Contributors

Evelina Samson

Executive Director, Tax-Smart Specialist

As the year comes to a close, both philanthropy and taxes often come to the forefront. There are ways to combine your year-end charitable giving with “harvesting” losses within your portfolio, to maximize tax efficiency and boost your donating power.

Here’s how to combine tax-smart strategies – tax-loss harvesting declines in the value of holdings in your portfolio – with gifting appreciated securities held long-term. Together, they let you give even more to your favorite charities tax-efficiently, and lower your tax bill, too.

Tax-loss harvest to lower capital gains taxes

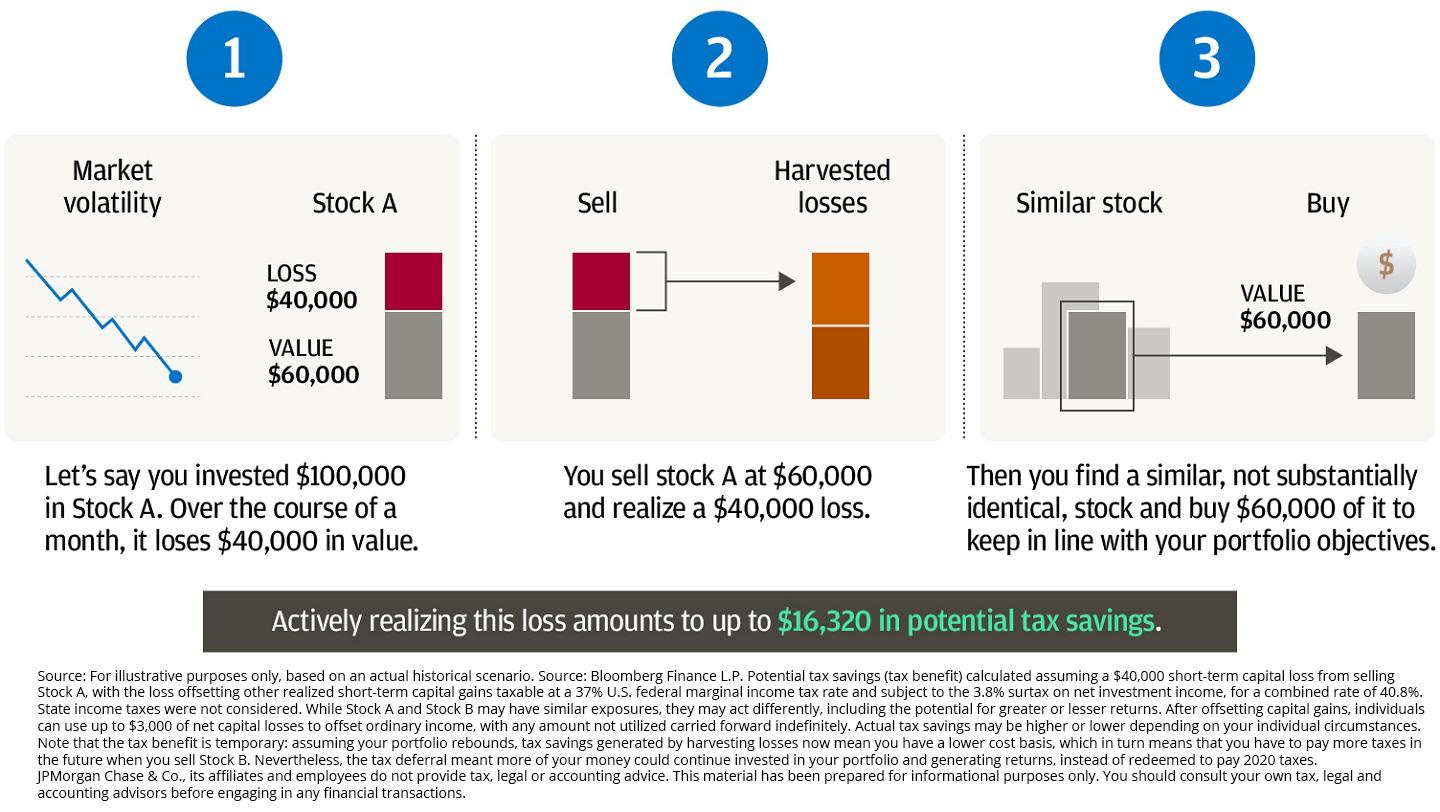

You may be familiar with the practice of tax-loss harvesting to reduce your tax burden. That’s the process of selling a stock that’s declined below its purchase price, realizing a loss and then using that loss to offset capital gains in other parts of your portfolio. (The loss must be realized; it cannot be an unrealized loss on paper alone.)

Two points to keep in mind when harvesting tax losses:

- Selling depreciated stock needn’t disrupt your long-term investing goals or your asset allocation. When selling a stock for tax purposes, you can preserve your portfolio’s objectives and maintain your desired portfolio balance by buying another stock with similar characteristics.

