Sustainability continues to be a priority for business leaders and policymakers in 2024, and we’re excited to see so much momentum in the green economy space.

Since our last update in Q1, the Green Economy Banking team has met and talked with hundreds of companies that are advancing decarbonization across the globe. We have closed several meaningful transactions, launched a new webinar series and held regional events in Chicago, Houston, New York City, Phoenix and San Francisco. And we’re gearing up for summer events in San Francisco and Washington, D.C.

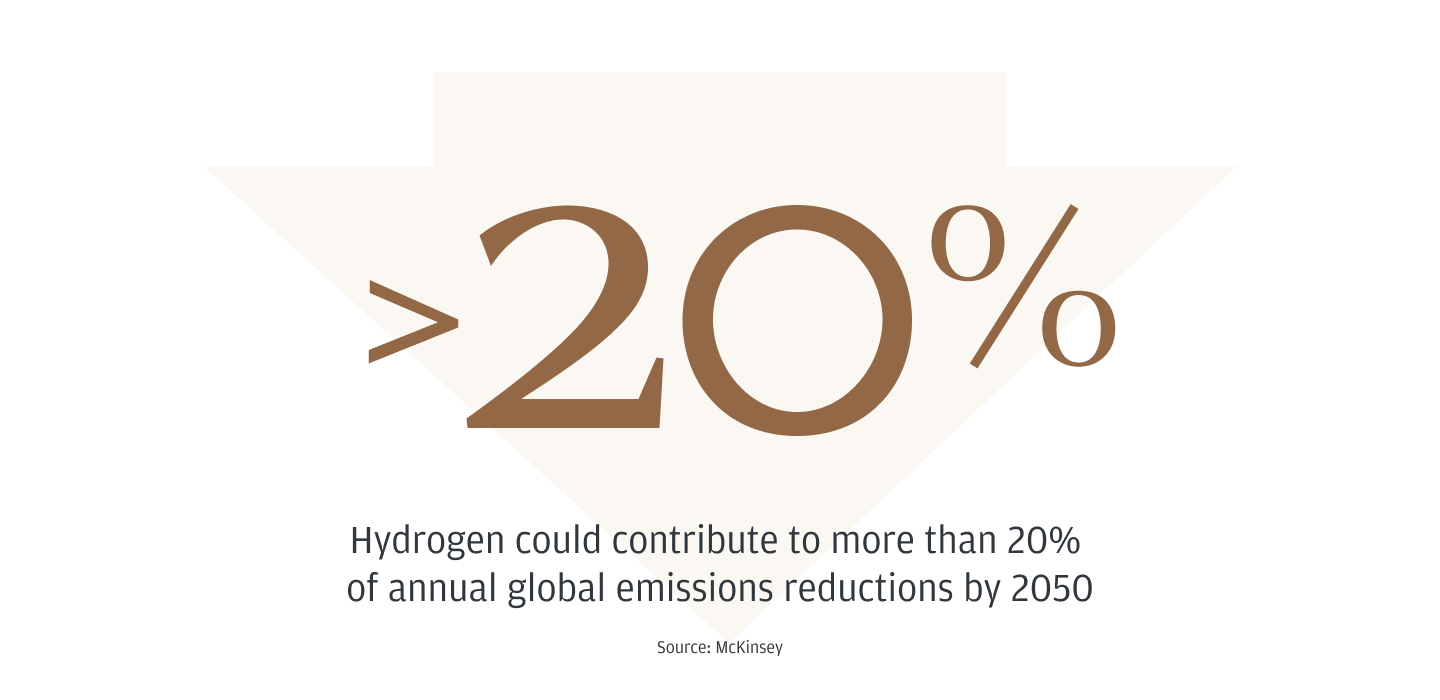

This Q2 update takes a closer look at hydrogen, a clean-burning gas that McKinsey predicts “could contribute to more than 20% of annual global emissions reductions by 2050.” Here, you’ll find a Q&A about what to watch for in the hydrogen space, profiles of two J.P. Morgan bankers who support hydrogen companies, a peek into one of the innovators in this sector, recent deal highlights and relevant insights from J.P. Morgan thought leaders.

What to watch

The hydrogen industry has been quite active in the past year. Darcy Partners, a technology scouting and market intelligence firm serving the energy industry, reported 1,418 total global hydrogen project announcements in 2023. Global investments in these projects reached $570 billion, up 31% from 2022.

Even with this progress, engineering challenges and gaps in the hydrogen value chain remain.

