Corporates

Simplify your complex payments ecosystem with industry-leading end-to-end payment solutions. Our virtual account structures can help you accept, process, manage and pay out transactions quickly and easily.

Accept cards and automate receivables.

Automate nearly every payables process to help save time.

Manage cash with ease and drive efficiencies across payments, receipts and liquidity.

Discover a simplified, frictionless payments experience, domestic or cross-border.

Build a competitive edge with embedded finance solutions for a seamless experience.

One blockchain-based ecosystem with myriad solutions to help you tackle today’s most complex payments challenges. That’s kinexys by J.P. Morgan.

Assess risk, mitigate fraud and implement controls to protect your business globally.

With the ability to accept, manage, and send payments on a single platform, you can create solutions that drive your business forward without the complexities of managing multiple vendors

The point-of-sale is just the beginning. Sophisticated solutions from J.P. Morgan Payments do more than process payments. They connect your business to the world.

(music playing)

look closely. no, closer.

your payments can show you

how to connect the dots in new and innovative ways

because when you understand how

[trade & working capital commerce, treasury,embedded finance]

can work together

information becomes Inspiration

and scaling becomes second-nature.

growing your business starts with seeing what others don’t.

more than a payments partner

it’s giving you a new perspective

In daily payments processed

JPMC proprietary data 2023

Countries

JPMC proprietary data 2023

Currencies

JPMC proprietary data 2023

As a leader across the payments ecosystem, we combine global scale with nearly 150 years of in-region expertise to help you access new markets and connect to your customers, suppliers and partners.

As a leader across the payments ecosystem, we combine global scale with nearly 150 years of in-region expertise to help you access new markets and connect to your customers, suppliers and partners.

From regional expertise to innovative products and solutions, we help businesses in EMEA build strong payments foundations for resiliency and scalability.

APAC is the cradle of innovation for digital payments. We provide innovative solutions that are tailored to your business needs, helping you to optimize operations, manage liquidity and mitigate risk.

Simplify your complex payments ecosystem with industry-leading end-to-end payment solutions. Our virtual account structures can help you accept, process, manage and pay out transactions quickly and easily.

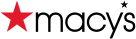

Benefit from the cost efficiencies, process automation and seamless digital customer experience J.P. Morgan solutions offer, led by advanced application programming interfaces.

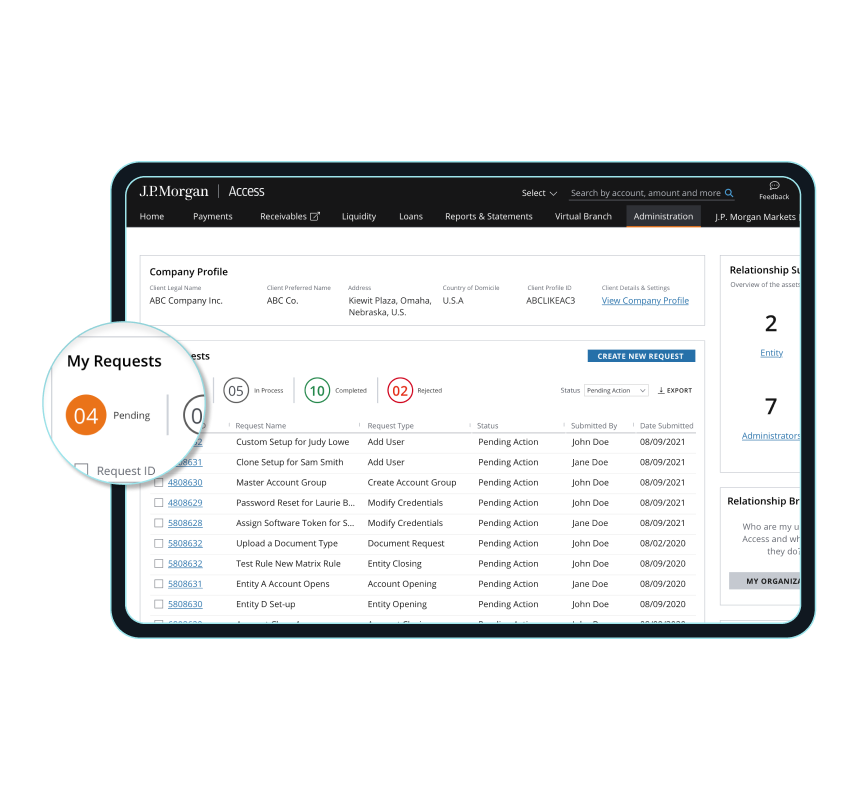

If you're part of the e-commerce revolution, you want a bank that's both agile and resilient. Look to us to help support growth opportunities, anytime, anywhere with solutions like J.P. Morgan WalletTM.

Get flexible payment acceptance, fast funding and fortress-level security with payment solutions that include Chase Smart TerminalTM and Chase QuickAccept®.

Takis Georgakopoulos

Global Head of Payments, J.P. Morgan

SCALABILITY

Macy’s Marketplace delivers seamless payments to sellers using J.P. Morgan solutions

Macy’s sought to expand its offerings by building a marketplace that provides consumers with more options and elevates the platform of small businesses. Developing this marketplace came with payments-related considerations that J.P. Morgan helped to solve.

Trade & Working Capital

Caterpillar: Constructing the future of working capital, growth and innovation

Caterpillar’s Patrick McCartan, Vice President & Corporate Treasurer, and Pete Chambers, Senior Manager Supplier Finance, share how J.P. Morgan helps Caterpillar optimize working capital and preserve a resilient supply base.

TREASURY AND PAYMENTS

Forecasting Payments

Our view on what everyone should keep top-of-mind as organizations navigate success in 2023 and beyond.

| SPOTLIGHT

Payments Unbound

In a bi-annual publication exploring the innovative advances in payments, J.P. Morgan and WIRED are exploring the payments revolution and its impact on customers, businesses, and the very nature of currency.