Liquidity & Account Solutions

Grow your business with an account strategy that makes your liquidity work smarter with visibility, control and optimization.

Payments as a strategy

Create a payments strategy that moves liquidity intelligently and unlocks more value from your cash through advanced, real-time currency optimization and global connectivity.

Get in touch

Hide

Get in touch

Hide

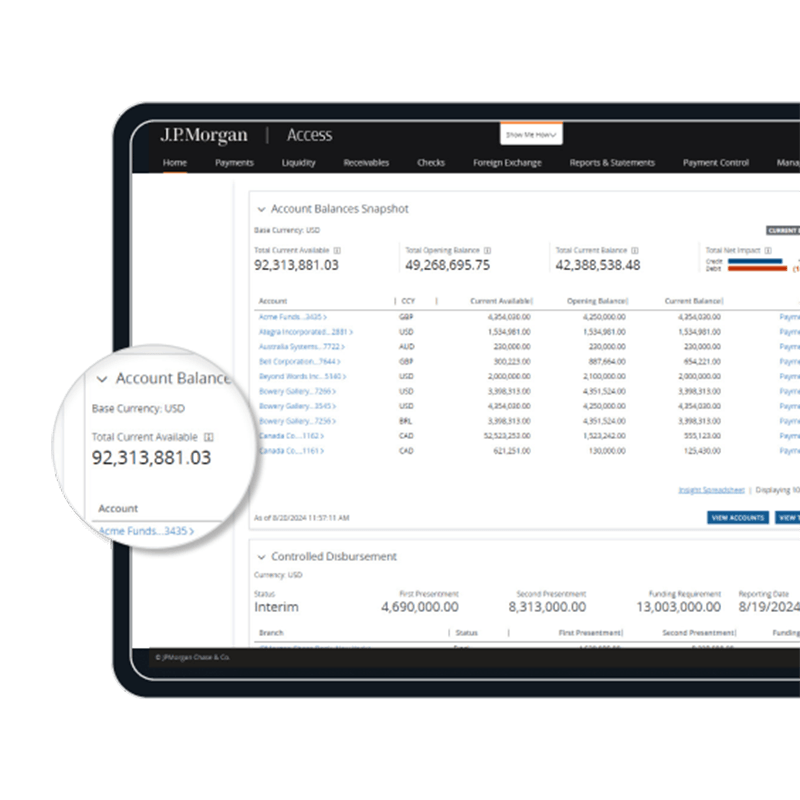

Visibility, control and optimization

Achieve next-level liquidity objectives with J.P. Morgan

Transform your treasury from an operational to a critical business growth engine with account structuring solutions and agile liquidity management architected with you in mind.

Get insights into your capital, across all channels

Identify and capture new sources of value, gain access to tools to help you manage risks associated with third-party monies and unlock treasury optimization across your organization.

Accounts that do more

Capitalize on market opportunities, including reconciliation, funding efficiency, and foreign-exhange management and safeguarding, while meeting financial and business goals.

Physical solutions

Turn cash positions into answers, information and insights, so you can make informed decisions.

