Contributors

What’s happening?

Markets had a rocky start to the week. Monday’s session was met with a strong risk-off sentiment following last week’s jobs report, which showed a rise in U.S. unemployment. Tuesday brought some reprieve as global markets began to recoup at least some of Monday’s losses. Investors are still grappling with two major questions:

- Is the recent economic data weakness a shallow descent into a soft landing or a downward spiral toward recession?

- If it’s the latter, are rate cuts too little, too late?

Google keyword searches for “recession” hit their highest point in almost two years. On Monday, the CBOE Volatility Index (VIX), which gauges S&P 500 volatility, had its largest intra-day spike since 1990 and closed at its highest level since October 2020. We acknowledge that risks feel more elevated than they did even just a couple of weeks ago, but we’re not getting carried away: A soft landing remains our base case. While volatility could persist in the months ahead, we think it presents opportunity for cross-asset class investors.

How do we make sense of the moves?

Investor jitters surrounding the July U.S. labor market report, recent manufacturing data misses and a fear that the Fed is “behind the curve” were a sell-off spark for a market that was already characterized by high valuations and a concentration of performance leadership. We note three important dynamics as we consider the path ahead for markets:

- The rise in the unemployment rate probably overstates labor market weakness. The tick higher in the unemployment rate from 4.1% to 4.3% triggered what’s known as the Sahm Rule (it says that historically, a rise of 0.5% or more in the unemployment rate over a relatively short period of time signaled that the economy was in recession). It is a risk worth monitoring, but note that much of the rise was attributable to a surge in labor force participation and rise in temporary, not permanent, layoffs. To boot, other labor market data sets aren’t showing signs of a downward spiral, weekly unemployment claims data remains in-line with seasonal averages, and few companies are mentioning plans for layoffs on earnings calls. There are other tangible positives that persist in the economic backdrop, like the recently released Institute for Supply Management (ISM) Services Index data that surprised to the upside and points towards a continuation of the economic expansion.

- Market moves are being exacerbated by an unwind of global “carry trades.” Given how low rates in Japan have been relative to the rest of the world, it has offered opportunistic investors a compelling “carry trade” opportunity: Borrow (cheaply) in Japanese yen, then use the proceeds to invest in higher yielding assets elsewhere in the world. That opportunity has been narrowing, however, as the Bank of Japan pushes rates higher and the yen appreciates. Add the global market downturn, and “carry trade” unwinds get catalyzed as leveraged investors sell their global risk asset positions. These kinds of technical and positioning dynamics have added downward pressure on markets, but could wane in the weeks ahead as positioning normalizes.

- Geopolitical concerns add an additional sprinkle of anxiety. At the present, this seems to be a bit secondary from a market volatility standpoint but is important to acknowledge. There are concerns around a potential attack on Israel by Iran, which U.S. intelligence evidently believes to be imminent.

All considered, the Fed is likely paying attention to labor market data and the recent pickup in volatility. Markets are pricing towards a cut of 50 basis points at the September Federal Open Market Committee (FOMC) meeting; our own view calls for three cuts of 25 basis points through the end of the year. Either way, the “Fed put” is back in play – we don’t think conditions are deteriorating so rapidly that the Fed won’t be able to avoid recession with rate cuts. The soft landing still looks achievable.

What does this mean for investors?

