Over the past 50 years, gaming has evolved from simple experiences like Pong into sophisticated virtual worlds where over 3 billion video game consumers engage today. Leveraging advanced graphics, artificial intelligence and seamless online connectivity, modern games offer rich, dynamic experiences considered science fiction just a few decades ago. Casual gaming has surged, making gaming a daily pastime for many, even those who don’t see themselves as traditional gamers. As gaming becomes increasingly ubiquitous and accessible via mobile and other digital devices, the landscape is ripe with opportunity for founders and investors.

Gaming is omnipresent

No longer are video games confined to a single platform or medium—they are everywhere. From blockbuster movies and TV shows inspired by iconic game franchises to gaming streamers who have turned social media platforms into bustling hubs of gaming culture, gaming has never been more accessible. According to the Entertainment Software Association, in 2023, 78% of U.S. households reported playing a video game on a mobile device in the past 12 months, up from 33% in 2012.1 This widespread accessibility has led to a significant portion of the U.S. population engaging in the activity regularly, with 61% of Americans reporting they play video games at least one hour every week. A growing population of gamers creates a greater need for new content and game genres, presenting an exciting opportunity for gaming startup founders.

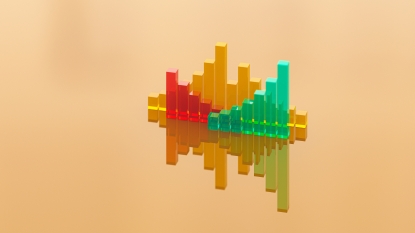

Percentage of U.S. gamers that play 1+ hours per week (by generation)

Source: The Entertainment Software Association; 2024 Essential Facts About the U.S. Video Game Industry

More gamers, more innovation (and competition)

