How AI is shaping these three industries in China

May 13, 2024

What are some of the use cases for AI in healthcare?

AI is being deployed across the health care industry in areas such as medical imaging devices, diagnostics, and drug discovery. The first drugs fully generated by artificial intelligence entered clinical trials with human patients in China last year and major pharma groups are investing heavily in the space to increase research and development (R&D) efficiency and long-term cost savings. The chronic and autoimmune drug market is expected to be a significant growth area in China, with an estimated market size of $20 billion by 2030, where AI could play a major role.

“The innovative drug market for chronic diseases is still dominated by multinational pharmaceutical companies, but we expect domestic players to play catch-up by increasing R&D in this therapeutic area. AI is set to become increasingly important to drug discovery,” said Yang Huang, China Healthcare Research, J.P. Morgan Securities.

The autoimmune drug market in China is expected to grow at a compound annual growth rate of 0% and reach $20 billion by 2030.

Source: J.P. Morgan Research

AI contribution along healthcare value chain

AI is also being used in medical scenarios, such as disease diagnosis and treatment. An online medical platform, Medlinker, recently launched MedGPT, an AI tool similar to ChatGPT used for diagnosing common diseases, designed to handle the entire process of diagnosis to prescribing tests and medication.

“MedGPT underlines the immense potential in this area. We have seen quite a few tools in recent years and will likely see more large language model (LLM) based applications being introduced to the market of this kind. Given the overall AI solution market will experience higher growth in China vs. global, we expect to see even higher growth in the healthcare-related AI solution market in China,” added Huang.

