Contributors

Preeti Bhattacharji

Head of Sustainable Investing, US Private Bank

Olivia Childs

Senior Associate

Over the past year, we have been getting a lot of questions about inclusive investing. The topic has become mired in controversy, leaving some clients uncertain about what inclusivity – the practice of deliberately incorporating diverse perspectives – has to do with investing. We’re here to help unpack this rapidly changing space and showcase how other clients are navigating it as well.

For some clients, inclusivity reflects personal values. For others, it simply makes good business sense because investing inclusively can potentially deliver stronger returns.

With these twin priorities in mind, we help clients find opportunities to invest with managers and businesses operated by people with a wide array of experiences. This diversity of experiences can help them make differentiated decisions that can enhance returns and may better align with some clients’ values.

For clients seeking enhanced returns

Often, critics present inclusivity as a distraction that will impair financial returns over time. The facts say otherwise.

Factually, inclusive investing often outperforms the market. Across all asset classes, diverse managers performed similar to or better than majority-owned peers.1, 2 In private equity, for example, minority managers3 outperformed the BURGISS Index (a benchmark that measures returns in private markets) across key performance metrics between 1998 and 2022.4

Part of the reason that minority managers have outperformed is because their unique experiences and networks can offer differentiated deal flow, which can enhance diversification and mitigate risk.5

Haircare products for Black consumers are illustrative examples. Black haircare is a large and growing industry currently valued at $7 billion, with a projected compound annual growth rate (CAGR) of 6% through 2031.6 But only 20% of venture capital goes to female founders, and only 1% of venture capital funding goes to Black founders.7 These patterns can leave companies that operate in the Black haircare market undercapitalized.8 Through their networks and personal experiences, minority managers can be well positioned to identify and invest in opportunities such as these.

We see similar patterns in the public markets: Companies with diverse teams can be better positioned to service the needs of their diversifying consumer bases. Beverage companies with Latino staff, for example, have successfully targeted their marketing campaigns for culturally specific events such as quinceañeras and soccer tournaments in the United States. These differentiators have been meaningful, as Latinos represented half of U.S. population growth from 2010 to 2020, and are on track to comprise 30% of the U.S. population by 2050.9

