In an era of heightened geopolitical tensions and rapid technological advancements, the United States continues to prioritize defense innovation to maintain its global leadership and national security. The U.S. House of Representatives in July passed its version of the Fiscal Year 2026 Defense Appropriations Act, which would allocate approximately $832 billion in discretionary funding for defense programs if enacted. The proposal includes roughly $148 billion for research, development, test and evaluation (RTD&E), and continued funding support for the Defense Innovation Unit (DIU), Accelerate the Procurement and Fielding of Innovative Technologies (APFIT), and Office of Strategic Capital (OSC).1 Ultimately, any federal spending bill must be reconciled with the Senate version and signed by the president before taking effect.

By examining the landscape of defense tech investment and the Department of Defense’s (DOD) efforts to bridge the gap between innovation and production, we provide a look at how the U.S. is using the power of innovators to address the latest national security challenges.

In 2023, the DOD released the National Defense Science and Technology Strategy (NDSTS), which articulated the department’s priorities and the importance of “leveraging critical emerging technologies … to bolster our competitive advantages … that will help ensure our national security over the long term.” This built on the DOD’s technology vision established in 2022 by then-Undersecretary of Defense for Research and Engineering Heidi Shyu, which outlines 14 critical technology areas, including quantum science, AI and autonomy, and space technology as part of the greater national-defense strategy.2 However, current Undersecretary Emil Michael—who also serves as acting director of the Defense Innovation Unit—said at an industry conference in August that he plans to streamline this list, arguing too many priorities dilute focus and make it harder for the DOD workforce to prioritize effectively. Michael said he aims to concentrate on fewer, more critical areas, focusing on “sprints” that can deliver tech to the armed forces within the next few years.3

Making it successfully through the “Valley of Death”

From large defense incumbents to small startups, the DOD works with a variety of partners to fulfill its needs. However, for startups with tight resources and less familiarity with how the DOD operates, procuring a government contract can be a very challenging process to navigate. This is a problem, as startups are often the ones developing the latest technological innovations. Many startups encounter the “Valley of Death,” the difficult period between receiving initial government funding and achieving commercialization. To solve this problem, the DOD has been redefining how it collaborates with private companies. This, combined with ample amounts of private capital, means the success rate of defense tech startups could greatly improve.

