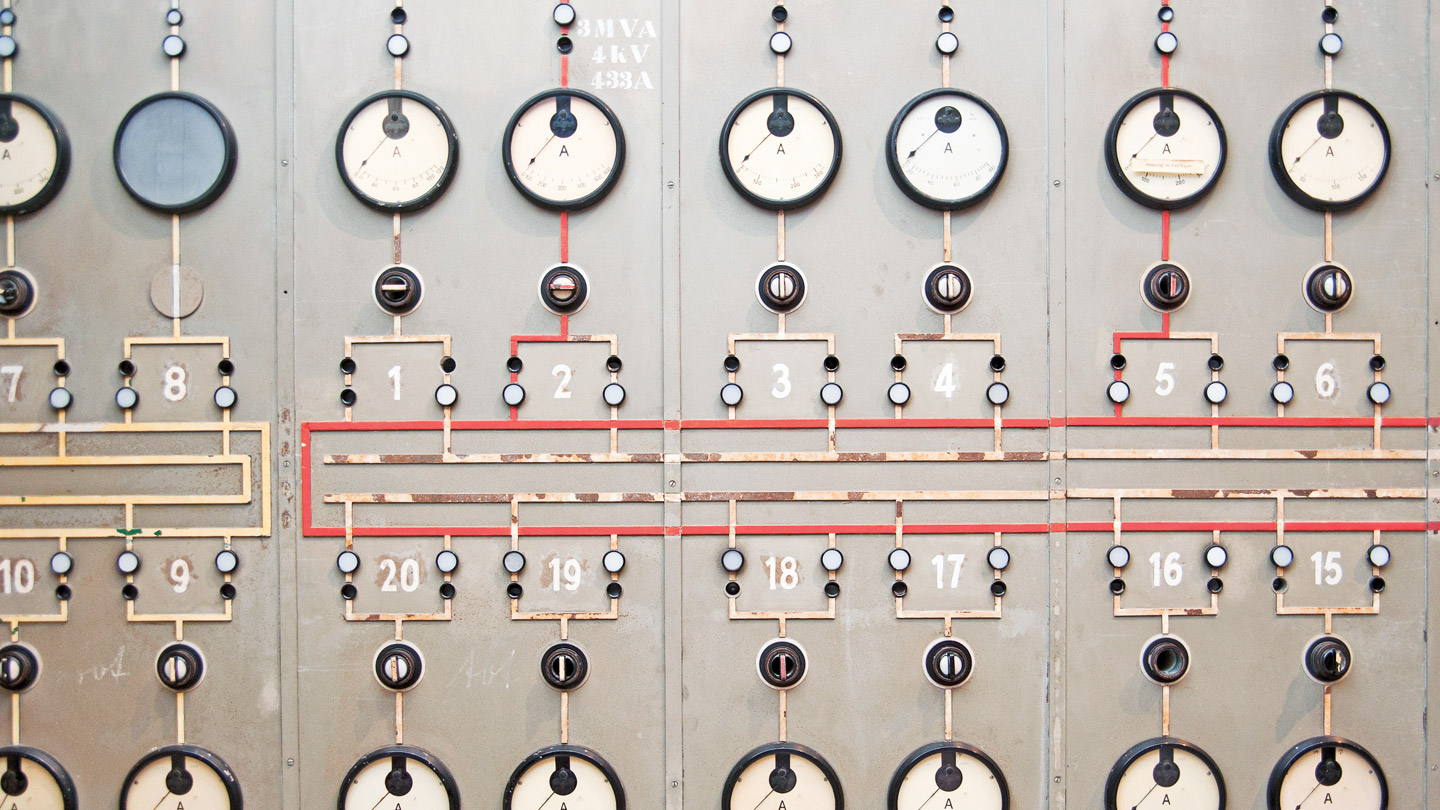

What we do

Preserve working capital without compromising your competitiveness with flexible business equipment and technology financing. Regardless of the complexity of your situation, we work with you to structure a customized financing solution to support your bottom-line growth objectives.

