Note: Given the expansiveness of the ocean-climate tech sector, these categories are not encompassing of all technologies in the space.

Sources: J.P. Morgan analysis and Propeller Ventures.

The ocean serves a vital role in regulating the planet's climate and providing essential resources for the global economy and human life. It balances the Earth's climate by managing temperature, carbon dioxide and other greenhouse gases. The ocean stores 50 times more carbon than the atmosphere, absorbing 25% of carbon emissions and 90% of excess heat. Economically, the ocean is significant, with an estimated annual gross marine product of $2.5 trillion, equivalent to the eighth largest economy globally. Its resources support the livelihoods of over three billion people1 and provide the primary daily source of protein for nearly one billion people.2 Despite the importance of the ocean and its resources, technologies aimed at economies operating in its proximity garnered less than 3% of climate technology investment last year, presenting an opportunity for greater investment at the ocean-climate nexus.

Defining the opportunities at the ocean-climate nexus

The ocean-climate nexus refers to the interconnected relationship between the ocean and Earth’s climate system, the role the ocean plays in regulating the global climate, and the expansive economic activity that operates at this intersection. Startups focused on this area are developing technologies to address both climate and ocean challenges and, at times, extend to biodiversity and pollution. Some in the sector have previously grouped these technologies under the term blue technology (or blue tech).

“Entrepreneurs aren’t worried about fitting into categories such as blue tech or the blue economy. Rather, they are hungry to apply their entrepreneurial energy to new technology and innovation in the many areas where oceans and the global economy interact.”

—Rodrigo Prudencio, Managing Partner, Propeller Ventures

Select ocean-climate nexus technology sectors

Carbon

Within the carbon sector, many startups are working on technologies to capture and sequester carbon dioxide from seawater or finding ways to safely store carbon in the ocean. These processes are collectively known as marine carbon dioxide removal (mCDR). Startups are developing methods to, for instance, use electrochemistry to extract carbon dioxide directly from ocean water to increase carbon sequestration. Another way startups are enhancing the oceans’ carbon sink capabilities is through accelerating limestone weathering, which stores carbon dioxide safely and stably as oceanic bicarbonate.

Industrials

The industrials sector includes solutions that reduce water and energy use, improve efficiency and reduce the impact of heavy industries, like maritime and wastewater. It also includes underwater vehicles and robots for ocean-climate data collection and maritime security. For example, the shipping industry, which transported over $1.5 trillion in U.S. trade in 2020,3 contributes to 3% of global emissions annually4 and is under regulatory pressure to decarbonize. To reduce shipping’s carbon footprint, startups are developing electrification technology, carbon capture devices and alternative fuels.

The number of applications within the industrials sector has increased due to advancements in manufacturing, battery technology and autonomous technology. As a consequence, new solutions like dual use-technologies, autonomous underwater vehicles and oceans sensors have emerged. Dual-use technologies, including unmanned autonomous and underwater vehicles, are utilized for both civilian and military applications like surveillance and trade route monitoring. Ocean sensors have a wide range of uses, from helping scientists collect ocean-climate data to assisting in naval operations.

Organics

Organics refers to novel biological ingredients and technologies across several industries including food, agriculture and pharmaceuticals. Use cases include aquaculture technology, algae-based biotechnology, cell-based proteins and seaweed cultivation for food, skincare and compostable resins. The U.S. produces $11 billion5 of processed seafood annually and is one of the largest seafood markets in the world. Aquaculture startups are working to optimize fish, shrimp, and oyster feeding and harvesting to improve efficiency and scale production. Innovation in the aquaculture space also extends to supply management, traceability and compliance, as consumers and policymakers are increasingly interested in a sustainable and safe food supply.

The ocean-climate technology investment landscape

Given the breadth of opportunities, many startups have entered the space looking to solve problems with novel technologies. Investment has been rising to support the development of technologies like mCDR, autonomous underwater vehicles and enhanced aquaculture.

