Contributors

Sarah Stillpass

Global Investment Strategist

September jitters

After a 1% gain in August, the S&P 500 closed out its first week of September down 3%.

While September has historically had the lowest average monthly return over the last 30 years, we think there is a bit more to the story than seasonality. For starters, the September Federal Reserve meeting is less than two weeks away and all eyes are on the labor market:

- The August jobs report was released on Friday. The data showed an acceleration of job growth to 142,000 positions added last month and a move down in the unemployment rate to 4.2% from 4.3% in July. That said, job growth over the prior two months was revised down by 89,000 jobs. The report is likely to be a major factor in the Federal Reserve’s decision to deliver a 25-basis-point or 50-basis-point rate cut. Immediately after the print, markets slightly increased the odds of a 50-basis-point move.

- U.S. manufacturing data suggested more sluggish activity. Even though the Institute for Supply Management (ISM) Manufacturing Index ticked up to 47.2 in August versus 46.8 in July, any reading below 50 indicates contraction. According to the ISM survey, manufacturing activity has now shrunk in 21 of the last 22 months, extending the second-longest downturn in history.

Elsewhere, a smattering of geopolitics, trade and commodity moves gave investors angst:

- Japanese restrictions on Chinese chipmakers added to increasing uncertainty around global chip supply chains. The semiconductor index was down 9% and Nvidia was down 10%.

- Oil prices broke $75 per barrel, selling off nearly 5% on Tuesday due to weak Chinese demand and excess supply.

It’s not all doom and gloom, however, as we saw other pockets of the market excel despite the sell-off. We’re calling this “A Tale of Two Markets.” In this week’s Top Market Takeaways, we dive into the “haves” and “have-nots” in markets and what it all may mean for your portfolio.

A Tale of Two Markets

“It was the best of times, it was the worst of times.” While the opening of Charles Dickens’ “A Tale of Two Cities” may be a bit dramatic to use here, we think it is an apt description of what we saw unfold over the last few days.

Let’s start with stocks:

1. The artificial intelligence (AI) trade felt the pain. Nvidia fell more than 10% on the week and set the record for largest single loss in market cap in history. Investors are starting to ask the same questions that our Chairman of Market and Investment Strategy, Michael Cembalest asked in his latest note, COVIDIA. Here are a couple factors:

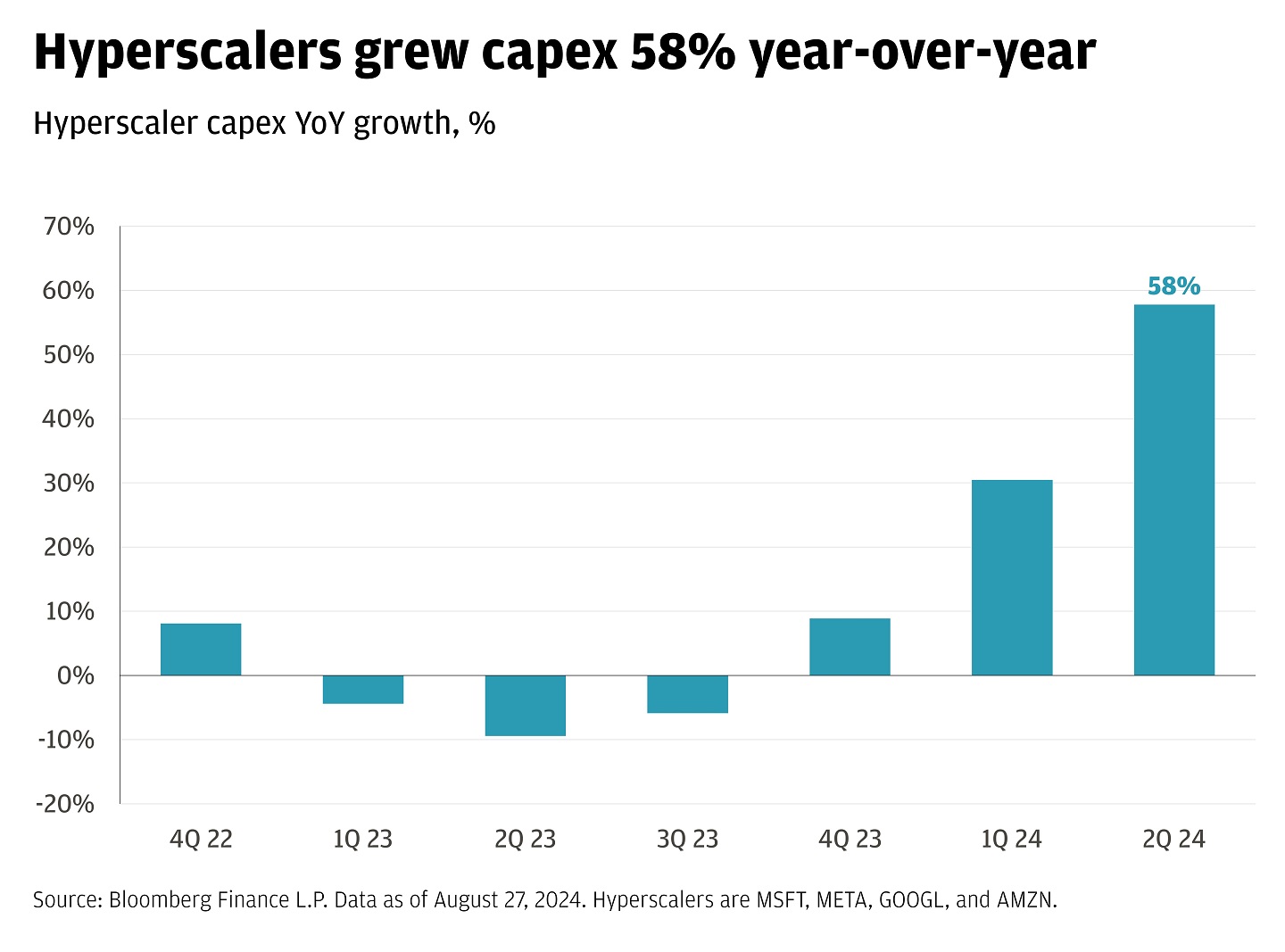

- Hyperscaler capital expenditures are through the roof. Magnificent 7 capital spending now exceeds that of the entire energy sector. In fact, in the second quarter, hyperscalers have spent $53 billion on capex, up 58% year-over-year versus 30% in the first quarter. Investors tend to meet capital spending plans with more scrutiny because they want assurance that the investment is going to be worth it.

- If you build it, will they come? The first phase of the AI build out is deeply rooted in ensuring enough infrastructure is in place. That means building the basics, producing things like semiconductors, data centers and sourcing the energy needed to power AI models. On top of it all, the hyperscalers need to train those models. All of that seems to be progressing but the next leg of the journey is putting generative AI into practice to increase productivity and generate profits. While we have seen powerful examples of “inference tasks” like those from customer service provider, Klarna, broad adoption is still in its early days.

We are believers in the long-term investment potential of AI. Bad days are to be expected, but over the next decade, we see AI-linked names outperforming the broader market. We think the questions surrounding stretched valuations and fears of AI over-hype are healthy. Skepticism is a good thing, as it keeps markets in check and this week’s price action seems to be a momentum story, not one of economic fundamentals. Investors today require companies to “show” and not just “tell.”

2. On the flip side, defensive and certain interest rate sensitive stocks shined. Enter the “boring is not bad” story. While the risks of an economic slowdown may make some investors feel like adding to risk is a not-so-good idea, opportunities across sectors still exist.

The Federal Reserve is prepared to cut rates this month, and that means the “Fed put” is in play. In other words, declining interest rates may support outperformance of more interest rate sensitive sectors.

This week, only three of the 11 S&P 500 sectors landed in the green: consumer staples, utilities and real estate. While other traditionally defensive sectors like financials and health care were down on the week, they outperformed tech by almost double. Defensive stocks, for example, tend to be less sensitive to the ebbs and flows of the economic cycle. This means they may have the ability to produce more durable cash flows and consistent revenues. Earnings estimates show the health care, industrial and consumer staples (to name just a handful) sectors growing into 2025.

