4 min read

In the early years of starting a company, personal finances and business success are often linked. Founders and entrepreneurs should ensure they have funds available to support themselves during the time before their company begins to generate revenue—otherwise, they might be forced to split time between building and sourcing capital.

Founders may find it daunting to shore up personal finances while simultaneously building their company. Fortunately, founders can figure out their finances before they start their company—so they can ensure they are prepared for their entrepreneurial endeavor. Here is a step-by-step startup financial planning guide for founders to use as they embark on their entrepreneurial journey.

1. Evaluate current finances and financial plans

Before entrepreneurs make a full-time commitment to their business idea, they should dig into their current finances.

- Examine expenses: Founders' income can fluctuate, so it's smart to consider how to reduce monthly spending if one’s income dips unexpectedly. For instance, track spending on dining out, entertainment and other discretionary costs to know which levers to pull to reduce spending if needed.

- Assess debts: Founders should evaluate and make a financial plan to address their debts if they leave their primary job to commit to a startup full-time. An updated, more conservative budget should anticipate potentially reduced or less-consistent income while the founder bootstraps their startup.

- Build an emergency fund: This fund is a cash reserve to use for unexpected expenses, such as car repairs or medical bills. The longer founders can defer their own compensation, the more resources they can devote to their business.

2. Invest personal funds into your startup

Many founders rely on various funding sources to develop early prototypes. They may tap into their own savings, raise money from friends and family or seek grants to develop a minimal viable product (MVP). These early funds help founders gain traction before approaching investors. And to potential investors, a founder’s willingness to commit his or her own money can signal commitment and passion for their idea.

However, entrepreneurs should be strategic about how they allocate their own funds to their ventures. Drawing funds from retirement accounts like 401(k)s or IRAs can trigger early-withdrawal penalties and reduces those accounts’ compound growth. Similarly, borrowing on high-interest credit cards to fund a startup can add to capital costs and eat into profitability.

3. Develop a prototype while still employed

As founders foray into the entrepreneurial world, a regular paycheck represents security. That’s why many founders keep their primary income source, spending nights and weekends developing their business idea, until it’s feasible to transition to full-time entrepreneurship.

Founders must give themselves time to understand the problem they want to solve and how they will solve it, the total addressable market for their product or service and how they can interest potential customers before making the move from a steady paycheck to uncertain compensation. A day job can give founders financial stability while developing their idea into a fine-tuned prototype or pitch deck they can present to investors.

4. Investigate suitable funding options

Once confident their startup business solves a compelling problem, founders can explore financing options from professional investors, such as angels, incubators, accelerators and venture capital firms. Securing funding, especially for first-time founders, is not an easy task. J.P. Morgan offers limited partners and venture capitalists to help them find new opportunities and complete deals.

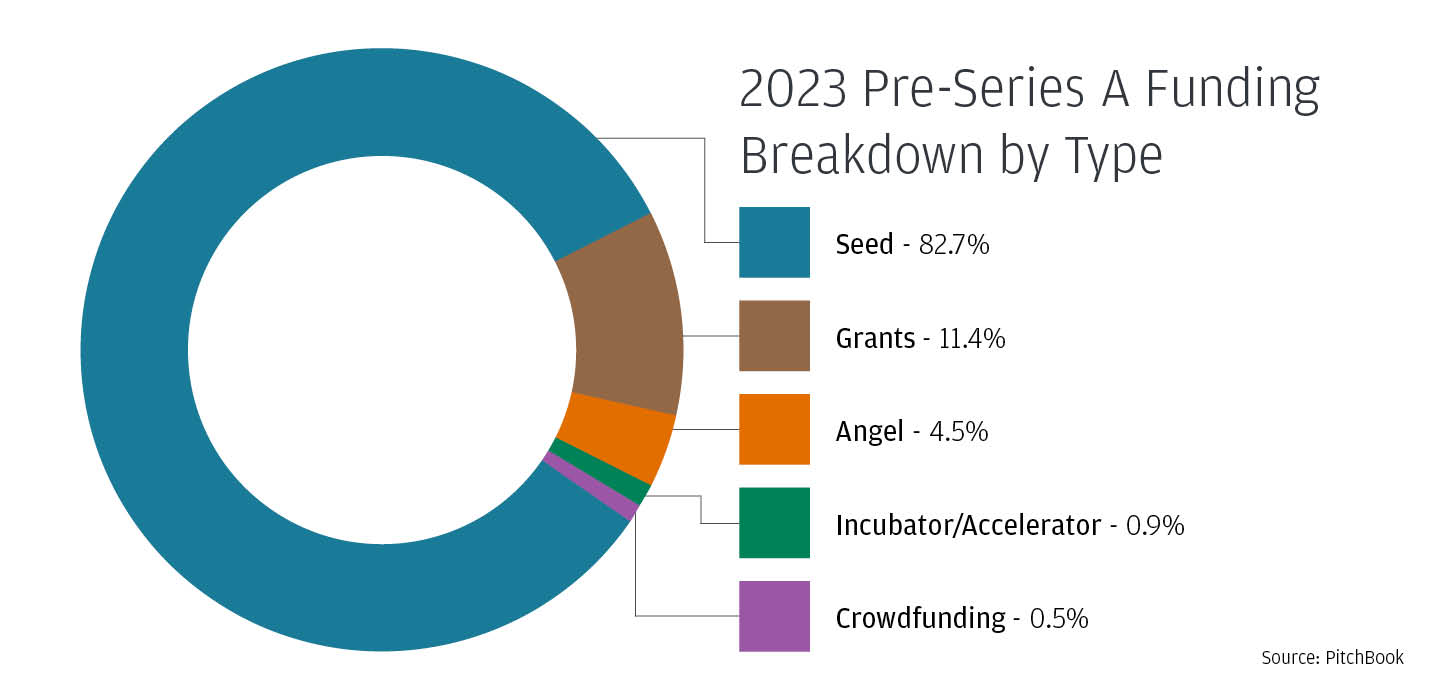

While it’s a common belief that startups raise significant capital through friends and family rounds or by participating in incubators or accelerators before their seed round, data shows that’s not always the case.

Seed funding accounted for more than 80% of the pre-Series A funding raised by startups that reached their Series A round in 2023, according to PitchBook. Grants and angel investors also played a notable role, while crowdfunding and incubators/accelerators made up a slim portion of the overall funding mix.

Certain funding mechanisms, such as seed fundraising, can help reduce your personal financial risk when starting a company. Seed funding involves raising capital from outside investors in exchange for equity in your new company. This approach gives you access to funds needed soon, without relying solely on personal finances.

According to Pitchbook, the median deal size was $3.9 million for startups that raised a seed round between 2020 and 2023. Startups typically raise a seed round to make initial hires, build out their MVP and start commercialization. For founders, it’s important to get a sense of how much they’ll need to raise and the corresponding metrics, such as valuation, terms and dilution.

While incubators or accelerators may not provide equivalent financial support, they offer valuable nonfinancial benefits, including access to subject-matter experts, shared workspaces, networking and mentorship opportunities.

How we can help

Starting a business is exciting, but never simple. By evaluating personal finances early, developing a prototype and understanding funding options and benchmarks—including investing personal funds—founders will be better able to focus their energy on their new startup.

If you’re looking for financial guidance or solutions while starting your business, discover the wealth of options J.P. Morgan has for the innovation economy. We help startups thrive today and prepare for tomorrow.

Learn more

Hide

Learn more

Hide

JPMorgan Chase Bank, N.A. Member FDIC. Visit jpmorgan.com/commercial-banking/legal-disclaimer for disclosures and disclaimers related to this content.