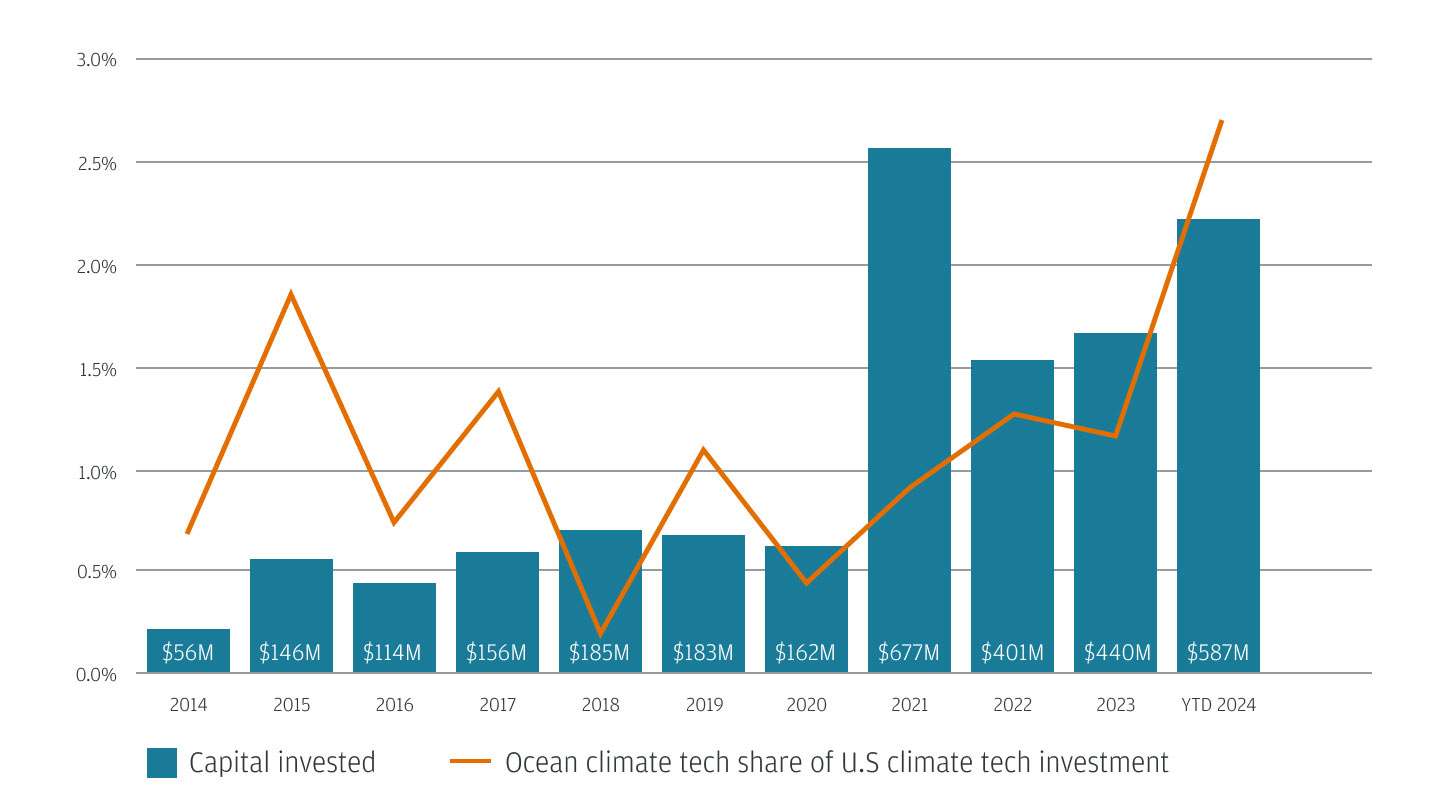

U.S. ocean-climate nexus technology investment and share of total U.S. climate technology investment

Note: Year-to-date 2024 data is as of 11/01/24. Climate tech as defined by J.P. Morgan taxonomy. Excludes offshore wind.

Source: PitchBook. Data has not been reviewed by PitchBook analysts.