To better understand the current landscape—and where things are headed—Eric Cohen, Head of Green Economy Banking for JPMorgan Chase Commercial Banking, North America, spoke with physicist Lindsey Motlow, Senior Research Associate, Energy Transition and Sustainability at Darcy Partners.

Q&A

Cohen: How would you characterize the state of the hydrogen market today?

Motlow: In 2023, we saw a heavy focus on production and a gap in infrastructure investments. We also saw a limited uptake of green hydrogen in existing markets.

That said, 2023 brought a lot of projects and policies from the planning phase to construction and realization. We also saw a big focus on more investment—exceeding $330 billion—in giga-scale low-carbon hydrogen projects.

2023 was also a great year for learning. With more projects, pilots and feasibility studies breaking ground, passing through complex permitting and regulatory channels, EPC [engineering, procurement and construction] engagement, and enabling component procurement, Darcy Partners published new findings from these first-of-a-kind projects that can help guide future progress and strategic planning and investment for everyone in the industry.

Cohen: You mentioned policy. What major developments in the past year are worth calling out?

Motlow: Policy and regulation development are a huge part of ensuring the success of a “clean hydrogen economy.”

In June 2023, the U.S. Department of Energy (DOE) released the U.S. National Clean Hydrogen Strategy and Roadmap, which outlines the country’s approach to clean hydrogen. The DOE also released an updated guidance document containing a proposal for the Clean Hydrogen Production Standard (CHPS) to meet the requirements of the Infrastructure Investment and Jobs Act of 2021. The updated guidance establishes a target of 4.0 kilograms of carbon dioxide-equivalent emissions per kilogram of hydrogen (kgCO2e/kgH2) for life-cycle greenhouse emissions associated with hydrogen production.

Meanwhile, the European Union's Clean Hydrogen Joint Undertaking further narrowed its focus on research and innovation activities related to the production, distribution, storage and end-use applications of clean hydrogen—in line with the European Green Deal and the EU Hydrogen Strategy.

Cohen: What progress are you seeing when it comes to infrastructure development?

Motlow: The DOE has been working to drive infrastructure development and stimulate demand for hydrogen with the announcement and launch of its Regional Clean Hydrogen Hubs Program. Other countries have launched similar funding opportunities and initiatives, pushing for scale-up and development of infrastructure solutions down the full hydrogen value chain.

Cohen: Where are there knowledge gaps for people working in the hydrogen space? How is Darcy helping to fill them?

Motlow: Our research model takes input from our members and uses their strategic priorities to inform where we can best provide insights. Many of the hydrogen knowledge gaps are the same across industries, whether the Darcy customer is in oil and gas, utilities or private equity.

And there’s no question about it: The pull from our customer base on hydrogen is significant. One quarter of all the questions we’ve received in the past year have focused on hydrogen specifically. Some of the production-related topics we’ve researched include distributed hydrogen production, methane pyrolysis, waste-to-hydrogen technology, hydrogen electrolysis and lowering the carbon intensity of blue hydrogen production. Meanwhile, our focus on engineering challenges and solutions down the value chain has included studies in storage and transport, hydraulic modeling of hydrogen and hydrogen blends, compatible materials and solutions for pipelines and stationary storage, and opportunities for connective infrastructure development.

Cohen: What are your current research priorities?

Motlow: When it comes to hydrogen, we are spending a lot of time in 2024 on a few key areas: enabling technologies, green ammonia, geologic hydrogen, and offtake and end-use markets. But our research, tech scouting and market intelligence services go beyond hydrogen and the broader energy transition. Our team produces impressive insights each week across the energy complex for oil and gas, utility and industrial customers seeking to deploy and de-risk new technology.

The Darcy Partners team includes investors, scientists, consultants and energy-sector veterans who have come together as a one-stop shop for innovation in the energy industry. Learn more at darcypartners.com.

Banker showcase

Meet some of the people supporting our clients in the green economy space.

Name: Teresa Benet

Title: Executive Director, Infrastructure Finance and Advisory

Location: New York City

Years of experience: 10 years at J.P. Morgan

Area of specialty/expertise: Project financing for energy assets across the Americas

Recent accomplishment I’m proud of: I advised on a landmark $7 billion project financing for a greenfield liquefied natural gas (LNG) export project on the Texas Gulf Coast. The project is expected to play an important role in the global energy transition away from higher-carbon fuels and helps support Europe’s energy security with majority European offtake.