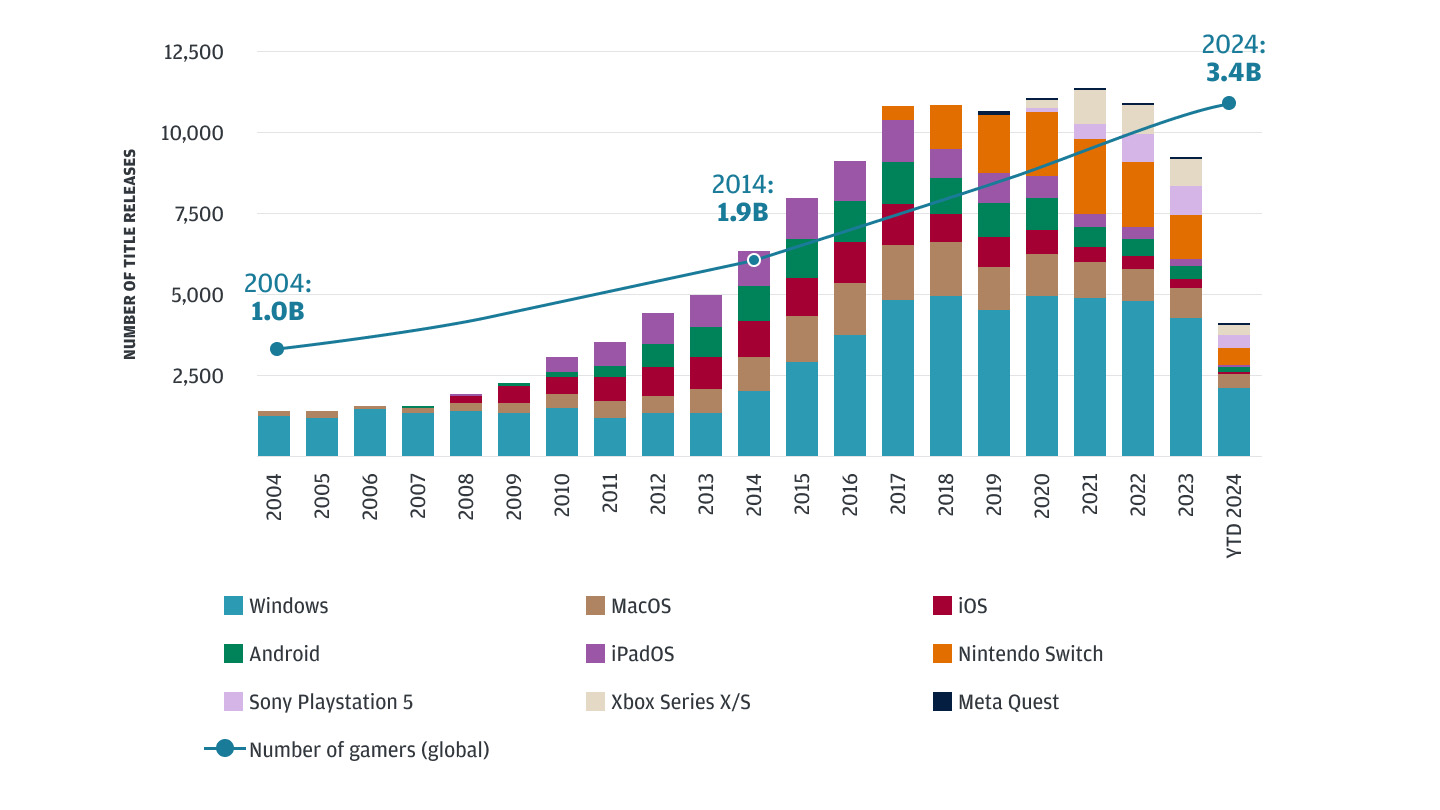

Unlike traditional tech startups that focus on scaling software solutions, gaming companies typically focus on creating compelling intellectual property (IP) to capture and retain a player base. This IP-led approach distinguishes the gaming industry from others, where the primary value is derived from the unique content and experiences provided. However, creating compelling IP is easier said than done. The proliferation of gamers has led to a significant increase in the number of titles being released and a surge in new developers entering the market.

Number of video game players and number of video game titles released per active platform

Source: J.P. Morgan estimates, MobyGames platform database, YTD 2024 as of Aug. 15, 2024.

Indeed, expanded consumer interest provides opportunities for early-stage developers to create innovative IP as more niche markets and genres become viable. However, the sheer volume of content releases across major platforms also intensifies competitive pressure. In this case, founders may pursue venture capital to bolster resources and access industry expertise.