Over the last decade, ocean-climate technology startups have raised over $5 billion in venture funding, a small but growing proportion of all U.S. climate tech funding. Of these startups, 41% have yet to raise a series A round.

However, some sectors are more developed than others:

- Carbon: Since 2014, the carbon sector has attracted only 2% of total ocean-climate technology capital investment. This promising but fledgling sector is primarily composed of early-stage companies focused on mCDR. These startups are launching initial pilot plants and working to establish a track record of operating effectively.

- Industrials: The industrials sector has secured 42% of ocean-climate tech funding. Startups developing unmanned surface vehicles to enhance maritime security received half of industrials funding in 2024. As these vehicles traverse the oceans, they are collecting ocean data, which can be used by the defense, offshore oil and gas, and shipping sectors to monitor ocean conditions and reinforce business continuity.

- Organics: Organics startups have received 56% of ocean-climate tech funding since 2014. Within this sector, aquaculture startups have secured about 60% of the funding. These startups develop efficient and sustainable methods for raising fish and other seafood while reducing water usage and waste.

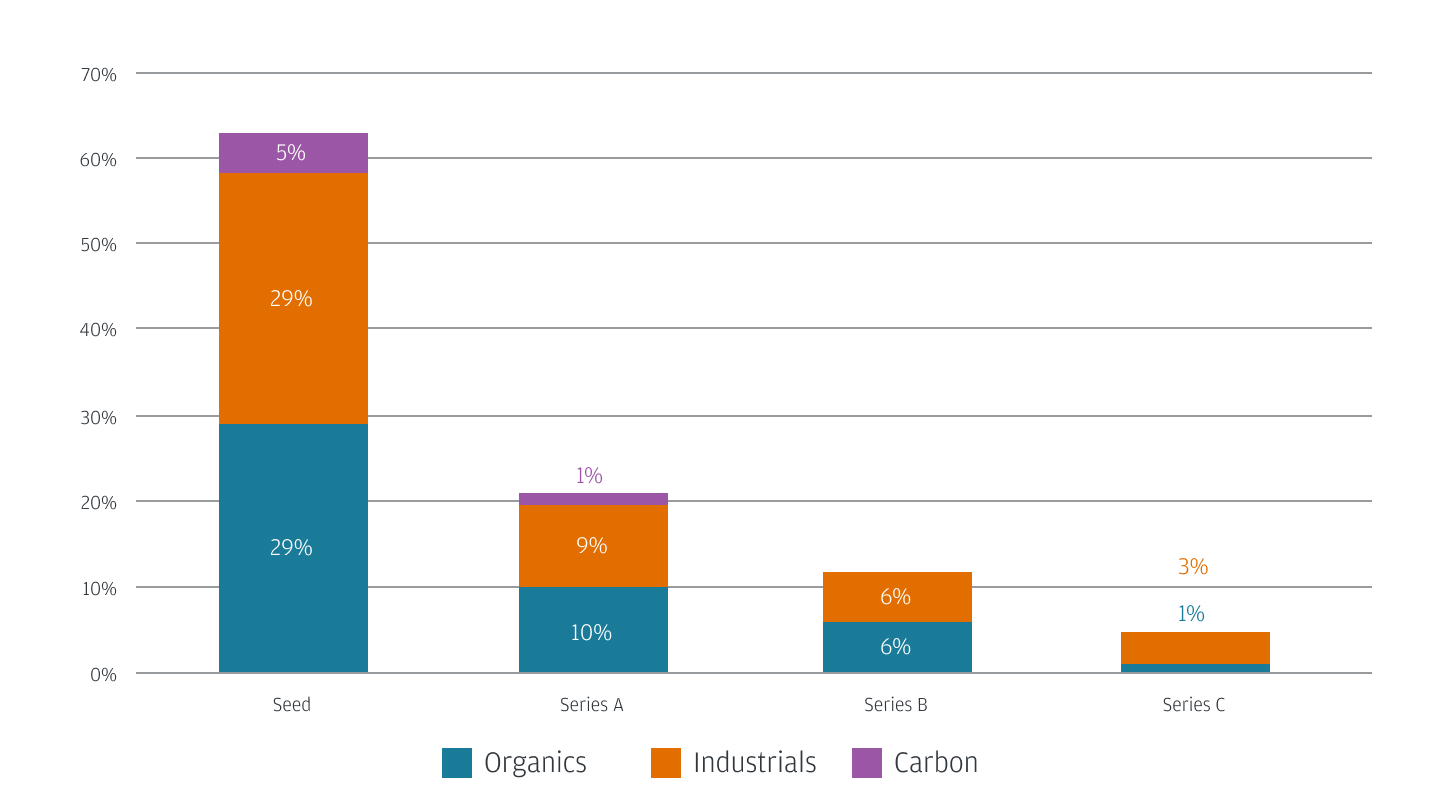

Distribution of U.S. venture-backed ocean-climate tech startups by series and sector

Note: Includes companies that raised a round with a specified series in the period 1/1/2022 to 11/1/2024. Percentages in the graph represent each series’ and sector’s share of all startups analyzed.

Source: PitchBook. Data has not been reviewed by PitchBook analysts.

Ocean-climate tech has benefited from the broader interest in climate technology, as well as increased federal focus and spending to spur innovation. For example, the federal government’s Ocean Policy Committee released its first Ocean Climate Action Plan in 2023, which highlights the role of the oceans in addressing climate change. The plan has three goals: (1) eliminate ocean-based emissions, (2) accelerate the development and use of nature-based solutions, and (3) strengthen the U.S.’s ability to adapt to ocean change. The Department of Commerce (DoC) and National Oceanic and Atmospheric Administration (NOAA) have allocated $60 million in awards through the Ocean-based Climate Resilience Accelerators program to support startups working on climate resilience. These federal initiatives are