7 min read

Key takeaways

- Cognizant was relying on a third-party accounting firm to handle all its account payables and receivables via a local bank, resulting in several pain points.

- Through innovation, Cognizant, with the help of J.P. Morgan, fully digitized, automated and migrated its entire accounts payables and receivables operation in Japan.

- The solution not only resolved the local language treasury challenges Cognizant faced in Japan, but also finally brought its only outlier market into its global cash pooling ecosystem.

About

IT consulting and services firm Cognizant is a U.S.-based, Nasdaq-listed industry leader in helping clients modernize their businesses. The company serves more than a third of the Fortune 500 and posted $18.5 billion revenue in 20211; it counts Asia Pacific (APAC) as a key growth market in its global expansion plans.

Cognizant operates its APAC treasury function from Kuala Lumpur, Malaysia and Chennai, India, which in most part is efficiently run via a cash pooling structure that connects almost all its markets in the region – including Singapore, Hong Kong, Malaysia, Australia and New Zealand – to a global header pool in London.

The challenge

The only outlier to the APAC cash pool is Japan, a key revenue contributor in the region. This was because Cognizant’s treasury system was unable to support the unique local language requirements necessary in Japan’s local clearing system, whereby all payments, including those coming from overseas, must be made in local phonetic language (called Katakana) instead of the alpha-numeric standard used in Cognizant’s enterprise resource planning (ERP). This impacted the more than 1,500 beneficiaries in Japan receiving payments from its global payments team (GPT) in India, comprising of customers, employees and local municipals.