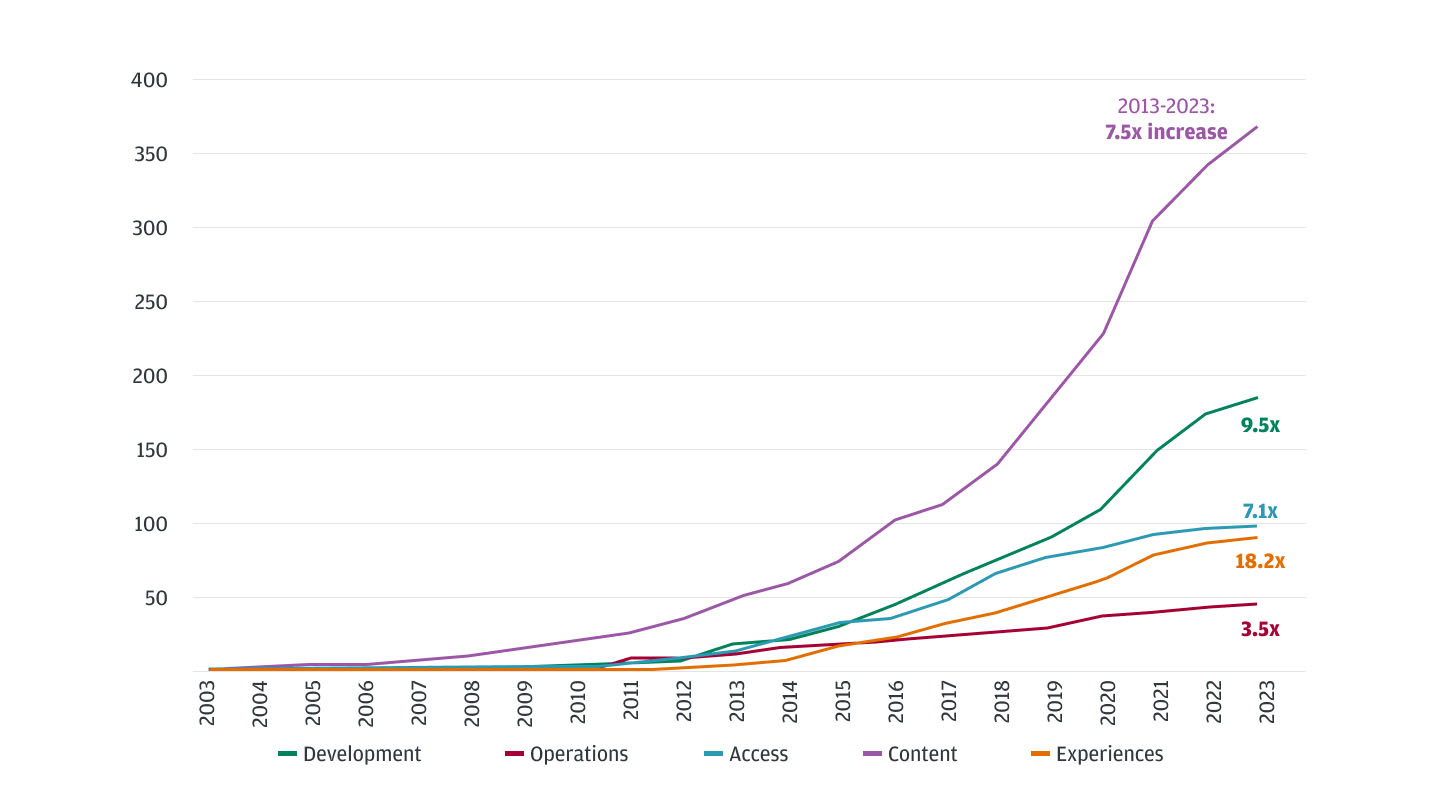

The gaming startup ecosystem is maturing

Roughly half of active venture-backed gaming startups today are focusing on content creation, reflecting a high demand for new IP. However, over the past decade, there has also been a notable increase in startups specializing in two areas:

- Development: Game engines, development tools and technology services

- Experiences: Streaming services, coaching and training, social and community, marketplace and rewards

Cumulative count of active venture-backed gaming startups by specialization

Source: PitchBook

As the industry evolves, there is an increasing need for advanced tools and services that support and enhance content creation. Moreover, startups in development and experiences play a key role in making gaming even more accessible by enhancing aspects of modern gaming such as livestreaming and sharing content with friends, ultimately facilitating wider gaming consumption and fostering a more inclusive gaming environment.