Range of solutions

While your current need determines the type of solution we construct, it may include a(n): equipment loan, tax-exempt financing, conditional sales agreement (CSA), true lease, terminal rental adjustment clause (TRAC) lease, split TRAC lease or synthetic lease.

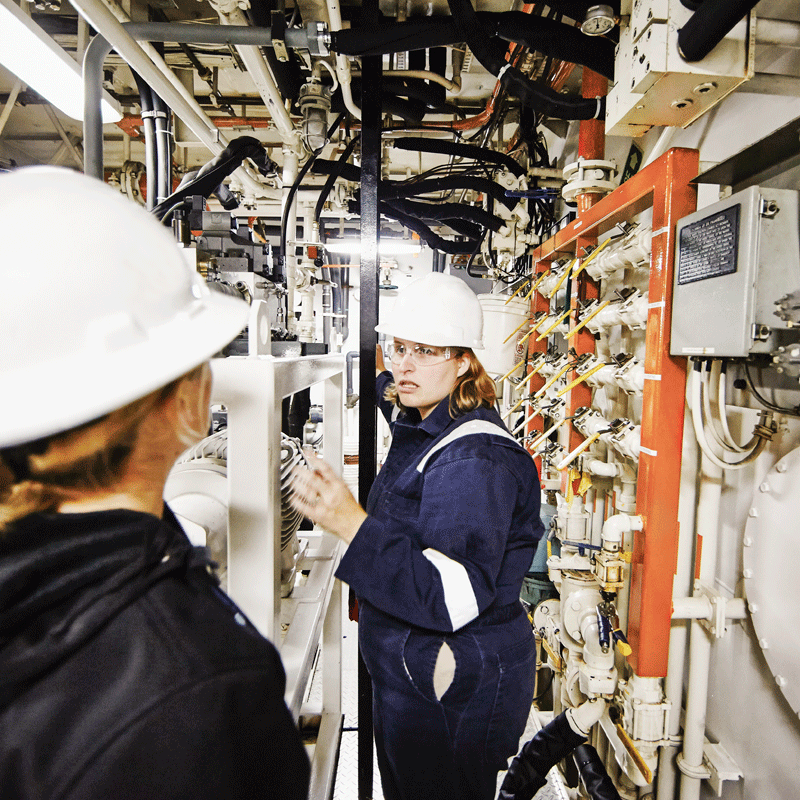

Specialized industry experts

We are here to make this simple, with a single point of contact and streamlined documentation process. From a dedicated back office to our industry expertise, we serve thousands of clients including those involved in construction, manufacturing, technology and the nonprofit sectors.

ASA-certified appraisers

With an in-house staff of appraisers, we have a thorough understanding of the value and nuances of any mission-critical assets your company chooses to finance, as well as the tax implications that may apply to each.

Leasing alternatives

In cases where an equipment purchase may not be the most cost- or tax-effective option for your business, we can work with you to arrange a leasing transaction that is better suited to your operational and financial circumstances.

Who we are

Linda Redding

Head of Equipment Finance

Mark Bennett

Executive Director

William Crotty

Executive Director

David Nehf

Executive Director

Mike Lucas

Executive Director Coverage Manager-EF

Mike Riley

Executive Director / Syndication Manager

Related insights

Banking

Understanding working capital loans

Dec 11, 2025

Learn how working capital loans provide financial flexibility to cover short-term gaps—even for businesses with strong cash reserves.

Read more

Banking

Debt-to-EBITDA ratio: What it means for borrowing capacity

Nov 17, 2025

The debt-to-EBITDA ratio helps assess your business’s ability to support new debt. Discover how to determine your company’s ideal ratio.

Read more

Banking

What are asset-based loans and how do they work?

Nov 14, 2025

Asset-based loans help businesses access capital using accounts receivable, inventory and equipment as collateral. Find out how they work and how businesses can benefit from their flexibility.

Read moreReferences

We have over 40 years of experience in providing equipment-financing services to middle market and multinational corporate clients.

We strive to maintain an overall ranking that places us among the top of all middle market lenders in the US. Source: Chase CB Facts and Financials; Thompson Reuters LPC, 3Q17 YTD

An estimated three-quarters of all equipment-related financings we make each year represent repeat business from current clients.