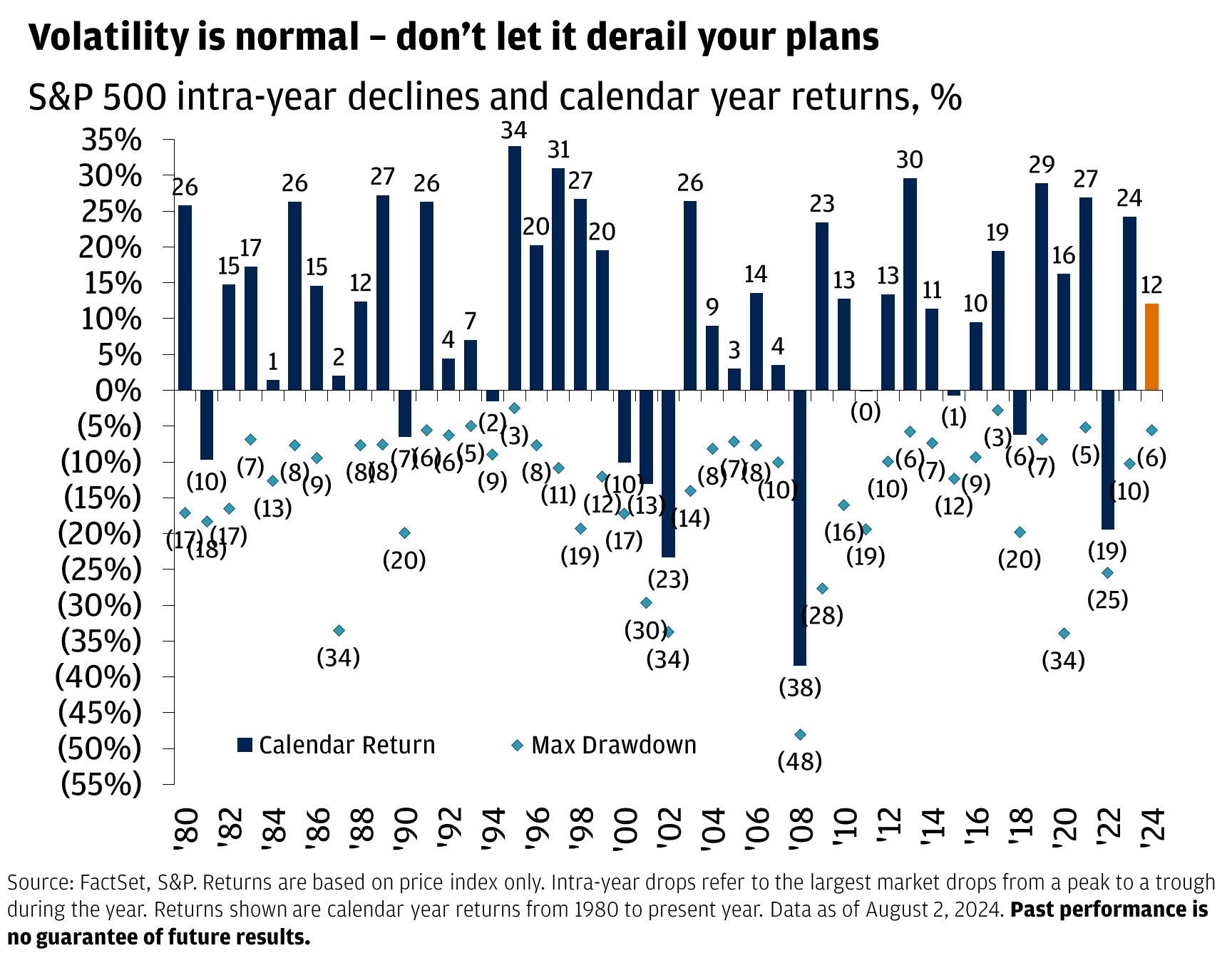

For investors, it can feel uncomfortable when the risk pendulum swings rapidly from fears of sticky inflation to fears of an impending recession. But market moves like those witnessed at the start of August remind us that pullbacks are a feature – not a bug – of investing. Historically, the average year that ends with a gain for the S&P 500 comes with an 11% peak to trough decline. As of Monday’s close, the S&P 500 was about 8% below all-time highs. In other words, volatility is normal and shouldn’t derail a long-term financial strategy.

The recent market pullback may be an apt time to consider phasing into portfolios. Examine the potential benefits of extending duration as cash rates seem set to fall faster than expected. Most of all, assess your investments in the context of their role within a larger wealth plan.

Connect with a Wealth Advisor

Our Wealth Advisors begin by getting to know you personally. To get started, tell us about your needs and we’ll reach out to you.

IMPORTANT INFORMATION

This material is for informational purposes only, and may inform you of certain products and services offered by J.P. Morgan’s wealth management businesses, part of JPMorgan Chase & Co. (“JPM”). Products and services described, as well as associated fees, charges and interest rates, are subject to change in accordance with the applicable account agreements and may differ among geographic locations. Not all products and services are offered at all locations. If you are a person with a disability and need additional support accessing this material, please contact your J.P. Morgan team or email us at accessibility.support@jpmorgan.com for assistance. Please read all Important Information.

GENERAL RISKS & CONSIDERATIONS. Any views, strategies or products discussed in this material may not be appropriate for all individuals and are subject to risks. Investors may get back less than they invested, and past performance is not a reliable indicator of future results. Asset allocation/diversification does not guarantee a profit or protect against loss. Nothing in this material should be relied upon in isolation for the purpose of making an investment decision. You are urged to consider carefully whether the services, products, asset classes (e.g. equities, fixed income, alternative investments, commodities, etc.) or strategies discussed are suitable to your needs. You must also consider the objectives, risks, charges, and expenses associated with an investment service, product or strategy prior to making an investment decision. For this and more complete information, including discussion of your goals/situation, contact your J.P. Morgan representative.

NON-RELIANCE. Certain information contained in this material is believed to be reliable; however, JPM does not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. No representation or warranty should be made with regard to any computations, graphs, tables, diagrams or commentary in this material, which are provided for illustration/reference purposes only. The views, opinions, estimates and strategies expressed in this material constitute our judgment based on current market conditions and are subject to change without notice. JPM assumes no duty to update any information in this material in the event that such information changes. Views, opinions, estimates and strategies expressed herein may differ from those expressed by other areas of JPM, views expressed for other purposes or in other contexts, and this material should not be regarded as a research report. Any projected results and risks are based solely on hypothetical examples cited, and actual results and risks will vary depending on specific circumstances. Forward-looking statements should not be considered as guarantees or predictions of future events.

Nothing in this document shall be construed as giving rise to any duty of care owed to, or advisory relationship with, you or any third party. Nothing in this document shall be regarded as an offer, solicitation, recommendation or advice (whether financial, accounting, legal, tax or other) given by J.P. Morgan and/or its officers or employees, irrespective of whether or not such communication was given at your request. J.P. Morgan and its affiliates and employees do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any financial transactions.

Legal Entity and Regulatory Information.

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

Bank deposit accounts and related services, such as checking, savings and bank lending, are offered by JPMorgan Chase Bank, N.A. Member FDIC.

This document may provide information about the brokerage and investment advisory services provided by J.P. Morgan Securities LLC (“JPMS”). The agreements entered into with JPMS, and corresponding disclosures provided with respect to the different products and services provided by JPMS (including our Form ADV disclosure brochure, if and when applicable), contain important information about the capacity in which we will be acting. You should read them all carefully. We encourage clients to speak to their JPMS representative regarding the nature of the products and services and to ask any questions they may have about the difference between brokerage and investment advisory services, including the obligation to disclose conflicts of interests and to act in the best interests of our clients.

J.P. Morgan may hold a position for itself or our other clients which may not be consistent with the information, opinions, estimates, investment strategies or views expressed in this document. JPMorgan Chase & Co. or its affiliates may hold a position or act as market maker in the financial instruments of any issuer discussed herein or act as an underwriter, placement agent, advisor or lender to such issuer.