Key takeaways

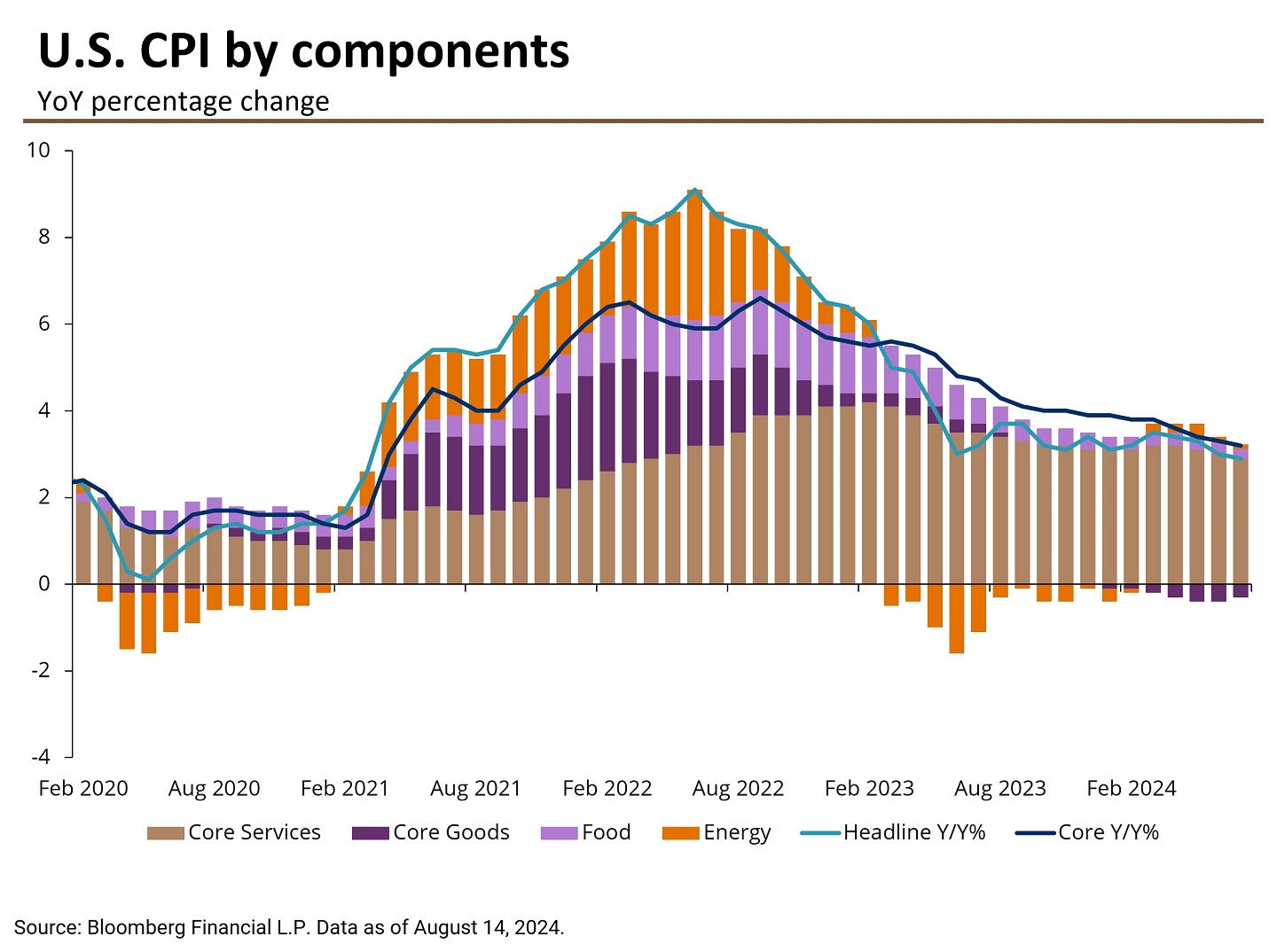

- The July 2024 Consumer Price Index (CPI) rose 0.2% month-over-month (MoM) and 2.9% year-over-year (YoY), the smallest annual increase since March 2021.