What I’m looking forward to: I continue to advise companies in capital raising to support their decarbonization goals, and I’m excited to play a role in the growth of new energy sectors, including hydrogen and carbon capture. I’m interested to see how U.S. energy policy unfolds this year and in the wake of the election, particularly in the LNG and hydrogen industries following the pause on LNG export permits and the proposed Section 45V guidance.

Name: Andrew Tellam

Title: Executive Director, Energy, Power, Renewables, Metals & Mining, Investment Banking

Location: New York City

Years of experience: 7 years at J.P. Morgan, 11 years in broader infrastructure industry (inclusive of renewables)

Areas of specialty/expertise: Coverage of regulated utilities, renewable developers/operators, and companies and projects leveraged to the clean-hydrogen value chain

What I’m working on now: I’m working across the J.P. Morgan platform—from Infrastructure Finance and Advisory to tax equity, from public-sector coverage to hedging—trying to crack the code on how best to finance the scaling of clean hydrogen and ammonia projects we are just starting to see emerge.

Julia Grinshpun and Janice D’Arco (center), from Commercial Banking’s Green Economy Banking team, recently hosted a cooking event in San Francisco for women working in the clean-tech industry.

H2 Green Steel case study: Scaling green solutions

JPMorgan Chase acted as exclusive financial advisor to Altor as they were lead investor into H2 Green Steel’s $1.9 billion capital raise. Proceeds from the private placement are expected to be allocated to finance the construction and development of H2 Green Steel’s flagship plant in Boden, Sweden. Groundwork commenced in summer 2022, and the plant is anticipated to be operational by the end of 2025. Once operational, the plant is expected to be the world’s first large-scale green steel facility, featuring on-site hydrogen production using Europe’s largest electrolyzer powered with renewable energy.

The H2 Green Steel plant aims to produce steel with up to 95% less CO2 compared to traditional blast-furnace technology. The CO2 reduction will be achieved by replacing coal in the steel production process, with hydrogen produced on-site. The plant is also anticipated to be the first of its kind to incorporate next-generation technology, digitalization, and a comprehensive approach to circularity and recycling.

This transaction builds on our efforts to help scale green and innovative solutions to support the global transition to a low-carbon economy.

Client highlights

Here’s a closer look at some of our clients working toward transformative change—and how we facilitated their progress.

Electric Hydrogen

J.P. Morgan is proud to help Electric Hydrogen advance its objective to transform the economics of green hydrogen production. Founded in late 2020, Electric Hydrogen delivers low-cost hydrogen at scale. Its 100-megawatt plant solution involves all system components required to turn water and electricity into green hydrogen, including power conversion, gas processing, water treatment and thermal management.