- Be mindful not to violate the wash sale rule. This IRS statute states that you can’t claim the loss if you buy the same or substantially identical stock or securities 30 days before – or after – the loss sale trade date. So choose your replacement stock wisely, and time the purchase correctly.1

Over time, tax-loss harvesting can create significant tax savings. For example, if you owned a $10 million equity portfolio, realizing a tax benefit of 1.5% in a single year could result in potential savings of about $150,000.

What is tax-loss harvesting?

Tax-loss harvesting enables investors to lower their tax bill by selling securities at a loss to offset realized capital gains

By intentionally realizing losses to help minimize your tax bill, tax-loss harvesting also lowers your portfolio’s overall cost basis.2

This gradual decrease of the portfolio’s cost basis over time, combined with markets’ historically upward direction, can leave your portfolio holding many highly appreciated stocks (with large, unrealized gains). That would limit your opportunities for further loss harvesting.

Which brings us to the topic of charitable giving…

Consider donating (some) unrealized gains

If charitable giving is part of your wealth objectives, you can boost your philanthropic giving even further, and reap additional tax benefits, by combining tax-loss harvesting and charitable giving – i.e. donating low-basis (bought low and now highly appreciated) securities with a long-term holding period – gifting them, for example, to a donor-advised fund (DAF).

If you itemize deductions on your tax return instead of taking the standard deduction, gifting qualified appreciated stock that has been held for over a year3 to a DAF, for example, may complement tax-loss harvesting and extend your tax benefits, as many donations are, of course, tax deductible.4

This way, the charity benefits – and you don’t pay those taxes.

Let’s break down the advantages of donating appreciated securities to benefit both your tax bill and your favorite charity:

- You can deduct the shares’ full market value. Donating stock you have held for over a year5 to charity generally allows you to deduct the security’s full fair market value (subject to limitations based on adjusted gross income). You can use the tax deduction in the tax year in which the charitable gift is made, with any excess charitable deductions carried forward for use in five subsequent years.

- You may eliminate capital gains tax on the appreciation. There’s a big difference between donating appreciated stock and selling the stock and donating the proceeds. The capital gains tax you’d incur by selling the stock can potentially be eliminated because charities are typically exempt from paying these taxes. This is likely to increase your charitable contribution’s value by over 20%, benefiting both you and the charity.

The ins and outs of charitably giving appreciated stock

You’ll want to bear in mind a few details if you’re considering charitably giving appreciated stock:

- For the stock to be qualified, you must have held it for over a year6

- You must be a U.S. taxpayer who itemizes deductions on your tax return

- If you have various lots of the same stock, it’s possible to choose, and give to charity, the lot with the lowest basis (the highest gainer)

A donor-advised fund might make sense

DAFs are charitable giving vehicles that are easily established, simple to use, cost-effective and tax-efficient. You can receive an immediate itemized tax deduction for your contribution to a DAF, while having time to strategically identify the charities and causes that you’d like to donate to.

After donating appreciated stock to a DAF, you can replenish your portfolio with cash to purchase the same or similar stock. This would create fresh lots with higher cost bases, complementing the tax benefit of charitable gifting. That’s because fresh lots are more likely to go into loss territory and qualify for capturing tax losses, extending the runway for tax benefits in the future.

Combining tax-loss harvesting with charitable giving can provide significant tax benefits while helping you make a meaningful impact on the causes you care about.

Contact us for tax efficient gifting this season

Don't let these powerful strategies go untapped. Take the next step toward optimizing your investment portfolio and achieving your financial and philanthropic goals. Your J.P. Morgan advisor can help tailor a plan that aligns with your distinct needs and aspirations.

Your journey to smarter giving and greater tax efficiency starts now.

References

Please consult your tax advisor to see whether tax loss harvesting is advisable with your accounts and how potential buybacks might be done successfully. Taxes should not be the only factor to drive an investment decision.

Basis is generally the purchase price you paid for an asset, adjusted for certain corporate actions (e.g., mergers, stock splits, etc.). Basis helps determine the gain or loss the taxpayer realizes on the sale or other disposition of the property.

Under current tax laws, if a stock is held for one year or less, it's considered a short-term holding and an investor would only be able to deduct the purchase price, not the appreciated fair market value.

Consult your tax professional for guidance.

Under current tax laws, if a stock is held for one year or less, it's considered a short-term holding and an investor would only be able to deduct the purchase price, not the appreciated fair market value.

Under current tax laws, if a stock is held for one year or less, it's considered a short-term holding and an investor would only be able to deduct the purchase price, not the appreciated fair market value.

Connect with a Wealth Advisor

Reach out to your Wealth Advisor to discuss any considerations for your current portfolio. If you don’t have a Wealth Advisor, click here to tell us about your needs and we’ll reach out to you.

IMPORTANT INFORMATION

Tax loss harvesting may not be appropriate for everyone. If you do not expect to realize net capital gains this year, have net capital loss carryforwards, are concerned about deviation from your model investment portfolio, and/or are subject to low income tax rates or invest through a tax-deferred account, tax loss harvesting may not be optimal for your account. You should discuss these matters with your investment and tax advisors.