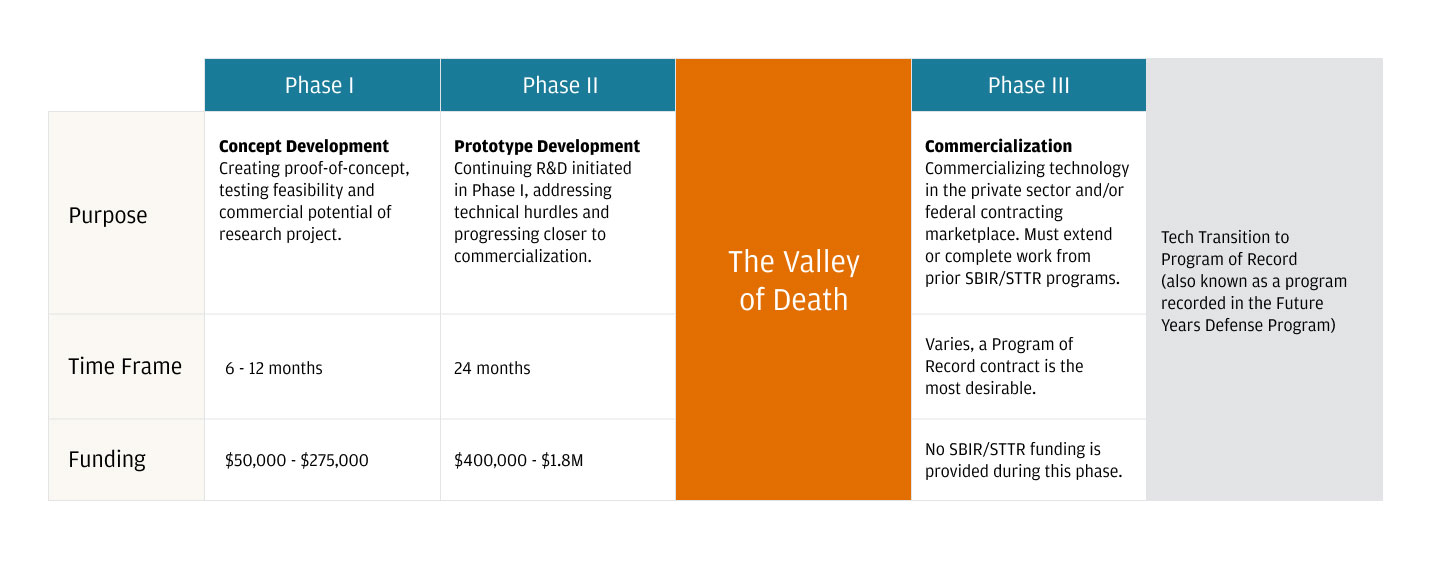

To support startups in overcoming these funding challenges, the DOD leverages Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs. These programs, including those administered by the Defense Advanced Research Projects Agency (DARPA), provide funding to founders who apply to conduct research and develop prototypes based on defense agencies’ needs. The demands on a startup’s time and capital can be significant as they move from concept (Phase I) and prototype (Phase II) to commercialization (Phase III). Over the last decade, only 16% of DOD SBIR-funded companies received Phase III contracts.4

Phases of SBIR & STTR programs and the Valley of Death

The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs provide non-dilutive funding to small businesses that propose solutions to the corresponding agency’s solicitations. To accelerate bringing new tech into use, the DoD and other federal agencies are testing new ways to fund and support startups across the valley of death, where small businesses have often perished.

Startups that make it to Phase III still face an uphill battle to meet the DOD’s requirements to achieve the coveted Program of Record (POR) status. A POR is recorded in the Future Years Defense Program for which Congress has appropriated funding. This is a critical milestone for a defense tech company. However, few companies reach this goal: Fewer than 1% of Phase I awardees achieve POR status.

The DOD jumps into action

The DOD has launched multiple innovation-focused organizations over the last decade to foster the development and deployment of new technologies. This strategy aims to create greater alignment between how the DOD is accustomed to working and how startups prefer to operate. This multipronged approach is illustrated by a growing list of organizations and programs, including:

- The Defense Innovation Unit (DIU), which focuses on scaling defense innovation through greater connection and collaboration with private companies

- The Office of Strategic Capital (OSC), which aims to attract and scale private capital to bolster national security

- National Security Innovation Capital (NSIC), a new program focused on funding hardware startups solving defense-related issues

- AFWERX, the innovation arm of the Air Force focused on connecting with the startup ecosystem and adopting new tech

- Army Applications Lab, an Army organization focusing on bridging the Valley of Death by providing funding and testing and potentially deploying new tech

This builds on the activities of established organizations like DARPA and In-Q-Tel.

Ramping commercial technology adoption through the DIU

Launched in 2015, the Defense Innovation Unit was specifically created to accelerate DOD adoption of commercial technology, transform military capacity and capability and strengthen the American national security innovation base. The DIU 1.0 and DIU 2.0 strategies emphasized connecting the DOD with the commercial technology sector and proving out the innovation hub’s model for delivering commercial capabilities to the battlefield. Other Transaction Agreements (OTAs) were a key part of DIU 2.0, as the program specifically aimed to help startups bridge the Valley of Death. Launched in 2024, DIU 3.0 is the latest strategy to ensure the organization is better equipped to target bottlenecks and maximize the impact of its funds across the DOD.

In 2025, the DIU has continued to support innovative startups through several key programs. Among these is the Defense Tech Accelerator Challenge, which seeks to identify and support cutting-edge innovations that address critical DOD needs. Additionally, the Blue Object Management Challenge focuses on advancing AI-enabled decision-making capabilities that improve how mission-critical data is integrated, accessed, and used across DOD platforms and forces.5 6

“Since the inception of Military and Veterans Affairs in 2011, we have worked to deepen and diversify our support for the military community and their families. By partnering across JPMorganChase’s lines of business, we directly engage with veteran and military spouse founders and investors. We are proud of this commitment and focus, and believe a strong economy and robust national security are both imperative and mutually dependent. Veterans naturally gravitate toward businesses that support the national security space, many of which are dual use and represent significant commercial opportunities. Veterans throughout our firm understand the journey of veteran founders and how to best support them.”

-Rhett Jeppson, Executive Director, JPMorganChase

Robust defense tech investment bucks recent trend

In response, venture investment in defense tech has grown considerably since 2017, remaining relatively robust as total venture investment fell from its peak in 2021. Through the first half of 2025, venture investments into U.S.-based defense tech startups totaled roughly $38 billion and could very well exceed the 2021 peak should the pace of investing remain constant through the end of the year.