- However, shelter inflation rebounded in July, up 0.4% from the prior month, following a low 0.2% reading in June. Overall, shelter inflation is on a downward trajectory, but the data is a reminder that the process will take time.

- Outside of the shelter component of the CPI report, we see deflationary readings, particularly in certain categories such as used autos and airfare.

- In our strategists’ view, this is a welcome report for the Federal Reserve (Fed) that should further increase the Fed’s confidence that inflation is on its way back to the 2% target. July’s inflation report, along with the recent jobs report, supports the view of a rate cut, most likely at the next Federal Open Market Committee (FOMC) meeting in September.

Contributors

Associate, Wealth Planning & Advice

The July 2024 Consumer Price Index for All Urban Consumers (CPI-U) rose by 0.2% month-over-month (MoM), as expected, after falling by 0.1% in June. The year-over-year (YoY) CPI fell to 2.9% from 3% YoY in June,1 the smallest annual rise since March 2021. The easing in headline inflation suggests that inflation is trending in the right direction in the eyes of the Federal Reserve.

The softer inflation data, coupled with July’s weaker-than-expected employment report, highlights inflation and the labor market are coming into a better balance. These developments should increase the Fed’s confidence that inflation is on its way back to the 2% target and position the Fed to begin easing policy, most likely at the September Federal Open Market Committee meeting.

Report highlights

The monthly rise in July’s headline CPI was primarily driven by a 0.4% rebound in the shelter index and a 1% rise in motor vehicle insurance prices. The gain in the shelter index contributed to the majority of the monthly headline CPI increase – this means that rent is the primary reason for the difference between the Fed’s 2% target and the current inflation rate.2

The food index increased 0.2% MoM again in July and 2.2% YoY. The food away from home index rose 0.2% MoM while the food at home index rose 0.1% MoM. Out of the six major grocery store food group indexes, three saw monthly increases while three saw monthly declines. Notably, prices for meats, poultry, fish and eggs rose 0.7% MoM.3

The energy index was unchanged MoM, following a 2% decline in June, and rose by 1.1% YoY. Gasoline prices were unchanged MoM and fell 2.2% YoY.4 While energy prices were mostly unchanged in July, our strategists will keep a close eye on energy prices as they are historically a more volatile component of the inflation basket.

Our strategists expect slowing inflation, along with wages that remain supportive, to continue to enhance consumer purchasing power. This will likely bolster consumer spending in the near term.

Core CPI findings

Core CPI (excluding food and energy) rose by 0.2% MoM, following a milder 0.1% rise in June. Over the past year, core CPI rose by 3.2%, the smallest annualized increase since April 2021.5 Core prices were boosted by a rise in the shelter component, which accounts for about a third of the total inflation basket.

Shelter inflation rebounded in July, up 0.4% from the prior month, following a low 0.2% reading in June. Within the shelter component, owners’ equivalent rent (OER) increased by 0.4% in July and the rent index rose by 0.5%.6 Over the past year, shelter prices rose by 5.1%, driving over 70% of the annual gain in core CPI.

Overall, shelter inflation is on a downward trajectory, but the data is a reminder that the process will take time. The shelter component of inflation needs to decline further for rates to move closer to the Fed’s 2% target.

July’s uptick in the shelter index drove the core services index up to 0.3% MoM, the highest reading since April. The rise in core services prices was also driven by increases in motor vehicle insurance prices, while medical services and airfare prices declined. Core goods prices fell 0.3% MoM, the softest reading for core goods prices in a year, driven by falling prices for used vehicles and apparel.7

Going forward, our strategists expect core inflation to further moderate this year as the economy slows and the labor market becomes more balanced amid pressure from high interest rates.

Possible implications for the Fed

At the FOMC meeting in July, the Fed announced that it would maintain the overnight federal funds rate at the current range of 5.25% to 5.5%. Notably, the Fed signaled it is leaving the door open to start cutting rates in September and the July inflation data reinforces that notion.8

Fed Chairman Jerome Powell reiterated that the Fed’s decision on the direction of rates continues to be made on a meeting by meeting basis with data leading the way.9 Following July’s weaker-than-expected jobs report and producer prices report, the cooldown in July’s inflation data should give the Fed further confidence that inflation is heading closer to its 2% target. This supports our strategists’ view that the Fed will likely cut interest rates in September.