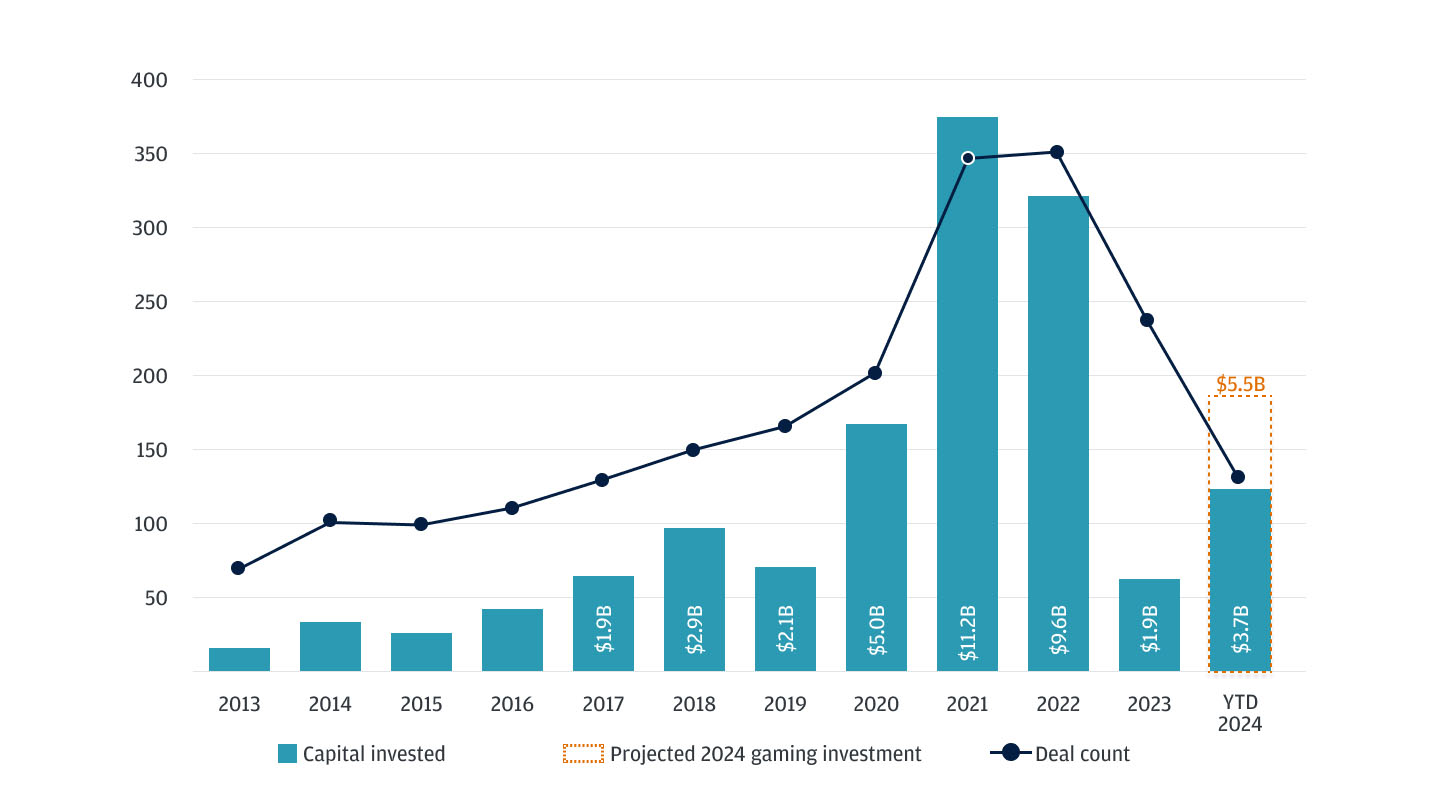

Where venture capital investors are putting money to work

Venture capital funding plays a vital role in the gaming industry, helping accelerate time to market and allowing developers to capitalize on emerging trends. VC investments into gaming startups have risen drastically from a decade ago; the amount of capital invested in gaming has increased 3.7 times from 2014 to 2024 YTD, surpassing the growth rate of the broader venture capital market, which has expanded by approximately 1.5 times over the same period.

U.S. venture investment in gaming startups

Source: PitchBook, YTD 2024 as of Aug. 15, 2024

In 2021, total U.S. venture funding into gaming startups peaked at $11.2 billion. Like virtually every other industry, venture activity has fallen sharply since 2021, however 2024 is showing some bright spots. $3.7 billion of capital has been invested into gaming startups through August 2024, which is nearly double the sum invested over all of last year. Assuming VC investment in gaming companies continues at a similar rate through the end of the year, 2024 could end with roughly $5.5 billion in total investments—the third-highest year on record.