This surge in activity may be attributed to several factors, including an increasingly tense geopolitical landscape, heightened demand from defense customers, and ongoing support from the current administration for innovative startups. Additionally, many defense tech founders are developing technologies with multiple applications; for example, advances in AI and cybersecurity are proving beneficial not only in defense but also in commercial sectors like manufacturing and energy.

Strategic public-private partnerships are emerging to secure critical supply chains, exemplified by MP Materials’ recent agreement with the U.S. government to boost domestic rare-earth magnet production capabilities and reduce dependence on Chinese suppliers—a move that supports both defense manufacturing and broader economic security.7 8

U.S. Defense Tech venture investment activity

Defense tech includes advanced computing & software, advanced materials & manufacturing, autonomous systems, biotechnology, defense-specific technologies, human-machine interfaces, quantum sciences, renewable energy generation & storage, semiconductors & microelectronics, sensing, connectivity & security, and space technology. These categories align with the DOD’s CTAs. US-based, VC investment.

Source: PitchBook. Data has not been reviewed by PitchBook analysts.

The highest-funded categories since 2015 within defense tech were:

- Advanced computing and software: Includes startups providing intelligent data-management software, data resilience and multicloud networking. With the rise of generative AI, AI-related data processing is an emerging area.

- Sensing, connectivity and security (also known as integrated network systems-of-systems): Includes startups providing security operations centers to proactively protect, detect and recover systems. Investment activity is concentrated on solutions protecting industrial systems, financial compliance and multicloud networks.

- Biotechnology: Biotech is a broad category, but as it relates to defense tech, AI-driven therapies and precision medicine are a focus. The DOD has indicated that biomanufacturing is a key focus area for the agency.

- Autonomous systems: A rising priority for the DIU, illustrated by the 2024 Replicator initiative which secured a $500 million budget for all-domain attritable autonomous systems (ADA2). Similar to advanced computing and software, the AI surge has driven a range of use cases, including automated industrial and logistics robots, and uncrewed aerial and field intelligence systems.

Cumulative invested venture capital (U.S. only, from 2015) for select Defense Tech categories

Categories are not mutually exclusive; companies can appear in more than one category.

Source: PitchBook. Data has not been reviewed by PitchBook analysts.

The outlook for defense technologies

The tumultuous geopolitical landscape seems unlikely to let up any time soon. Recent agreements by NATO member countries to increase defense spending targets to 5% of GDP reflect the broader allied recognition of current security challenges and the need for enhanced defense capabilities.9

The DOD’s continued emphasis on technology as a major factor for its mission is apparent with the creation of a multitude of initiatives, like the DIU, supported by significant (rising) budgets. The number of startups working on defense-orientated technologies is rising, backed by record venture investment. The DOD’s acknowledgement and efforts to support startups and help them bridge the Valley of Death will likely result in more successes, in turn fueling the interest in defense tech.

Banking the innovation economy

We are committed to being the leading bank of the innovation economy—bringing together founders, investors, startups, and high- growth companies. Learn more about J.P. Morgan Innovation Economy Startup Banking solutions. Additionally, through JPMorganChase’s Military and Veterans Affairs programs and initiatives, we’re working to help military members, veterans and families thrive in their post-service lives.

Visit our Innovation Economy content hub to discover more insights.

References

House Committee on Appropriations, “House Passes FY26 Defense Bill, Investing in America's Military Superiority,” press release, July 18, 2025.

Office of the Under Secretary of Defense for Research and Engineering, “Critical Technology Areas,” U.S. Department of Defense, accessed Sept. 10, 2025.

Jon Harper, “Pentagon to trim list of critical technology areas,” DefenseScoop, Aug. 27, 2025.

Defense Innovation Board Strategic Investment Capital Task Force, “Terraforming the Valley of Death: Making the Defense Market Navigable for Startups,” July 18, 2023.

National Security Innovation Network, “DIU Presents: Defense Tech Accelerator Challenge,” Feb. 27, 2025.

Defense Innovation Unit, “DIU Presents: Blue Object Management Challenge,” Aug. 13, 2025.

Katha Kalia, Eric Onstad and Ernest Scheyder, “MP Materials seals mega rare-earths deal with US to break China's grip,” Reuters, July 10, 2025.

J.P. Morgan, "Rare earths, real impact: Inside the MP Materials deal," What's the Deal? podcast, Sept. 15, 2025.

Holly Ellyatt, “NATO allies agree to higher 5% defense spending target,” CNBC, June 25, 2025.

JPMorgan Chase Bank, N.A. Member FDIC. Visit jpmorgan.com/commercial-banking/legal-disclaimer for disclosures and disclaimers related to this content.