Treasury Insights

Strengthen cash flow forecasting, increase visibility and find previously invisible patterns via cutting-edge technology, including AI and machine learning.

LET'S TALK

Hide

LET'S TALK

Hide

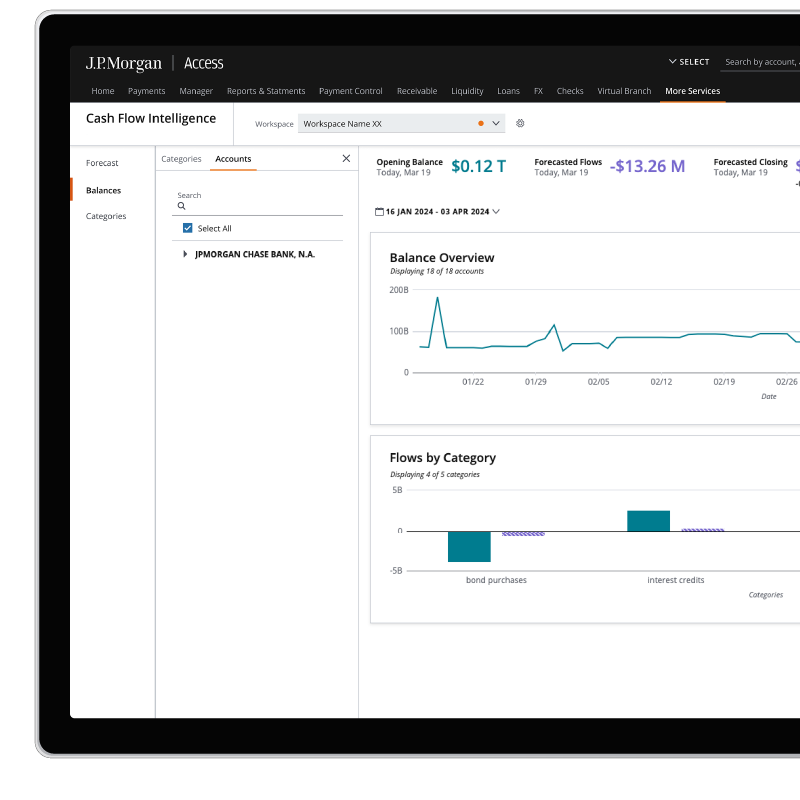

Simplify cash management with AI

Easily access your cash flows and quickly produce forecasts based on historical data with our AI-as-a-service solution.

Chief Financial Officers

Reduce manual processes by incorporating automation and analytics into your day-to-day treasury workstreams.

Treasurers

Make more informed decisions and align financial decisions with the overall business strategy with real-time payment flow visibility.

Suppliers/Heads of Procurement

Better balance procurement responsibilities, project management and operational duties through increased productivity and efficiencies.

Treasury of the future

Automate the way you organize, analyze and forecast your cash.

Help inform funding decisions

Get enhanced visibility into past and future-anticipated cash needs easily on our J.P. Morgan Access® platform.

Transaction categorization

Organize and analyze your payments the way you organize your business with automated rules.

AI-powered forecasts

Leverage the power of our AI platform to quickly forecast your cash flows and balances.*

Flexible workbench

Customize and share your insights with features that make it easy to collaborate across your treasury team.

Treasury Today 2023 Adam Smith Awards

Best Cash Flow Forecasting Solution Highly Commended: Arcosa Inc.1

Headquartered in Dallas, Arcosa Inc. provides infrastructure related products, manufacturing construction and transportation products and engineered structures.

In collaboration with J.P. Morgan, the treasury team is orchestrating a digital transformation across the organization. Embracing emerging data analytics and machine learning has optimized treasury decision-making processes, unlocking time, cost and risk management efficiencies.

Related solutions

Related solutions

Insights

Unlock previously hidden insights, make more informed decisions and better manage your bottom line with our access to payment data and AI and machine learning talent and technology.

Customer Insights**

Unlock your business’ full potential with a better understanding of your customer base and your performance vs. peers.

Merchant Insights

Increase authorization rates, minimize payments-related costs and mitigate the impact of disputes on your business.

Trust & Safety

Validate your accounts and proactively boost your defense for all your end-to-end payments.

J.P. Morgan Access®

Empower your business to thrive with treasury tools that help you manage your business and working capital.

Commerce

Transform B2C and B2B experiences with the next generation suite of commerce payment solutions by J.P. Morgan Payments.

Domino’s Pizza leverages Cash Flow Intelligence for global financial agility

August 20, 2024

Learn how Domino’s Pizza is transforming manual processes and unlocking efficiency with Cash Flow Intelligence.

*Cash flows are estimates and are no guarantee of future results.

**Future capabilities of Customer Insights are under development; features and timelines are subject to change at the Bank’s sole discretion.

© 2024 JPMorgan Chase & Co. All rights reserved. JPMorgan Chase Bank, N.A. Member FDIC. Deposits held in non-U.S. branches are not FDIC insured. Non-deposit products are not FDIC insured. The statements herein are confidential and proprietary and not intended to be legally binding. Not all products and services are available in all geographical areas. Visit jpmorgan.com/paymentsdisclosure for further disclosures and disclaimers related to this content.