Our base case still calls for a soft landing, but as economic activity inevitably slows to more normalized levels, we think it is apt to examine sector balances and risk exposures in portfolios. For investors that are feeling “big-tech fatigue,” looking across more defensive sectors could be compelling. Take today as an opportunity to assess strong performance from year-to-date portfolio standouts, as they may have put portfolios offsides in terms of desired allocations.

3. Oil prices are off more than 16% from July highs, and are at year-to-date lows. Fears surrounding a resumption of Libyan oil production, Chinese demand concerns and a mixed narrative on OPEC+ supply levels sent oil prices lower this week.

OPEC+ said in June it would restore production by 2.2 million barrels per day starting in October after a period of cuts – but has since waffled. Rumors mounted on Wednesday followed by an official announcement on Thursday that the proposed supply increase would be put on pause until January.

We do not think a two-month production delay takes away the fact that production will increase sometime this year. To boot, weak Chinese demand and oversupply elsewhere are likely to outweigh the measures. Thus, we see prices moving to $81 to $86 per barrel by year end. That said, factors like unrelenting geopolitical tensions and the upcoming U.S. presidential election could spur price action.

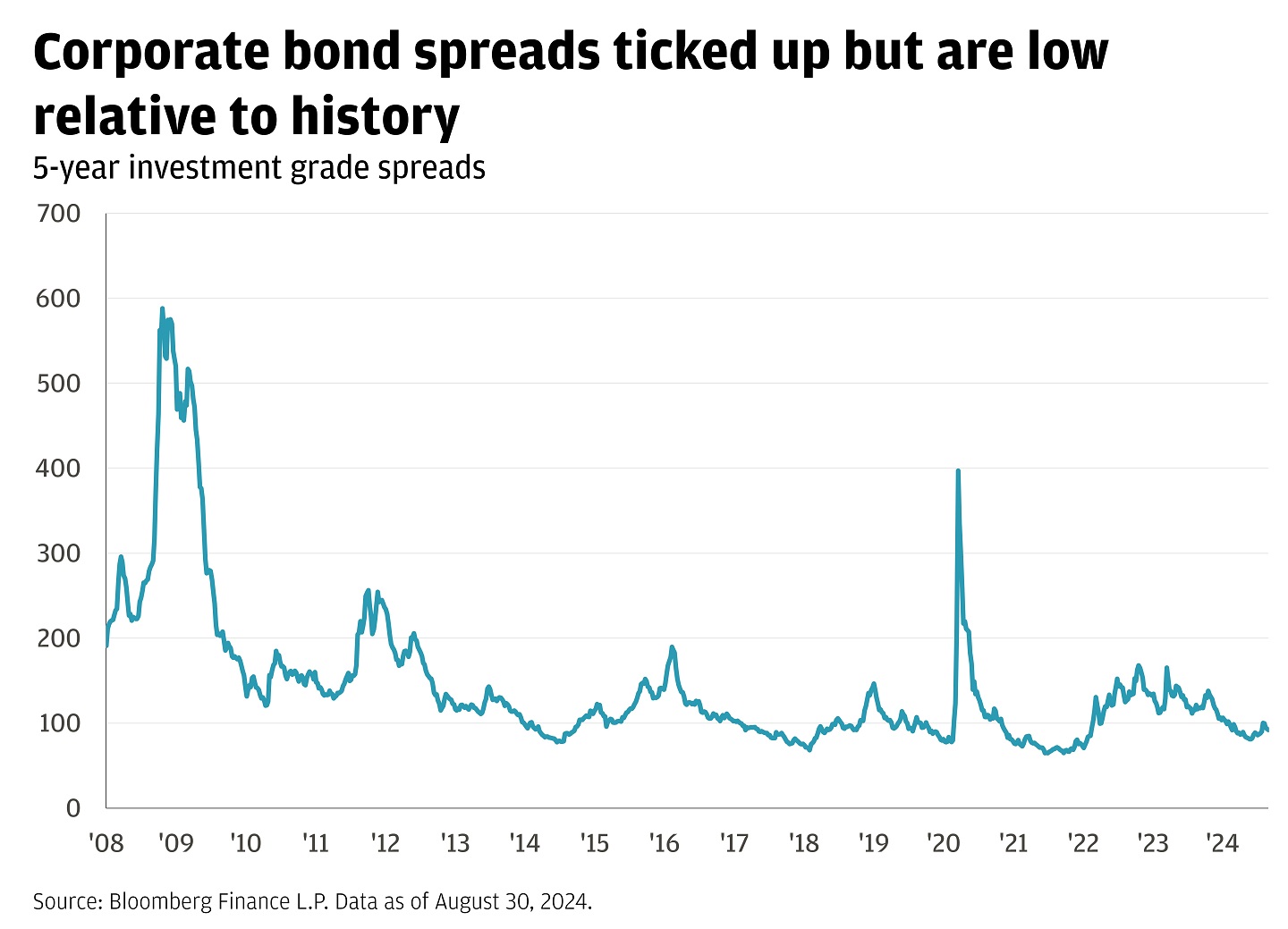

4. Corporate credit had a banner week. This week was one of the biggest on record for investment-grade bond sales led by over 50 firms. September is typically a busy month for issuers as investors return from summer vacations, and the day after Labor Day is historically one of the busiest days.

On Tuesday alone, a record 29 borrowers including Target, Ford and Barclays issued investment-grade bonds. Beyond seasonal factors, corporations are moving to lock in borrowing costs while yields are relatively low. First time IG borrower Uber tapped the market on Thursday. Corporates are taking advantage of all-in, investment-grade yields that have come down from a year-to-date high of 5.85% in April to 5.04% today.

We think credit is the foundation of markets. Borrower fundamentals look to be rock solid and investor demand is strong. Five-year credit spreads across investment-grade maturities remain tight relative to historical medians. At the same time, all-in yields are elevated and that could create a compelling opportunity for investors to lock in yields.

Boring is not bad. Investors should take comfort in the fact that bonds are there to provide a buffer against the shorter term volatility that we might see in higher growth investments (like artificial intelligence).

