Bank deposit accounts and related services, such as checking, savings and bank lending, are offered by JPMorgan Chase Bank, N.A. Member FDIC.

This document may provide information about the brokerage and investment advisory services provided by J.P. Morgan Securities LLC (“JPMS”). The agreements entered into with JPMS, and corresponding disclosures provided with respect to the different products and services provided by JPMS (including our Form ADV disclosure brochure, if and when applicable), contain important information about the capacity in which we will be acting. You should read them all carefully. We encourage clients to speak to their JPMS representative regarding the nature of the products and services and to ask any questions they may have about the difference between brokerage and investment advisory services, including the obligation to disclose conflicts of interests and to act in the best interests of our clients.

J.P. Morgan may hold a position for itself or our other clients which may not be consistent with the information, opinions, estimates, investment strategies or views expressed in this document. JPMorgan Chase & Co. or its affiliates may hold a position or act as market maker in the financial instruments of any issuer discussed herein or act as an underwriter, placement agent, advisor or lender to such issuer.

Check the background of our firm and investment professionals on FINRA's BrokerCheck

To learn more about J. P. Morgan Wealth Management’s investment business, including our accounts, products and services, as well as our relationship with you, please review our J.P. Morgan Securities LLC Form CRS and Guide to Investment Services and Brokerage Products.

This website is for informational purposes only, and not an offer, recommendation or solicitation of any product, strategy service or transaction. Any views, strategies or products discussed on this site may not be appropriate or suitable for all individuals and are subject to risks. Prior to making any investment or financial decisions, an investor should seek individualized advice from a personal financial, legal, tax and other professional advisors that take into account all of the particular facts and circumstances of an investor's own situation.

This website may provide information about the brokerage and investment advisory services provided by J.P. Morgan Securities LLC ("JPMS"). When JPMS acts as a broker-dealer, a client's relationship with us and our duties to the client will be different in some important ways than a client's relationship with us and our duties to the client when we are acting as an investment advisor. A client should carefully read the agreements and disclosures received (including our Form ADV disclosure brochure, if and when applicable) in connection with our provision of services for important information about the capacity in which we will be acting.

INVESTMENT AND INSURANCE PRODUCTS ARE:

• NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, JPMORGAN CHASE BANK, N.A. OR ANY OF ITS AFFILIATES • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

Please read additional Important Information in conjunction with these pages.