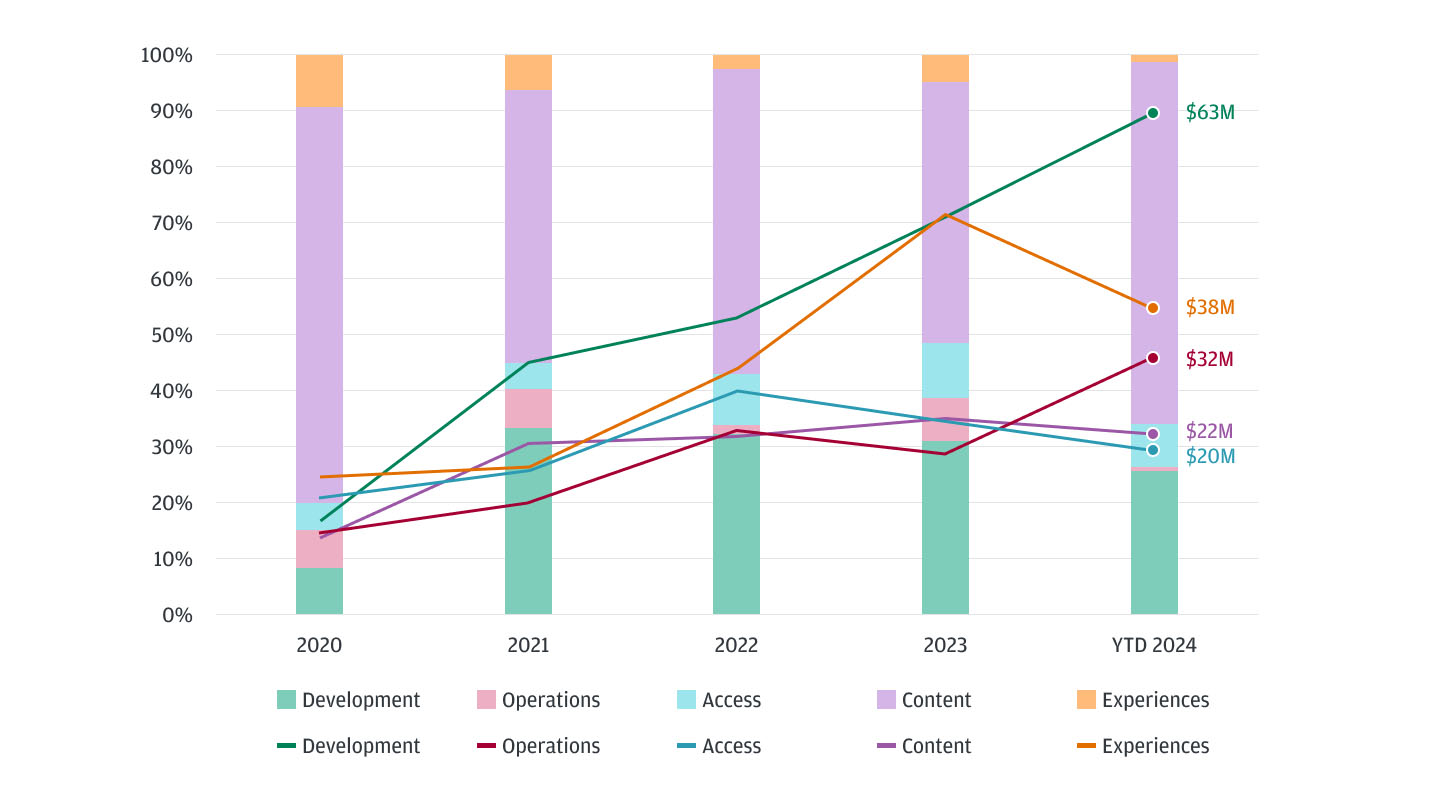

The majority of VC funding goes into gaming startups focusing on content development. Year to date, roughly 65% of the approximately $5 billion of venture capital invested in the gaming sector globally has gone to content-focused startups.