While each asset class has a distinct (and important) role in portfolios, both good and bad days are inevitable. The ultimate key to notching consistent returns over the long haul is diversification across asset classes and rightsizing positions.

As the Federal Reserve prepares to cut interest rates in the coming weeks, we encourage investors to review their asset allocation, particularly when it comes to excess cash.

For those looking to add to an already diversified portfolio or diversify further, we see opportunity in adding high quality, income yielding stocks and investment-grade fixed income (including municipal bonds for U.S. taxpayers).

At the end of the day, sell-offs are a feature – not a bug – of investing, and it is important to keep it all in perspective.

While past performance is no guarantee of future results, the past 13 times the first day of the month was down 2% or more (like it was in September), the market was higher in the remainder of the month every time. Here’s to September being number 14.

And as always, your J.P. Morgan advisor is here to help you think through what this could all mean for your portfolio.

All market and economic data as of 09/06/2024 are sourced from Bloomberg Finance L.P. and FactSet unless otherwise stated.

Connect with a Wealth Advisor

Our Wealth Advisors begin by getting to know you personally. To get started, tell us about your needs and we’ll reach out to you.

DISCLOSURES

The information presented is not intended to be making value judgments on the preferred outcome of any government decision or political election.

The price of equity securities may rise or fall due to the changes in the broad market or changes in a company's financial condition, sometimes rapidly or unpredictably. Equity securities are subject to "stock market risk" meaning that stock prices in general may decline over short or extended periods of time.

In general, the bond market is volatile and bond prices rise when interest rates fall and vice versa. Longer term securities are more prone to price fluctuation than shorter term securities. Any fixed income security sold or redeemed prior to maturity may be subject to substantial gain or loss. Dependable income is subject to the credit risk of the issuer of the bond. If an issuer defaults no future income payments will be made.

Investors should understand the potential tax liabilities surrounding a municipal bond purchase. Certain municipal bonds are federally taxed if the holder is subject to alternative minimum tax. Capital gains, if any, are federally taxable. The investor should note that the income from tax-free municipal bond funds may be subject to state and local taxation and the Alternative Minimum Tax (AMT).