- Demand Deposit Account

- Liquidity Management Account

- Earnings Credit Rate

- Escrow

- J.P. Morgan Coin

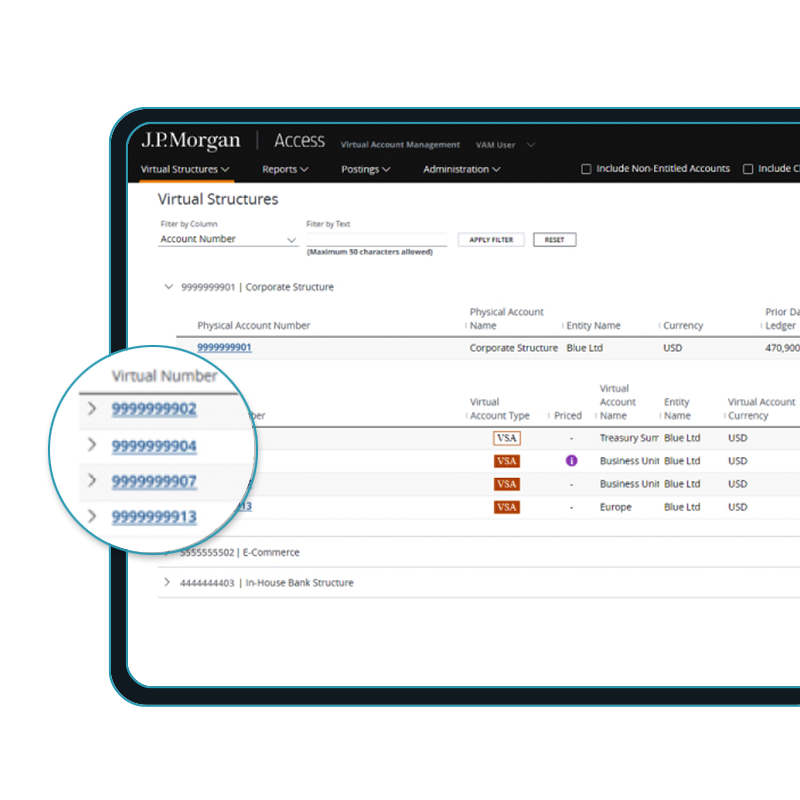

Virtual solutions

Enable virtual differentiation of cash activity within a single account with our Virtual Account Management solution, which combines a Demand Deposit Account with a virtual account subledger.

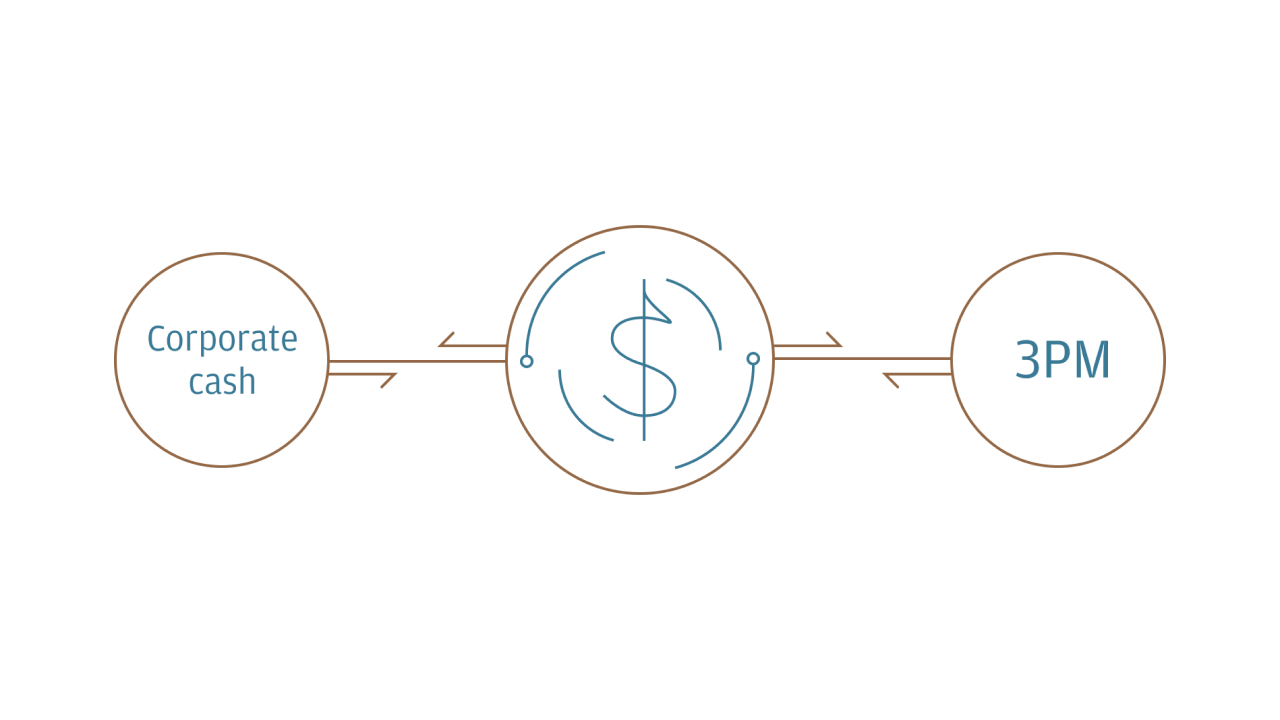

Third-party money (3PM)

Identify and capture new sources of value, manage risks associated with 3PM and optimize treasury across your organization.

- Client Money Account

- Sponsored Accounts

Liquidity solutions architected for your needs

- Account structuring and liquidity optimization

- Physical cash concentration

- Just-in-time funding

- Notional pooling

- Cross-currency sweeps

- Investment sweeps

Realize the power of global presence with local expertise to achieve visibility, control and optimization of your working capital.

Ecosystems integrated for performance

Determine new sources of value throughout the payments cycle and embrace third-party platform business models with confidence.

Third-party money (3PM)

Let us help you navigate the 3PM environment and achieve your e‑commerce goals to hold, transact and optimize third-party funds around the world through physical and virtual accounts.

Embedded finance

Easily embed the payments tools you need into your non-financial platforms to help your customers on their buyer journey, whether they are using non-bank mobile apps or online platforms.