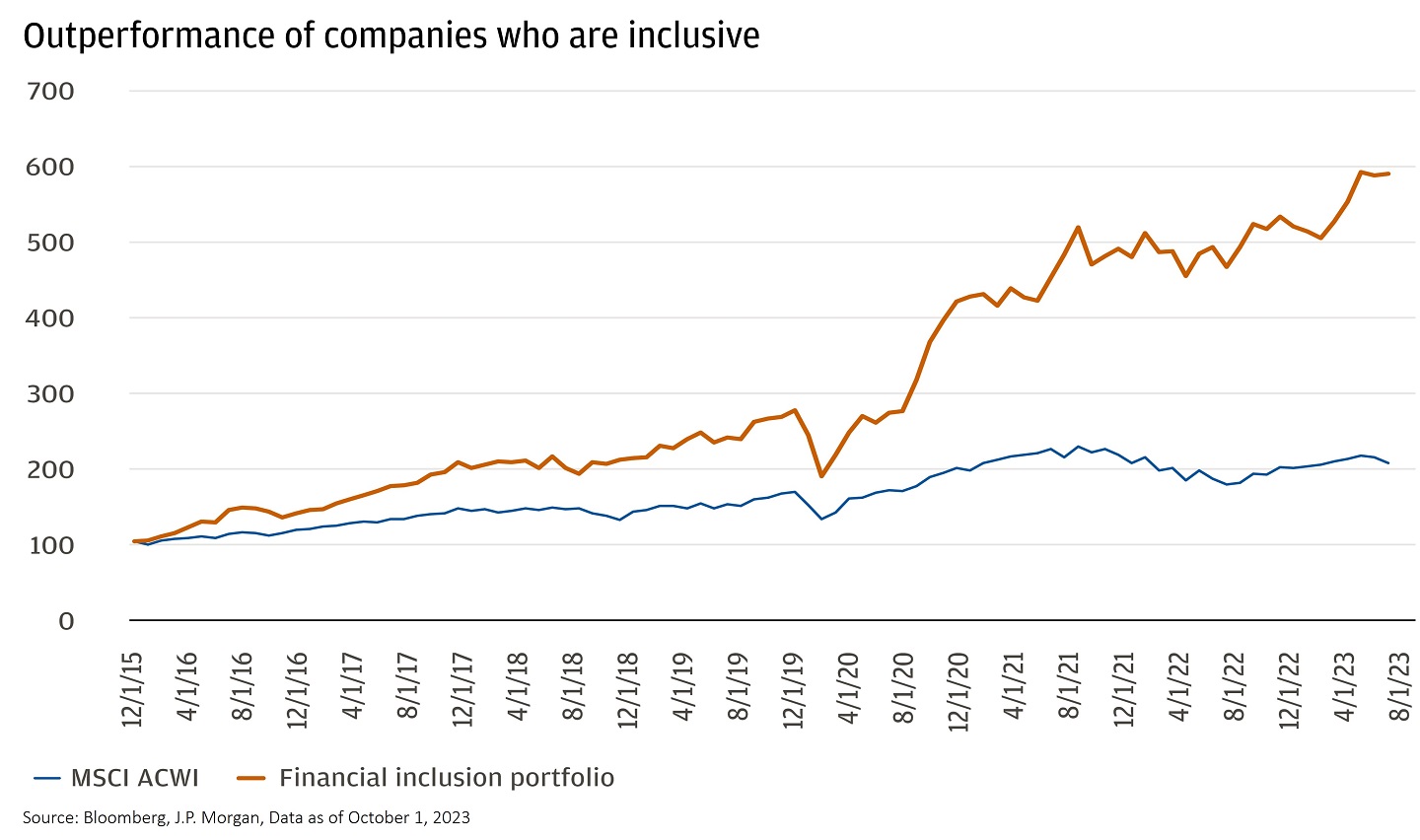

The trend extends beyond just consumer staples. Across the world, companies that prioritized financial inclusion, for example, have outperformed the MSCI ACWI (a global benchmark) by 6% annually since 2015.10

Skeptics point out that this might not last forever. With so few minority managers and executive teams getting funding, the only ones who do are often exceptional, and that could be driving some of their enhanced returns. As time goes on, if assets get distributed more broadly, then more minority teams will get funding, and that premium might fade. But the most recent performance data that we have suggests that, at least for now, the asymmetry continues to persist.

For clients who personally value inclusivity

Though they may acknowledge that the business case is strong, some clients are primarily driven by a desire to invest in accordance with values. Having achieved an element of financial success in their own lives, they want to focus on creating opportunities for others and contributing to what they believe to be a more just and equitable society.

As a first step, these clients often apply customizations to their portfolios that divest from companies that violate their values. An LGBTQIA+ customization, for example, can screen out companies that fail to provide equitable benefits for LGBTQIA+ workers. A racial equity customization can exclude companies that have disproportionately polluted in communities of color. A gender equity customization can exclude companies that lag in leadership representation.

This “leaders and laggards” approach penalizes companies that lag in their inclusive practices by divesting from them, and shifts capital toward companies that meet the necessary criteria. In some cases (like those outlined above), there can be a business case for investing in “leaders” that also aligns with enhanced returns. In other cases, there may be no business justification, but clients choose to do so anyway simply because they want to align their investments with their personal values.

One of the things to watch out for with this approach is “impact washing” – which is what we call it when companies make exaggerated (or in some cases, entirely false) claims about their social impacts. As more investors express interest in inclusivity, more companies have responded by trying to manipulate their statistics to look more inclusive than they actually are.

Given the prevalence of impact washing, we advise against relying exclusively on self-reported data from companies. Instead, we build portfolio customizations based on data from third-party nonprofits and watchdog groups such as the Human Rights Campaign, Equileap, Violation Tracker and the Political Economy Research Institute. These organizations are staffed by professionals with deep expertise and lived experience in the issue area that strengthens the reliability of their work, and we vet our data sources much like we vet any investment manager on the platform.

Beyond portfolio customization, another approach that some clients take is to invest in active managers that use corporate engagement to push for change. Some investment managers, for example, have filed shareholder resolutions demanding that companies complete Racial Equity Audits. Other investment managers have negotiated directly with companies to get them to publicly disclose the workforce demographic data they already share with the Equal Employment Opportunity Commission. In both cases, asset managers are using their power as shareholders to push for equity on behalf of their investors.

How to get started

If inclusive investing is interesting to you and your family, your J.P. Morgan team can help you explore your options in a way that feels relevant for your goals.

References

Bella, Private Markets and Knight Foundation, Knight Diversity of Asset Managers Research Series: Industry, September 2021.

NAIC, “Examining the returns 2023” (February 2024).

Defined here as TK.

NAIC, “Examining the returns 2023” (February 2024).

BCG, “Diversity in private investments”

LinkedIn, “Black hair care market size, share and growth report, 2030” (January 2024).

Fast Company, “Women cofounders raise about 20% of venture capital – but we often overlook them” (March 2023).

TechCrunch, “Black founders still raised just 1% of all VC funds in 2022” (January 2023).

United States Census Bureau, “2023 National Population Projections Datasets” (November 2023).

J.P. Morgan EMEA markets research (2023).

Connect with a Wealth Advisor

Our Wealth Advisors begin by getting to know you personally. To get started, tell us about your needs and we’ll reach out to you.