Diversification and asset allocation does not ensure a profit or protect against loss.

Index definitions:

The Russell 3000 Index is a capitalization-weighted stock market index that seeks to be a benchmark of the entire U.S. stock market. It measures the performance of the largest 3,000 U.S. companies representing approximately 96% of the investable U.S. equity market.

The S&P 500 Equal Weight Index is the equal-weight version of the widely-used S&P 500. The index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 EWI is allocated a fixed weight of the index total at each quarterly rebalance.

The Bloomberg U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency).

The S&P 500 Equal Weighted Index is the equal-weight version of the widely-used S&P 500. The index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 EWI is allocated a fixed weight – or 0.2% of the index total at each quarterly rebalance.

The Magnificent Seven stocks are a group of influential companies in the U.S. stock market: Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla.

The Magnificent 7 Index is an equal-dollar weighted equity benchmark consisting of a fixed basket of 7 widely-traded companies (Microsoft, Apple, Nvidia, Alphabet, Amazon, Meta, Tesla) classified in the United States and representing the Communications, Consumer Discretionary and Technology sectors as defined by Bloomberg Industry Classification System (BICS).

The S&P Midcap 400 Index is a capitalization-weighted index which measures the performance of the mid-range sector of the U.S. stock market.

The S&P 500 index is widely regarded as the best single gauge of large-cap U.S. equities and serves as the foundation for a wide range of investment products. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization.

Bonds are subject to interest rate risk, credit, call, liquidity and default risk of the issuer. Bond prices generally fall when interest rates rise.

Standard and Poor’s 500 Index is a capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index was developed with a base level of 10 for the 1941–43 base period.

The Bloomberg Eco Surprise Index shows the degree to which economic analysts under- or over-estimate the trends in the business cycle. The surprise element is defined as the percentage difference between analyst forecasts and the published value of economic data releases.

The MSCI World Index is a free float-adjusted market capitalization index that is designed to measure global developed market equity performance.

The NASDAQ 100 Index is a basket of the 100 largest, most actively traded U.S companies listed on the NASDAQ stock exchange. The index includes companies from various industries except for the financial industry, like commercial and investment banks. These non-financial sectors include retail, biotechnology, industrial, technology, health care, and others.

The Russell 2000 Index measures small company stock market performance. The index does not include fees or expenses.

We believe the information contained in this material to be reliable but do not warrant its accuracy or completeness. Opinions, estimates, and investment strategies and views expressed in this document constitute our judgment based on current market conditions and are subject to change without notice.

The views, opinions, estimates and strategies expressed herein constitutes the author's judgment based on current market conditions and are subject to change without notice, and may differ from those expressed by other areas of J.P. Morgan. This information in no way constitutes J.P. Morgan Research and should not be treated as such. You should carefully consider your needs and objectives before making any decisions. For additional guidance on how this information should be applied to your situation, you should consult your advisor.

All companies referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by J.P. Morgan in this context.

JPMorgan Chase & Co., its affiliates, and employees do not provide tax, legal or accounting advice. Information presented on these webpages is not intended to provide, and should not be relied on for tax, legal and accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any financial transaction.

RISK CONSIDERATIONS

- Past performance is not indicative of future results. You may not invest directly in an index.

- The price of equity securities may rise or fall due to the changes in the broad market or changes in a company's financial condition, sometimes rapidly or unpredictably. Equity securities are subject to 'stock market risk' meaning that stock prices in general may decline over short or extended periods of time.

- Investing in fixed income products is subject to certain risks, including interest rate, credit, inflation, call, prepayment and reinvestment risk. Any fixed income security sold or redeemed prior to maturity may be subject to substantial gain or loss.

- In general, the bond market is volatile and bond prices rise when interest rates fall and vice versa. Longer term securities are more prone to price fluctuation than shorter term securities. Any fixed income security sold or redeemed prior to maturity may be subject to substantial gain or loss. Dependable income is subject to the credit risk of the issuer of the bond. If an issuer defaults no future income payments will be made.

