Merchant Insights

Proactively monitor and optimize your payments acceptance with robust tools and dashboards built with our decades of industry knowledge and technology expertise.

LET'S TALK

Hide

LET'S TALK

Hide

Get more from your partnership with J.P. Morgan Payments

Take action with Merchant Insights

Enhance your payments experience and improve decision making with data-driven insights.

Payments Professionals

Make more informed decisions. We enable you to unlock valuable business insights from your payments data so you can optimize your payments workflows.

CFOs

Save valuable time. Gain insights into your payments trends and performance. Make decisions that align with your overall business strategy.

Engineering/IT

Monitor payments trends proactively. Track daily processing trends, detect shifts and identify areas of interest to focus on without additional development.

Get more from your data

Navigate the rapidly changing payments landscape, make more informed decisions and manage your bottom line more effectively by uncovering insights within your payments data.

When you partner with us, you get more than payments

Enhance authorization rates, better monitor your costs and minimize the impact of disputes and fraud.

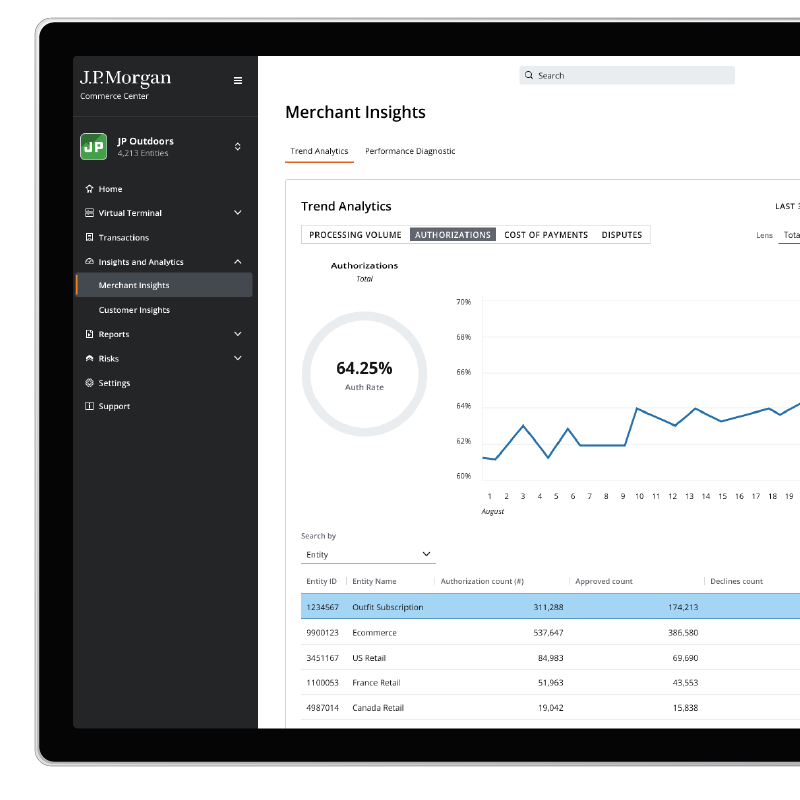

Trend analytics¹

Access time series analysis across the payments lifecycle that enables filtering to sub-entities and transaction characteristics. View performance for processing volume, authorizations, costs, disputes and fraud. Filter or view performance by a lens (e.g., card type, method of payment or entry method).

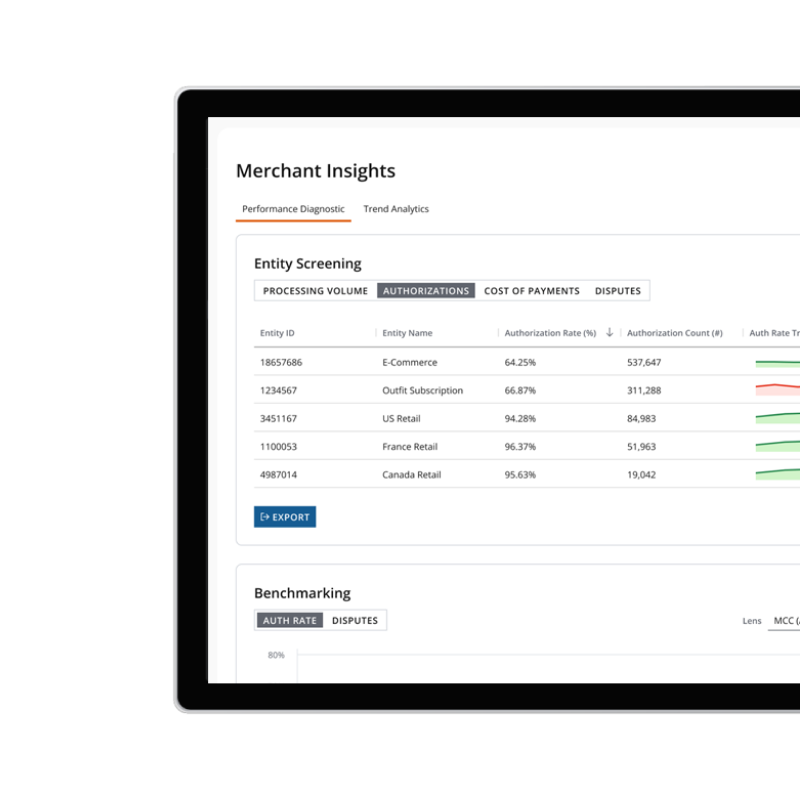

Performance diagnostics*

Access actionable insights that analyze your transactions to measure performance and recommend opportunities for improvement. Benchmark payments performance, screen for improvements and identify opportunities to enhance your retry strategy.

Five payment trends to help power your business in 2024 and beyond

With so many opportunities and risks amid an uncertain year ahead, Forecasting Payments, J.P. Morgan’s annual payments trends, details five trends for treasury and payments executives to keep top-of-mind.

Related solutions

Related solutions

Insights

Unlock previously hidden insights, make more informed decisions and better manage your bottom line with our access to payment data and AI and machine learning talent and technology.

Treasury Insights

Organize, analyze and forecast your cash in the way that works best for your business.

Customer Insights*

Unlock your business’ full potential with a better understanding of your customer base and your performance vs. peers.

Trust & Safety

Validate your accounts and proactively boost your defense for all your end-to-end payments.

J.P. Morgan Access®

Empower your business to thrive with treasury tools that help you manage your business and working capital.

Commerce

Transform B2C and B2B experiences with the next generation suite of commerce payment solutions by J.P. Morgan Payments.

*Future capabilities are under development; features and timelines are subject to change at the Bank's sole discretion.

© 2024 JPMorgan Chase & Co. All rights reserved. JPMorgan Chase Bank, N.A. Member FDIC. Deposits held in non-U.S. branches are not FDIC insured. Non-deposit products are not FDIC insured. The statements herein are confidential and proprietary and not intended to be legally binding. Not all products and services are available in all geographical areas. Visit jpmorgan.com/paymentsdisclosure for further disclosures and disclaimers related to this content.