Proportion of global VC gaming capital invested (%) vs. median post-money valuation ($M)

Source: PitchBook, YTD 2024 as of 8/15/2024

This trend clearly underscores investors’ ongoing belief in the power of IP to drive growth in the gaming industry, and it highlights the enduring value placed on developing compelling titles that can capture and sustain the attention of a broad (and broadening) gaming audience.

Conversely, valuation data reveals a nuanced picture. While content-focused startups continue to garner the largest share of capital flows into the gaming sector, startups focused on development and experiences command the highest valuation premiums. These areas of the gaming ecosystem are key to unlocking and enabling broader industry growth, given their potential to scale and ability to support a wide range of content creators.

For founders, while there is substantial opportunity in content creation, investor behavior suggests there is significant value in building the infrastructure and platforms that support content and enhance player experiences. This is evident in the rise of partnerships between gaming studios and infrastructure providers such as AWS, Google Cloud and others. These providers enable developers to scale globally, reduce latency and focus on creating content without the burden of managing servers or complex backend systems. Startups that can deliver solutions by leveraging gaming infrastructure (or creating it in-house) may be well-positioned to attract venture capital at a premium valuation and potentially benefit from a more stable and scalable business model compared with content-focused peers, which may face higher risks associated with the unpredictability of content success.

Will artificial intelligence define tomorrow’s gaming landscape?