funded through the Inflation Reduction Act (IRA), which may be affected by the incoming administration. Given global tensions and an increase in naval activity, rising interest in defense technologies has been another driver of ocean-climate tech investment. For instance, the NavalX initiative has been set up by the U.S. Navy to foster innovation and be a “super-connector” between the Department of Defense and external partners, like startups.

“It’s really simple. We can’t reach net zero without the ocean. And it was the ocean scientists in the labs I met who were optimistic about the opportunity. That’s why we started Propeller in the first place.”

—Brian Halligan, Founder and General Partner, Propeller Ventures

With rising venture investment and established support from the Ocean Policy Committee, NOAA and the DoC, ocean-climate startups are well positioned to take advantage of the opportunities in the sector. Even with the new administration, IRA-funded initiatives may not face a full repeal given how they support onshoring and job creation in the U.S. Trends like connectivity, autonomy and falling hardware costs have made developing ocean technologies more feasible. From improving shipping efficiency to scaling coastal adaptation, the intersection of climate tech and the ocean is likely to gain traction with entrepreneurs, incumbent industries and investors as they aim to better understand how to navigate the oceans sustainably.

Build your future with J.P. Morgan

We are committed to being the leading bank of the innovation economy—bringing together founders, investors, startups and high-growth companies with forward-thinking approaches. Learn more about J.P. Morgan Innovation Economy Startup Banking solutions.

References

United Nations Department of Economic and Social Affairs. Oceans and Seas.

Roundtable on Environmental Health Sciences, Research, and Medicine; Board on Population Health and Public Health Practice; Institute of Medicine. Understanding the Connections Between Coastal Waters and Ocean Ecosystem Services and Human Health: Workshop Summary. June 2014.

Bureau of Transportation Statistics. On National Maritime Day and Every Day, U.S. Economy Relies on Waterborne Shipping. May 2021.

U.S. Department of Energy. U.S. Department of Energy Leads International and Domestic Efforts for Zero-Emissions Shipping by 2050. April 2024.

NOAA Fisheries. U.S. Inspected Seafood and the Global Market. October 2023.

Contributors

Britt Gardner

Executive Director Relationship Exec - IE