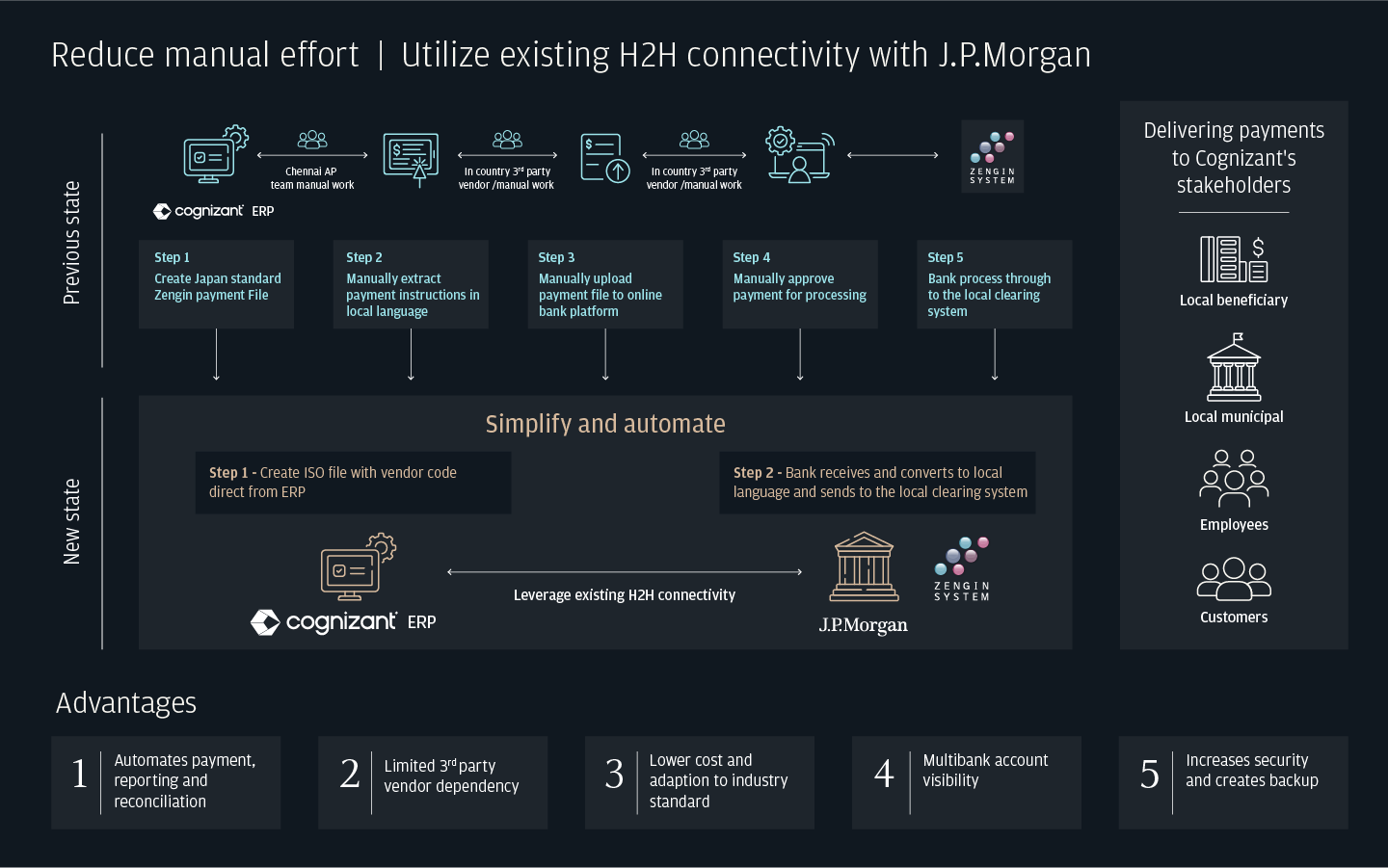

Hence, Cognizant was relying on a third-party accounting firm to handle all its account payables and receivables via a local bank, resulting in the following pain points:

- Expensive service fees paid to the accounting firm every year

- Manual process where payment files had to be extracted, uploaded and approved manually

- Lack of control and visibility over local bank accounts due to the third-party accounting firm

- Idle surplus funds in the local bank account

Cognizant desired a solution to resolve the local language barrier it was facing in Japan and one that could bring the market into its global cash pool, without having to change its entire ERP system that would be costly and require substantial investment on their end.

“It was only about a year ago when Japan was a location where Cognizant had no accounts with J.P. Morgan, no usage of the services, but now we are entitled to everything the bank can offer in Japan. It is truly remarkable what we have achieved in terms of operational optimization and the cost savings by making the best use of global payments team (GPT) in Chennai along with the connectivity and digital solutions and limiting the manual interaction by a local third-party vendor in Japan.”

Hariharan Subramanian

Senior Manager of APAC Treasury, Cognizant Technology Solutions

The solution

Cognizant looked to J.P. Morgan, with whom they had a long-time relationship, for help. The result was a bespoke vendor code mapping solution through a new bank account set up with J.P. Morgan Japan, where unique alpha-numeric codes were assigned to the over 1,500 beneficiary names and saved within ISO files at Cognizant’s GPT in India.

When a payment is made to a beneficiary, the corresponding assigned vendor code will be transmitted from the GPT to J.P. Morgan Japan via the existing host-to-host connectivity, then converted into local language and sent to the local clearing system. This automates the entire payment process including reporting and reconciliation.

With the solution, Cognizant reduced its dependency on the third-party accounting firm and now has full visibility of its accounts, enhancing data security and transparency. Equally important, the solution has brought the Japan market into the regional cash pooling structure, increasing the efficiency of the treasury processes not just in the region, but globally as well, as it feeds into the notional pool in London.

“By understanding the client’s problem statement, bringing in the right people and leveraging innovative technologies, we were able to deliver a simple yet transformative solution for Cognizant at minimal investment. Equally important, the solution has enabled Cognizant to finally integrate its Japan account into the global pooling ecosystem.”

Mahesh Kini

APAC Head of International Banking, Commercial Banking, J.P. Morgan

The results

By harnessing a simple but powerful innovation, Cognizant, with the help of J.P. Morgan, has been able to fully digitize, automate and migrate its entire accounts payables and receivables operation in Japan – which was previously outsourced to a third-party vendor – to its in-house GPT in Chennai. The change not only helped gain control and visibility, but also immediate savings in annual costs.

The vendor code mapping solution is also integrated into the existing host-to-host connectivity between J.P. Morgan and Cognizant, fully automating the payment, accounting and reconciliation processes of all payments, saving up to 60 man-hours a month through the elimination of manual processes.

With the vendor code mapping solution, Cognizant was able to assign unique alphanumeric codes that are compatible with its system against its more than 1,500 beneficiaries in the country, allowing overseas payments coming in from its India GPT – via the existing host-to-host connectivity – to be seamlessly converted into local language, and payments made nearly instantaneously.

The company was able to save significant costs in annual fees by eliminating the need for a third-party accounting firm. And in a milestone for Cognizant’s treasury function, the firm can now finally integrate Japan into its global cash pool, to yield tremendous working capital benefits.

Cognizant achieved its goals with minimal investment (and without having to overhaul its ERP) and going forward, the solution can help it quickly scale to cover more beneficiaries as it expands in this critical market.

To learn more about how we can support your business, please contact your J.P. Morgan representative.

Related insights

Treasury

Bridgestone Overhauls Treasury to Mobilize Surplus

Jul 19, 2023

With the help of a global banking provider, Bridgestone Asia Pacific adopted efficient and centralized liquidity management to streamline their banking infrastructure, helping free up capital.

Read more

Payments

Oct 31, 2023

Garrett Motion integrated a cross-border payments solution to reduce processing time and mobilize its surplus cash by prioritizing local controls and governance in China.

Read more

9:36 - Global Research

Is "another year of good growth" ahead for the US economy?

Feb 06, 2026

Listen now