Other green economy company highlights

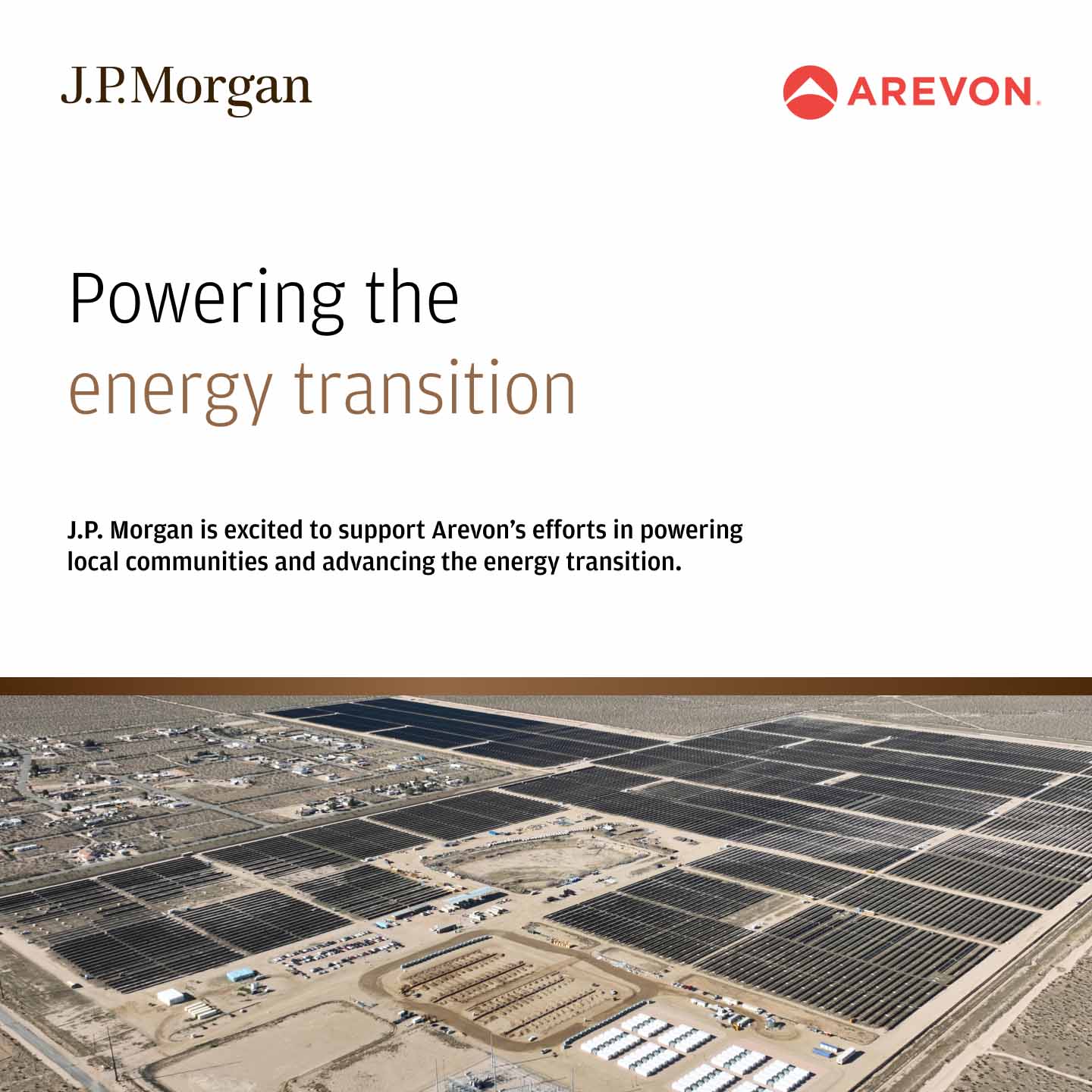

Arevon is a leading renewable energy developer, owner, and operator, supplying clean, reliable energy to homes and businesses through innovative approaches and leading-edge technology. J.P. Morgan is excited to support their leadership and innovation to power a clean energy future.

Strata Clean Energy accelerates the clean energy transition by providing grid-scale renewable energy solutions. J.P. Morgan served as administrative agent, depositary agent, collateral agent, coordinating lead arranger and joint bookrunner for the company’s 1 gigawatt-hour Scatter Wash Energy Storage project in Phoenix.

Arcadia, the largest community solar manager in the United States, connects consumers and businesses with solar developers to utilize solar energy. Their technology powers the next generation of climate solutions, giving customers the tools to electrify and decarbonize. J.P. Morgan acted as sole lender of a $30 million revolving line of credit for Arcadia Power as part of our Innovation Economy portfolio.

“We are excited to continue supporting Arcadia on their growth journey,” said Tanya Barnes, managing partner, J.P. Morgan Sustainable Growth Equity. “This transaction demonstrates J.P. Morgan’s broad value-add capabilities in support of companies that are providing [important] solutions to the global energy transition.”

We are proud to highlight pioneering women in the green economy space and to work with Gamechangers who push for progress and evolution of the industry. Celina Mikolajczak, Chief Battery Officer at Lyten, is a perfect example of a sustainability leader pairing innovation and business excellence in the field of battery technology.

Green economy insights

Here’s a roundup of recent thought leadership from J.P. Morgan experts that highlights decarbonization and renewable energy trends.

White papers

Videos

- Setting the low-carbon transition in motion

- Driving climate action through public-private partnerships

- In a housing crisis, building more affordable and sustainable homes is a solution

Podcasts

- What’s the Deal? | How can tax equity spur the energy transition?

- What’s the Deal? | Navigating the green investment frontier: Insights from the Clean Tech Stars Conference

- Research Recap | Is demand for electric vehicles slowing down?

- Market Matters | Data Assets & Alpha Group: Asset allocation amid climate risks

Articles

- Scaling green solutions: Advancing the low-carbon economy through the future of food

- A $5 billion supercharge for battery maker Northvolt

- Ready to dip your toe into innovative water markets?

- The electric high-speed rail accelerating Turkey’s low-carbon future

- Speed, scale, pragmatism: How to boost climate finance in 2024

- Decarbonization: Let’s be clear on what finance can and can’t do

- On the minds of investors: How much does policy influence sector performance?

- Investing in India’s clean energy future

Learn more

Contact the Green Economy Banking team to learn more about the ways we can help your company achieve its goals. Stay up to date with the latest news and insights by signing up for our quarterly update below.

Learn more

Hide

Learn more

Hide