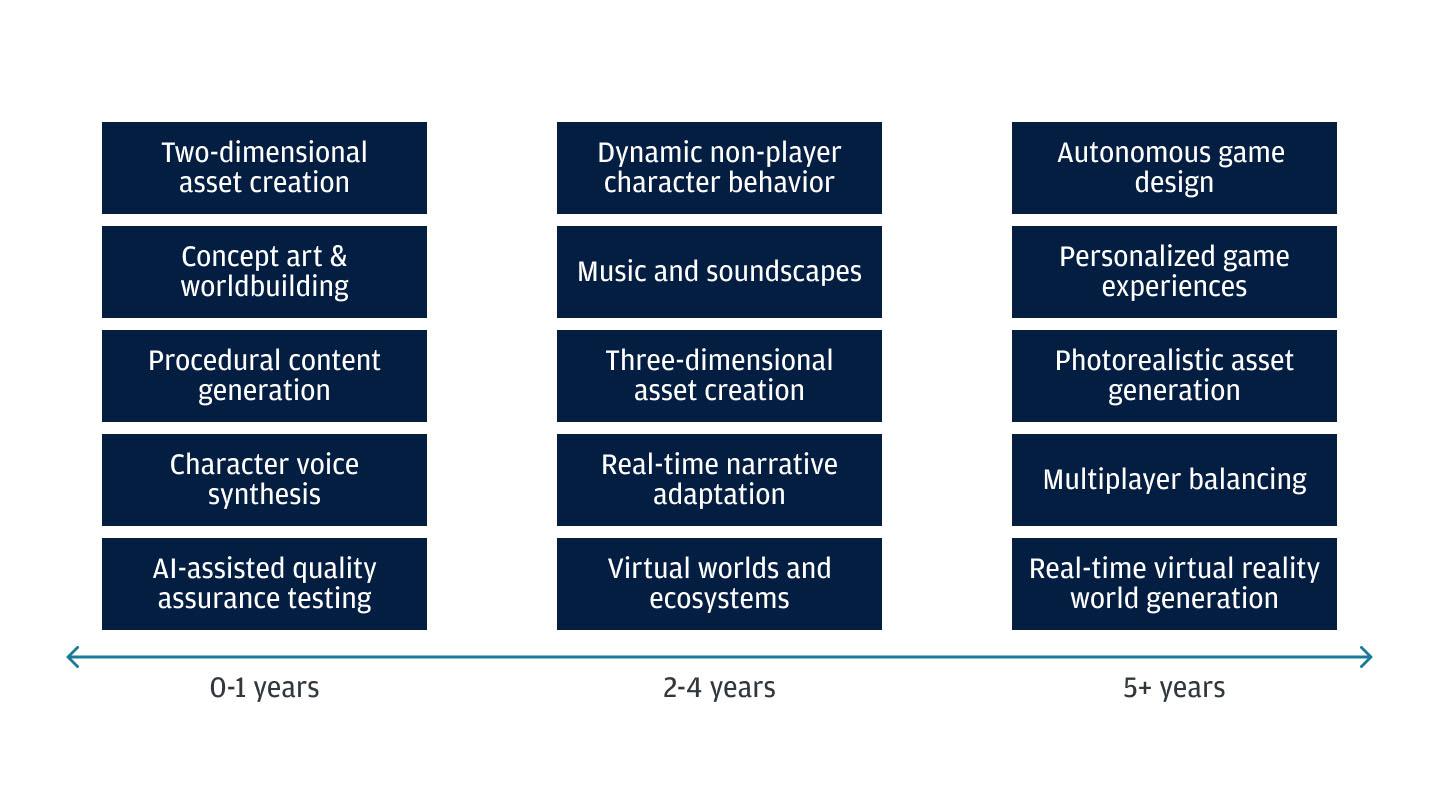

Recent advancement in AI will play a transformative role in game development, offering both immediate enhancements and longer-term shifts in how the industry operates. From streamlining creative processes to building entirely new gaming experiences, AI is rapidly becoming a core tool for developers. According to a survey conducted by Bain & Company, video game industry executives believe generative AI could manage more than half of game development within 5 to 10 years, up from less than 5% today.2

Generative AI use cases in game development

Source: J.P. Morgan predictions

The ability to rapidly develop and iterate games keeps them relevant in an industry where player preferences can shift overnight. With the rise of cloud-based development tools, remote and distributed teams can collaborate more efficiently and effectively, reducing the overhead costs typically associated with game development. These innovations provide an opportunity for startups with limited resources to compete with larger studios, develop more IP and infrastructure, and capitalize on emerging trends.

Key considerations for game development startups

In the evolving landscape of game development, startups must navigate a complex array of challenges and opportunities to succeed. Here are some priorities to consider:

- Build a deep bench of creative directors: Creative directors are essential for developing compelling gaming experiences. A diverse and deep talent pool is critical for creating the narratives that will set a company’s IP apart from its competitors.

- Pursue impactful ideas: Tomorrow’s successful gaming startups will focus on ideas that offer meaningful value beyond just gameplay. This commitment to creating experiences that resonate on a deeper level can enhance user engagement and loyalty and contribute to long-term success.

- Focus on efficient operations: This will be necessary to allow fast, iterative game development, reducing time to market.

- Access AI expertise: AI will be crucial for gaming startups to keep pace with the industry.

- Develop evangelists and advocates: An active and engaged community can promote releases and provide critical feedback, especially to newer gaming startups.

Build your future with J.P. Morgan

At J.P. Morgan, we’re not just in the game—we’re setting the high score. As the leading bank of the innovation economy, we bring together founders, investors, startups and high-growth companies to create the future of gaming. Ready to hit turbo on your gaming venture? Learn more about J.P. Morgan Innovation Economy Startup Banking solutions.

JPMorgan Chase Bank, N.A. Member FDIC. Visit jpmorgan.com/commercial-banking/legal-disclaimer for disclosures and disclaimers related to this content.

References

The Entertainment Software Association, 2024 Essential Facts About the U.S. Video Game Industry, May 2024

Bain & Company, How Will Generative AI Change the Video Game Industry? September 2023. Used with permission from Bain & Company.