IMPORTANT INFORMATION

Sustainable investing (“SI”) and investment approaches that incorporate environmental social and governance (“ESG”) objectives may include additional risks. SI strategies, including ESG separately managed accounts (“SMAs”), mutual funds and exchange-traded funds (“ETFs”), may limit the types and number of investment opportunities and, as a result, could underperform other strategies that do not have an ESG or sustainable focus. Certain strategies focused on particular sectors may be more concentrated in particular industries that share common factors and can be subject to similar business risks and regulatory burdens. Investing on the basis of sustainability/ESG criteria can involve qualitative and subjective analysis and there can be no assurance that the methodology utilized, or determinations made, by the investment manager will align with the beliefs or values of the investor. Investment managers can have different approaches to ESG or sustainable investing and can offer strategies that differ from the strategies offered by other investment managers with respect to the same theme or topic. ESG or sustainable investing is not a uniformly defined concept and scores or ratings may vary across data providers that use similar or different screens based on their process for evaluating ESG characteristics. Additionally, when evaluating investments, an investment manager is dependent upon information and data that may be incomplete, inaccurate or unavailable, which could cause the manager to incorrectly assess an investment’s ESG/SI performance.

The evolving nature of sustainable finance regulations and the development of jurisdiction-specific legislation setting out the regulatory criteria for a “sustainable investment” or “ESG” investment mean that there is likely to be a degree of divergence as to the regulatory meaning of such terms. This is already the case in the European Union where, for example, under the Sustainable Finance Disclosure Regulation (EU) (2019/2088) (“SFDR”) certain criteria must be satisfied in order for a product to be classified as a “sustainable investment.” Unless otherwise specified, any references to “sustainable investing” or “ESG” in this material are intended as references to our internally developed criteria only and not to any jurisdiction-specific regulatory definition."

This material is for informational purposes only, and may inform you of certain products and services offered by J.P. Morgan’s wealth management businesses, part of JPMorgan Chase & Co. (“JPM”). Products and services described, as well as associated fees, charges and interest rates, are subject to change in accordance with the applicable account agreements and may differ among geographic locations. Not all products and services are offered at all locations. If you are a person with a disability and need additional support accessing this material, please contact your J.P. Morgan team or email us at accessibility.support@jpmorgan.com for assistance. Please read all Important Information.

GENERAL RISKS & CONSIDERATIONS. Any views, strategies or products discussed in this material may not be appropriate for all individuals and are subject to risks. Investors may get back less than they invested, and past performance is not a reliable indicator of future results. Asset allocation/diversification does not guarantee a profit or protect against loss. Nothing in this material should be relied upon in isolation for the purpose of making an investment decision. You are urged to consider carefully whether the services, products, asset classes (e.g. equities, fixed income, alternative investments, commodities, etc.) or strategies discussed are suitable to your needs. You must also consider the objectives, risks, charges, and expenses associated with an investment service, product or strategy prior to making an investment decision. For this and more complete information, including discussion of your goals/situation, contact your J.P. Morgan representative.

NON-RELIANCE. Certain information contained in this material is believed to be reliable; however, JPM does not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. No representation or warranty should be made with regard to any computations, graphs, tables, diagrams or commentary in this material, which are provided for illustration/reference purposes only. The views, opinions, estimates and strategies expressed in this material constitute our judgment based on current market conditions and are subject to change without notice. JPM assumes no duty to update any information in this material in the event that such information changes. Views, opinions, estimates and strategies expressed herein may differ from those expressed by other areas of JPM, views expressed for other purposes or in other contexts, and this material should not be regarded as a research report. Any projected results and risks are based solely on hypothetical examples cited, and actual results and risks will vary depending on specific circumstances. Forward-looking statements should not be considered as guarantees or predictions of future events.

Nothing in this document shall be construed as giving rise to any duty of care owed to, or advisory relationship with, you or any third party. Nothing in this document shall be regarded as an offer, solicitation, recommendation or advice (whether financial, accounting, legal, tax or other) given by J.P. Morgan and/or its officers or employees, irrespective of whether or not such communication was given at your request. J.P. Morgan and its affiliates and employees do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any financial transactions.

Legal Entity and Regulatory Information.

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

Bank deposit accounts and related services, such as checking, savings and bank lending, are offered by JPMorgan Chase Bank, N.A. Member FDIC.

This document may provide information about the brokerage and investment advisory services provided by J.P. Morgan Securities LLC (“JPMS”). The agreements entered into with JPMS, and corresponding disclosures provided with respect to the different products and services provided by JPMS (including our Form ADV disclosure brochure, if and when applicable), contain important information about the capacity in which we will be acting. You should read them all carefully. We encourage clients to speak to their JPMS representative regarding the nature of the products and services and to ask any questions they may have about the difference between brokerage and investment advisory services, including the obligation to disclose conflicts of interests and to act in the best interests of our clients.

J.P. Morgan may hold a position for itself or our other clients which may not be consistent with the information, opinions, estimates, investment strategies or views expressed in this document. JPMorgan Chase & Co. or its affiliates may hold a position or act as market maker in the financial instruments of any issuer discussed herein or act as an underwriter, placement agent, advisor or lender to such issuer.