- When investing in mutual funds or exchange-traded and index funds, please consider the investment objectives, risks, charges, and expenses associated with the funds before investing. You may obtain a fund’s prospectus by contacting your investment professional. The prospectus contains information, which should be carefully read before investing.

- Investors should understand the potential tax liabilities surrounding a municipal bond purchase. Certain municipal bonds are federally taxed if the holder is subject to alternative minimum tax. Capital gains, if any, are federally taxable. The investor should note that the income from tax-free municipal bond funds may be subject to state and local taxation and the alternative minimum tax (amt).

- International investments may not be suitable for all investors. International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Some overseas markets may not be as politically and economically stable as the united states and other nations. Investments in international markets can be more volatile.

- Investments in emerging markets may not be suitable for all investors. Emerging markets involve a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Some overseas markets may not be as politically and economically stable as the united states and other nations. Investments in emerging markets can be more volatile.

- Investments in commodities may have greater volatility than investments in traditional securities, particularly if the instruments involve leverage. The value of commodity-linked derivative instruments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments. Use of leveraged commodity-linked derivatives creates an opportunity for increased return but, at the same time, creates the possibility for greater loss.

- Real estate investments trusts may be subject to a high degree of market risk because of concentration in a specific industry, sector or geographical sector. Real estate investments may be subject to risks including, but not limited to, declines in the value of real estate, risks related to general and economic conditions, changes in the value of the underlying property owned by the trust and defaults by borrower.

- Investment in alternative investment strategies is speculative, often involves a greater degree of risk than traditional investments including limited liquidity and limited transparency, among other factors and should only be considered by sophisticated investors with the financial capability to accept the loss of all or part of the assets devoted to such strategies.

- Structured products involve derivatives and risks that may not be suitable for all investors. The most common risks include, but are not limited to, risk of adverse or unanticipated market developments, issuer credit quality risk, risk of lack of uniform standard pricing, risk of adverse events involving any underlying reference obligations, risk of high volatility, risk of illiquidity/little to no secondary market, and conflicts of interest. Before investing in a structured product, investors should review the accompanying offering document, prospectus or prospectus supplement to understand the actual terms and key risks associated with the each individual structured product. Any payments on a structured product are subject to the credit risk of the issuer and/or guarantor. Investors may lose their entire investment, i.e., incur an unlimited loss. The risks listed above are not complete. For a more comprehensive list of the risks involved with this particular product, please speak to your J.P. Morgan team.

- As a reminder, hedge funds (or funds of hedge funds) often engage in leveraging and other speculative investment practices that may increase the risk of investment loss. These investments can be highly illiquid, and are not required to provide periodic pricing or valuation information to investors, and may involve complex tax structures and delays in distributing important tax information. These investments are not subject to the same regulatory requirements as mutual funds; and often charge high fees. Further, any number of conflicts of interest may exist in the context of the management and/or operation of any such fund. For complete information, please refer to the applicable offering memorandum.

- For informational purposes only -- J.P. Morgan Securities LLC does not endorse, advise on, transmit, sell or transact in any type of virtual currency. Please note: J.P. Morgan Securities LLC does not intermediate, mine, transmit, custody, store, sell, exchange, control, administer, or issue any type of virtual currency, which includes any type of digital unit used as a medium of exchange or a form of digitally stored value.

- The prices and rates of return are indicative, as they may vary over time based on market conditions.

- Additional risk considerations exist for all strategies.

- The information provided herein is not intended as a recommendation of or an offer or solicitation to purchase or sell any investment product or service.

- Opinions expressed herein may differ from the opinions expressed by other areas of J.P. Morgan. This material should not be regarded as investment research or a J.P. Morgan investment research report.

This material is for information purposes only, and may inform you of certain products and services offered by J.P. Morgan’s wealth management businesses, part of JPMorgan Chase & Co. (“JPM”). The views and strategies described in the material may not be suitable for all investors and are subject to investment risks. Please read all Important Information.

