5 min read

The internal rate of return (IRR) is a powerful tool for assessing a commercial real estate investment’s profitability. IRR can be particularly valuable when comparing potential investment opportunities with varying cash flows over time.

What is IRR?

IRR measures an investment’s compound annual growth rate, accounting for all cash flows over the life of the investment. It incorporates the time value of money—the idea that a dollar today is worth more than the same dollar generated in the future because today’s dollar can be reinvested.

IRR helps you compare your real estate investment to other opportunities. If this rate is higher than what you could get elsewhere, it’s a good investment. If not, you might want to reconsider.

Calculating IRR in real estate

To calculate a property’s IRR, you’ll need:

- Initial investment costs

- Projected cash flows for each time period, often a year

- The property’s value or sale price at the end of the hold period

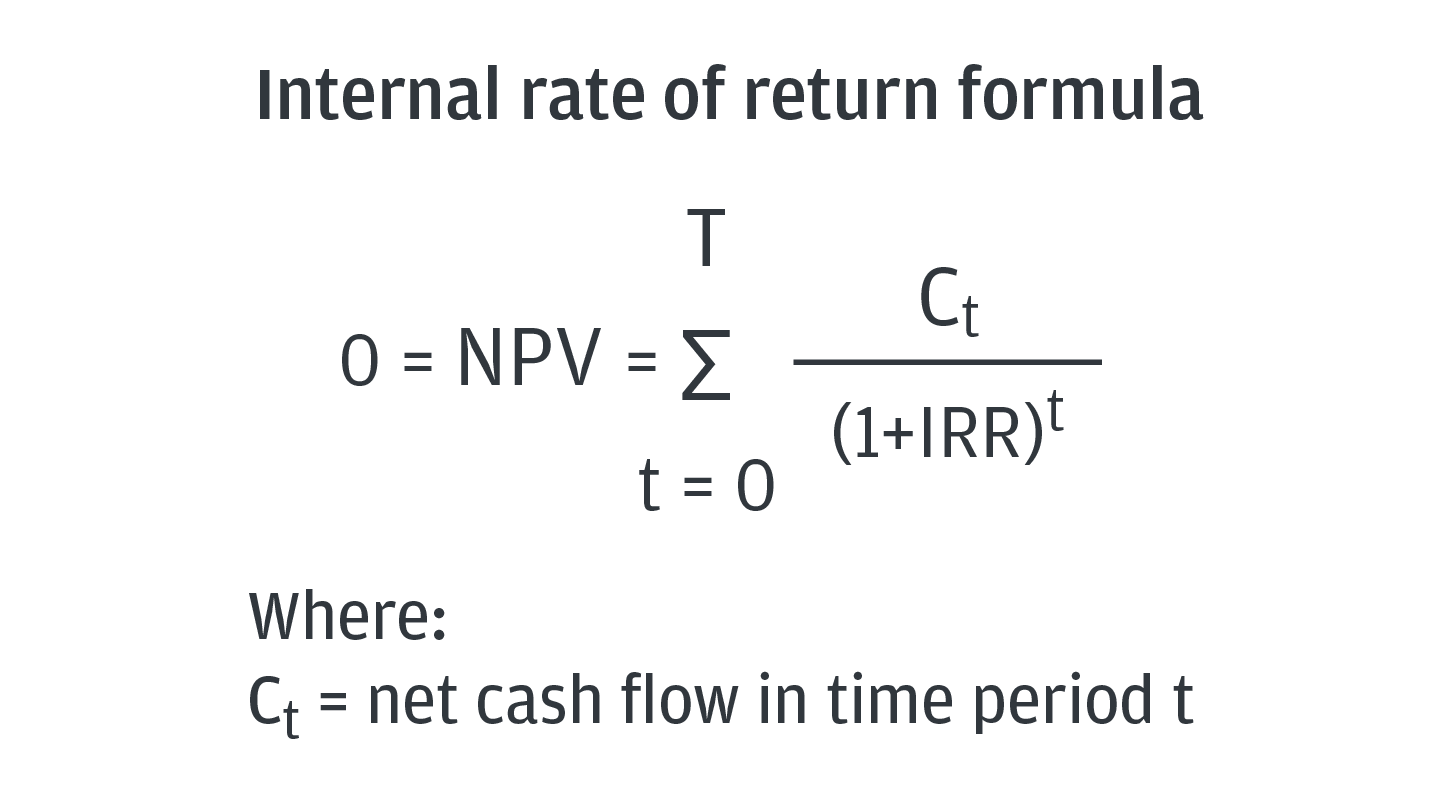

IRR relies on the same basic formula used to calculate a property’s net present value (NPV), with one key difference.