For more information on how this economic data may impact your investment strategy, consult a financial advisor.

References

U.S. Bureau of Labor Statistics (BLS), “Consumer Price Index Summary.” (July 11, 2024)

Ibid.

Ibid.

Ibid.

Ibid.

Ibid.

Ibid.

Board of Governors of the Federal Reserve System, “Federal Reserve Issues FOMC Statement.” (July 31, 2024)

Board of Governors of the Federal Reserve System, “Transcript of Chair Powell’s Press Conference Opening Statement” (July 2024).

Connect with a Wealth Advisor

Our Wealth Advisors begin by getting to know you personally. To get started, tell us about your needs and we’ll reach out to you.

IMPORTANT INFORMATION

This material is for informational purposes only, and may inform you of certain products and services offered by J.P. Morgan’s wealth management businesses, part of JPMorgan Chase & Co. (“JPM”). Products and services described, as well as associated fees, charges and interest rates, are subject to change in accordance with the applicable account agreements and may differ among geographic locations. Not all products and services are offered at all locations. If you are a person with a disability and need additional support accessing this material, please contact your J.P. Morgan team or email us at accessibility.support@jpmorgan.com for assistance. Please read all Important Information.

GENERAL RISKS & CONSIDERATIONS. Any views, strategies or products discussed in this material may not be appropriate for all individuals and are subject to risks. Investors may get back less than they invested, and past performance is not a reliable indicator of future results. Asset allocation/diversification does not guarantee a profit or protect against loss. Nothing in this material should be relied upon in isolation for the purpose of making an investment decision. You are urged to consider carefully whether the services, products, asset classes (e.g. equities, fixed income, alternative investments, commodities, etc.) or strategies discussed are suitable to your needs. You must also consider the objectives, risks, charges, and expenses associated with an investment service, product or strategy prior to making an investment decision. For this and more complete information, including discussion of your goals/situation, contact your J.P. Morgan representative.

NON-RELIANCE. Certain information contained in this material is believed to be reliable; however, JPM does not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. No representation or warranty should be made with regard to any computations, graphs, tables, diagrams or commentary in this material, which are provided for illustration/reference purposes only. The views, opinions, estimates and strategies expressed in this material constitute our judgment based on current market conditions and are subject to change without notice. JPM assumes no duty to update any information in this material in the event that such information changes. Views, opinions, estimates and strategies expressed herein may differ from those expressed by other areas of JPM, views expressed for other purposes or in other contexts, and this material should not be regarded as a research report. Any projected results and risks are based solely on hypothetical examples cited, and actual results and risks will vary depending on specific circumstances. Forward-looking statements should not be considered as guarantees or predictions of future events.

Nothing in this document shall be construed as giving rise to any duty of care owed to, or advisory relationship with, you or any third party. Nothing in this document shall be regarded as an offer, solicitation, recommendation or advice (whether financial, accounting, legal, tax or other) given by J.P. Morgan and/or its officers or employees, irrespective of whether or not such communication was given at your request. J.P. Morgan and its affiliates and employees do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any financial transactions.

Legal Entity and Regulatory Information.

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

Bank deposit accounts and related services, such as checking, savings and bank lending, are offered by JPMorgan Chase Bank, N.A. Member FDIC.

This document may provide information about the brokerage and investment advisory services provided by J.P. Morgan Securities LLC (“JPMS”). The agreements entered into with JPMS, and corresponding disclosures provided with respect to the different products and services provided by JPMS (including our Form ADV disclosure brochure, if and when applicable), contain important information about the capacity in which we will be acting. You should read them all carefully. We encourage clients to speak to their JPMS representative regarding the nature of the products and services and to ask any questions they may have about the difference between brokerage and investment advisory services, including the obligation to disclose conflicts of interests and to act in the best interests of our clients.

J.P. Morgan may hold a position for itself or our other clients which may not be consistent with the information, opinions, estimates, investment strategies or views expressed in this document. JPMorgan Chase & Co. or its affiliates may hold a position or act as market maker in the financial instruments of any issuer discussed herein or act as an underwriter, placement agent, advisor or lender to such issuer.