All case studies are shown for illustrative purposes only, and are hypothetical. Any name referenced is fictional, and may not be representative of other individual experiences. Information is not a guarantee of future results.

This material is for informational purposes only, and may inform you of certain products and services offered by J.P. Morgan’s wealth management businesses, part of JPMorgan Chase & Co. (“JPM”). Products and services described, as well as associated fees, charges and interest rates, are subject to change in accordance with the applicable account agreements and may differ among geographic locations. Not all products and services are offered at all locations. If you are a person with a disability and need additional support accessing this material, please contact your J.P. Morgan team or email us at accessibility.support@jpmorgan.com for assistance. Please read all Important Information.

GENERAL RISKS & CONSIDERATIONS. Any views, strategies or products discussed in this material may not be appropriate for all individuals and are subject to risks. Investors may get back less than they invested, and past performance is not a reliable indicator of future results. Asset allocation/diversification does not guarantee a profit or protect against loss. Nothing in this material should be relied upon in isolation for the purpose of making an investment decision. You are urged to consider carefully whether the services, products, asset classes (e.g. equities, fixed income, alternative investments, commodities, etc.) or strategies discussed are suitable to your needs. You must also consider the objectives, risks, charges, and expenses associated with an investment service, product or strategy prior to making an investment decision. For this and more complete information, including discussion of your goals/situation, contact your J.P. Morgan representative.

NON-RELIANCE. Certain information contained in this material is believed to be reliable; however, JPM does not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. No representation or warranty should be made with regard to any computations, graphs, tables, diagrams or commentary in this material, which are provided for illustration/reference purposes only. The views, opinions, estimates and strategies expressed in this material constitute our judgment based on current market conditions and are subject to change without notice. JPM assumes no duty to update any information in this material in the event that such information changes. Views, opinions, estimates and strategies expressed herein may differ from those expressed by other areas of JPM, views expressed for other purposes or in other contexts, and this material should not be regarded as a research report. Any projected results and risks are based solely on hypothetical examples cited, and actual results and risks will vary depending on specific circumstances. Forward-looking statements should not be considered as guarantees or predictions of future events.

Nothing in this document shall be construed as giving rise to any duty of care owed to, or advisory relationship with, you or any third party. Nothing in this document shall be regarded as an offer, solicitation, recommendation or advice (whether financial, accounting, legal, tax or other) given by J.P. Morgan and/or its officers or employees, irrespective of whether or not such communication was given at your request. J.P. Morgan and its affiliates and employees do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any financial transactions.

Legal Entity and Regulatory Information.

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

Bank deposit accounts and related services, such as checking, savings and bank lending, are offered by JPMorgan Chase Bank, N.A. Member FDIC.

This document may provide information about the brokerage and investment advisory services provided by J.P. Morgan Securities LLC (“JPMS”). The agreements entered into with JPMS, and corresponding disclosures provided with respect to the different products and services provided by JPMS (including our Form ADV disclosure brochure, if and when applicable), contain important information about the capacity in which we will be acting. You should read them all carefully. We encourage clients to speak to their JPMS representative regarding the nature of the products and services and to ask any questions they may have about the difference between brokerage and investment advisory services, including the obligation to disclose conflicts of interests and to act in the best interests of our clients.

J.P. Morgan may hold a position for itself or our other clients which may not be consistent with the information, opinions, estimates, investment strategies or views expressed in this document. JPMorgan Chase & Co. or its affiliates may hold a position or act as market maker in the financial instruments of any issuer discussed herein or act as an underwriter, placement agent, advisor or lender to such issuer.

Check the background of our firm and investment professionals on FINRA's BrokerCheck

To learn more about J. P. Morgan’s investment business, including our accounts, products and services, as well as our relationship with you, please review our J.P. Morgan Securities LLC Form CRS and Guide to Investment Services and Brokerage Products.

This website is for informational purposes only, and not an offer, recommendation or solicitation of any product, strategy service or transaction. Any views, strategies or products discussed on this site may not be appropriate or suitable for all individuals and are subject to risks. Prior to making any investment or financial decisions, an investor should seek individualized advice from a personal financial, legal, tax and other professional advisors that take into account all of the particular facts and circumstances of an investor's own situation.

This website provides information about the brokerage and investment advisory services provided by J.P. Morgan Securities LLC ("JPMS"). When JPMS acts as a broker-dealer, a client's relationship with us and our duties to the client will be different in some important ways than a client's relationship with us and our duties to the client when we are acting as an investment advisor. A client should carefully read the agreements and disclosures received (including our Form ADV disclosure brochure, if and when applicable) in connection with our provision of services for important information about the capacity in which we will be acting.

INVESTMENT AND INSURANCE PRODUCTS ARE: • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, JPMORGAN CHASE BANK, N.A. OR ANY OF ITS AFFILIATES • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

Please read additional Important Information in conjunction with these pages.