To calculate a property’s NPV, an investor uses a predetermined discount rate to determine the current value of all future cash flows—positive and negative—from the property. The discount rate, or minimum required return rate, can depend on a variety of factors, including the cost of capital and rate an investor could earn investing elsewhere.

Positive NPV means the present value of the property’s expected cash flows exceeds the cost of investing, indicating it may be a worthwhile investment. When NPV is negative, expected cash inflows aren’t expected to be worth enough to offset costs given the discount rate.

IRR calculates how high the discount rate would have to be for the present value of all cash flows from the property to be equivalent to the cost of investing.

Working through the IRR formula manually isn’t practical. Spreadsheet tools such as Microsoft Excel have a built-in IRR function that calculates it for you, along with similar functions such as extended IRR and modified IRR for more nuanced analyses.

IRR example

Consider two multifamily real estate properties, both requiring a $1 million initial investment and generating $200,000 in cash flow before being sold for $1.2 million in the fifth year.

One produces $50,000 in cash flow annually, while the other produces no cash flow for two years, then $100,000 each of the remaining years. Both properties generate the same total cash flow, but the first has a higher IRR because it generates some cash flow earlier.

| Year | Property A cash flow | Property B cash flow |

|---|---|---|

| 0 | ($1,000,000) | ($1,000,000) |

| 1 | $50,000 | 0 |

| 2 | $50,000 | 0 |

| 3 | $50,000 | $100,000 |

| 4 | $50,000 | $100,000 |

| 5 | $1,200,000 | $1,200,000 |

| IRR | 7.58% | 7.3% |

What is a good IRR?

In general, a higher IRR indicates higher profitability. If the IRR is less than the cost of capital, the investment may not be feasible. It’s also important to consider how the IRR stacks up against other potential investment opportunities’ IRRs.

Every investor will have their own benchmark, depending on location, property type, market conditions and other factors.

Using IRR in investment decision-making

Real estate investors often have a desired minimum rate of return for investments, sometimes called the hurdle rate. Assessing whether a potential investment’s IRR exceeds the hurdle rate is one factor that can help an investor decide whether it’s worth pursuing.

IRR can also help investors compare or prioritize investment opportunities. It’s particularly useful when those opportunities generate uneven cash flows. For instance, an investor might compare a stabilized apartment building to one requiring significant renovation before achieving full occupancy and higher cash flow. Or they could compare approaches to rehabbing a property: a major one-time investment versus a gradual plan.

While IRR is a powerful metric, it has some limitations:

- Forward-looking estimates: IRR relies on assumptions about a property’s cash flow and future value. If those assumptions aren’t accurate, the IRR won’t be, either. Assess the IRR’s sensitivity to changes in cash flow projections and understand how potential investments will fare in a range of scenarios, such as shifts in macroeconomic or market conditions.

- Consider reinvestment assumptions: The IRR formula assumes an investor can immediately reinvest cash flows and keep earning the same return rate. In reality, investors may face delays finding opportunities that yield similar returns, particularly if market conditions have changed. That means realized returns may fall short of the IRR.

- Scale: IRR provides a return rate but doesn’t factor in the size of the investment and cash flows. When weighing investment opportunities, total return also matters.

IRR vs. NPV

Both IRR and net present value assess the value of all cash flows from an investment while accounting for the time value of money. However, IRR estimates the expected return rate as a percentage, while NPV estimates the present value of anticipated cash flows in dollars.

Both metrics require the same estimates of cash flows throughout a property’s hold period, including initial capital investment and sale value. Calculating NPV also requires an investor’s discount rate, or required rate of return.

The NPV formula is similar to the IRR formula but substitutes the discount rate for IRR to calculate the discounted value of all cash inflows and outflows. When NPV is positive, estimated returns are expected to exceed the required return implied by the discount rate. A negative NPV indicates returns may fall short.

IRR vs. cash-on-cash return

IRR provides an estimate of the annual return over the life of an investment, while cash-on-cash return measures an investment’s return in a specific time period.

Cash-on-cash return is more straightforward to calculate. It can tell you how efficiently the cash you invest in a property generates cash flow at a point in time. But it doesn’t provide IRR’s long-term view of an investment, or account for the time value of money.

The bottom line: IRR is a valuable metric for assessing and comparing properties’ returns, but it’s important to understand the assumptions behind the calculations. IRR is one of several metrics and considerations that can inform well-rounded real estate investment decisions.

Understanding the real estate cycle is critical to projecting properties’ returns and choosing the best investment strategies.

JPMorgan Chase Bank, N.A. Member FDIC. Visit jpmorgan.com/commercial-banking/legal-disclaimer for disclosures and disclaimers related to this content.