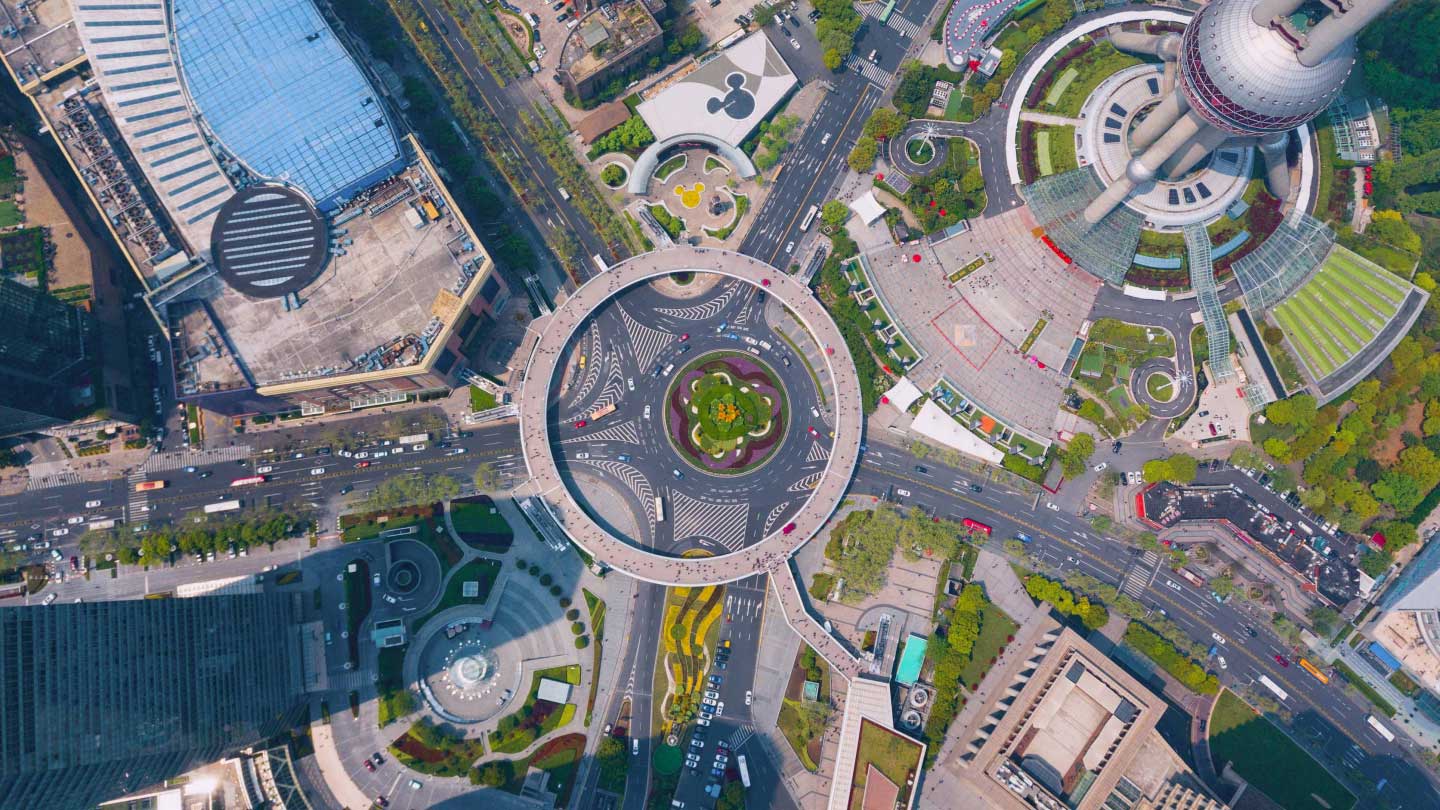

How is AI being used in EVs and driverless cars?

China is driving innovation for autonomous vehicles, with Level 3 and higher autonomous driving expected to reach a penetration rate of 0% by 2030.

Source: J.P. Morgan Research

Chinese automakers recently unveiled their latest electric vehicle (EV) models at the Beijing Autoshow, with competition in the Chinese EV market increasingly focused on AI and how it can support self-driving technology. Manufacturers are hoping to attract younger consumers through competitive pricing and autonomous driving capabilities, with firms expanding their R&D in China to focus on connectivity, automated driving, software and hardware development. AI in self-driving cars uses sensors and algorithms to understand the surrounding environment. There are 6 levels of driving automation, ranging from 0 (fully manual) to 5 (full automation), with China currently leading in the race to penetrate the driverless market.

Chinese smartphone makers have also entered the fiercely competitive driverless EV market, with the likes of Huawei playing an important role in China’s development in getting to level 3 and 4 markets. More recently, Xiaomi also launched its first EV at the end of March, with the company expecting to see shipment levels of100,000 units in 2024 according to J.P. Morgan Research, ahead of the group’s original estimates.

“With future EVs more and more like a smartphone or smart device with four-wheels, self-driving technology will become more important to companies

looking to attract young consumers,” said Nick Lai, Head of China Equity and Asia Autos Research at J.P. Morgan.

“We believe young Chinese car buyers will be increasingly educated that Level 3/4 semi-autonomous driving function is not just a ‘nice to have’ but a ‘need to have’, creating demand for such features when they purchase new cars; in other words, future products without such functionality may find it difficult to sell. AI will be very important in the race to getting driverless cars safely on the road,” said Lai.

Chinese automakers recently unveiled their latest electric vehicle (EV) models at the Beijing Autoshow, with competition in the Chinese EV market increasingly focused on AI and how it can support self-driving technology. Manufacturers are hoping to attract younger consumers through competitive pricing and autonomous driving capabilities, with firms expanding their R&D in China to focus on connectivity, automated driving, software and hardware development. AI in self-driving cars uses sensors and algorithms to understand the surrounding environment. There are 6 levels of driving automation, ranging from 0 (fully manual) to 5 (full automation), with China currently leading in the race to penetrate the driverless market.

Chinese smartphone makers have also entered the fiercely competitive driverless EV market, with the likes of Huawei playing an important role in China’s development in getting to level 3 and 4 markets. More recently, Xiaomi also launched its first EV at the end of March, with the company expecting to see shipment levels of100,000 units in 2024 according to J.P. Morgan Research, ahead of the group’s original estimates.