GENERAL RISKS & CONSIDERATIONS. Any views, strategies or products discussed in this material may not be appropriate for all individuals and are subject to risks. Investors may get back less than they invested, and past performance is not a reliable indicator of future results. Asset allocation/diversification does not guarantee a profit or protect against loss. Nothing in this material should be relied upon in isolation for the purpose of making an investment decision. You are urged to consider carefully whether the services, products, asset classes (e.g. equities, fixed income, alternative investments, commodities, etc.) or strategies discussed are suitable to your needs. You must also consider the objectives, risks, charges, and expenses associated with an investment service, product or strategy prior to making an investment decision. For this and more complete information, including discussion of your goals/situation, contact your J.P. Morgan team.

NON-RELIANCE. Certain information contained in this material is believed to be reliable; however, JPM does not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. No representation or warranty should be made with regard to any computations, graphs, tables, diagrams or commentary in this material, which are provided for illustration/reference purposes only. The views, opinions, estimates and strategies expressed in this material constitute our judgment based on current market conditions and are subject to change without notice. JPM assumes no duty to update any information in this material in the event that such information changes. Views, opinions, estimates and strategies expressed herein may differ from those expressed by other areas of JPM, views expressed for other purposes or in other contexts, and this material should not be regarded as a research report. Any projected results and risks are based solely on hypothetical examples cited, and actual results and risks will vary depending on specific circumstances. Forward-looking statements should not be considered as guarantees or predictions of future events.

Nothing in this document shall be construed as giving rise to any duty of care owed to, or advisory relationship with, you or any third party. Nothing in this document shall be regarded as an offer, solicitation, recommendation or advice (whether financial, accounting, legal, tax or other) given by J.P. Morgan and/or its officers or employees, irrespective of whether or not such communication was given at your request. J.P. Morgan and its affiliates and employees do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any financial transactions.

LEGAL ENTITY, BRAND & REGULATORY INFORMATION

In the United States, bank deposit accounts and related services, such as checking, savings and bank lending, are offered by JPMorgan Chase Bank, N.A. Member FDIC.

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

Bank deposit accounts and related services, such as checking, savings and bank lending, are offered by JPMorgan Chase Bank, N.A. Member FDIC.

This document may provide information about the brokerage and investment advisory services provided by J.P. Morgan Securities LLC (“JPMS”). The agreements entered into with JPMS, and corresponding disclosures provided with respect to the different products and services provided by JPMS (including our Form ADV disclosure brochure, if and when applicable), contain important information about the capacity in which we will be acting. You should read them all carefully. We encourage clients to speak to their JPMS representative regarding the nature of the products and services and to ask any questions they may have about the difference between brokerage and investment advisory services, including the obligation to disclose conflicts of interests and to act in the best interests of our clients.

J.P. Morgan may hold a position for itself or our other clients which may not be consistent with the information, opinions, estimates, investment strategies or views expressed in this document. JPMorgan Chase & Co. or its affiliates may hold a position or act as market maker in the financial instruments of any issuer discussed herein or act as an underwriter, placement agent, advisor or lender to such issuer.

Check the background of our firm and investment professionals on FINRA's BrokerCheck

To learn more about J. P. Morgan’s investment business, including our accounts, products and services, as well as our relationship with you, please review our J.P. Morgan Securities LLC Form CRS and Guide to Investment Services and Brokerage Products.

This website is for informational purposes only, and not an offer, recommendation or solicitation of any product, strategy service or transaction. Any views, strategies or products discussed on this site may not be appropriate or suitable for all individuals and are subject to risks. Prior to making any investment or financial decisions, an investor should seek individualized advice from a personal financial, legal, tax and other professional advisors that take into account all of the particular facts and circumstances of an investor's own situation.

This website provides information about the brokerage and investment advisory services provided by J.P. Morgan Securities LLC ("JPMS"). When JPMS acts as a broker-dealer, a client's relationship with us and our duties to the client will be different in some important ways than a client's relationship with us and our duties to the client when we are acting as an investment advisor. A client should carefully read the agreements and disclosures received (including our Form ADV disclosure brochure, if and when applicable) in connection with our provision of services for important information about the capacity in which we will be acting.

INVESTMENT AND INSURANCE PRODUCTS ARE: • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, JPMORGAN CHASE BANK, N.A. OR ANY OF ITS AFFILIATES • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

Please read additional Important Information in conjunction with these pages.