“With future EVs more and more like a smartphone or smart device with four-wheels, self-driving technology will become more important to companies looking to attract young consumers,” said Nick Lai, Head of China Equity and Asia Autos Research at J.P. Morgan.

“We believe young Chinese car buyers will be increasingly educated that Level 3/4 semi-autonomous driving function is not just a ‘nice to have’ but a ‘need to have’, creating demand for such features when they purchase new cars; in other words, future products without such functionality may find it difficult to sell. AI will be very important in the race to getting driverless cars safely on the road,” said Lai.

How will AI impact electricity and power consumption?

Electricity consumption from data centers in China, the US and EU

Global grid and electrical company stocks have rallied so far this year and China’s grid equipment names are no exception, climbing more than 20% year-to-date, compared to around 6% for the Shanghai Composite Index. Investors are starting to appreciate the structural growth story for electrical equipment globally, as AI adoption is increasing power consumption growth expectations. Rapid advancement of AI potential impacts electricity and transformer suppliers; as AI servers powered by Graphics Processing Units (GPUs) consume more power and run hotter, data centers may need to upgrade their electrical infrastructure to handle more power.

Source: IEA,*2020/26E data for China, compound annual growth rate (CAGR)

Note: 200 TwH in China for 2022 is an approximation.

This need for more power to support the growth of AI is set to boost demand for electrical equipment like transformers and switchgear, according to J.P. Morgan Research.

“AI may see 10x growth in power demand by 2026. This may increase the need to upgrade electrical infrastructure, which is in line with our view of structural

growth of grid capital expenditure (capex) across continents on rising global power consumption, with global grid capex expected to rise by around 5% a year over the decade. China companies with a global presence could likely benefit from that with their cost advantages,” said Stephen Tsui, Asia Power Equipment and Utilities analyst at J.P. Morgan.

This need for more power to support the growth of AI is set to boost demand for electrical equipment like transformers and switchgear, according to J.P. Morgan Research.

“AI may see 10x growth in power demand by 2026. This may increase the need to upgrade electrical infrastructure, which is in line with our view of structural growth of grid capital expenditure (capex) across continents on rising global power consumption, with global grid capex expected to rise by around 5% a year over the decade. China companies with a global presence could likely benefit from that with their cost advantages,” said Stephen Tsui, Asia Power Equipment and Utilities analyst at J.P. Morgan.

Related insights

This communication is provided for information purposes only. Please read J.P. Morgan research reports related to its contents for more information, including important disclosures. JPMorgan Chase & Co. or its affiliates and/or subsidiaries (collectively, J.P. Morgan) normally make a market and trade as principal in securities, other financial products and other asset classes that may be discussed in this communication.

This communication has been prepared based upon information, including market prices, data and other information, from sources believed to be reliable, but J.P. Morgan does not warrant its completeness or accuracy except with respect to any disclosures relative to J.P. Morgan and/or its affiliates and an analyst's involvement with any company (or security, other financial product or other asset class) that may be the subject of this communication. Any opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This communication is not intended as an offer or solicitation for the purchase or sale of any financial instrument. J.P. Morgan Research does not provide individually tailored investment advice. Any opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. You must make your own independent decisions regarding any securities, financial instruments or strategies mentioned or related to the information herein. Periodic updates may be provided on companies, issuers or industries based on specific developments or announcements, market conditions or any other publicly available information. However, J.P. Morgan may be restricted from updating information contained in this communication for regulatory or other reasons. Clients should contact analysts and execute transactions through a J.P. Morgan subsidiary or affiliate in their home jurisdiction unless governing law permits otherwise.

This communication may not be redistributed or retransmitted, in whole or in part, or in any form or manner, without the express written consent of J.P. Morgan. Any unauthorized use or disclosure is prohibited. Receipt and review of this information constitutes your agreement not to redistribute or retransmit the contents and information contained in this communication without first obtaining express permission from an authorized officer of J.P. Morgan.

Copyright 2024 JPMorgan Chase & Co. All rights reserved.