The risk allocation landscape

Historically, escrows have served as a classic deal protection mechanism in mergers and acquisition (M&A) transactions. However, representations and warranties (R&W) insurance has emerged as an escrow alternative, offering seller-friendly terms and competitive premiums. Is there room for two products on the market? Is one better than the other? Bottom line, it all depends. We explore some areas to consider when evaluating the optimal deal protection mechanism for your transaction.

Escrows: A primer

Holdback escrows are generally used by buyers to segregate a portion of the purchase price for various reasons, with the most common reasons being:

- Provide a means for the buyer to claim back a portion of the purchase price for breaches of R&W from the seller.

- Secure post-close purchase price adjustments until finalization of such amounts.

Escrows can also be used for other M&A purposes:

- Good faith deposit: Can demonstrate serious interest and/or comply with regulations (e.g., if government approval is needed); can also be used to hold potential termination fees.

- Closing agent/paying agent: Can centralize funding sources and enable funds to be on hand prior to close; can also facilitate exchange of company stock from seller for payment of cash from buyer.

R&W insurance

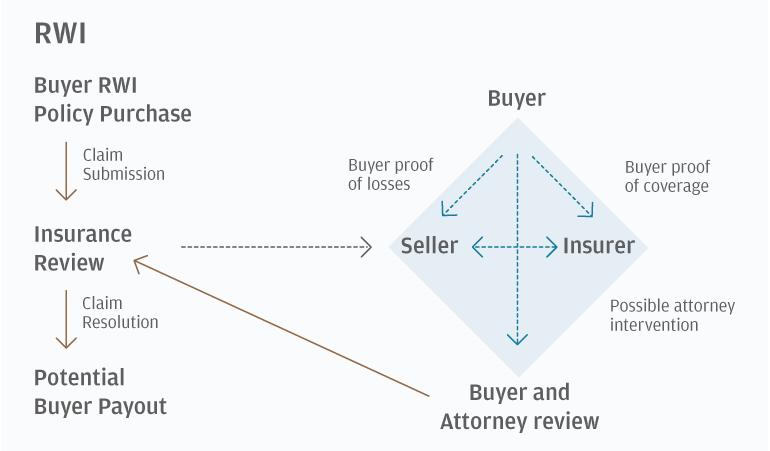

While there are seller and buyer R&W policies, the latter is more common. Under a buy-side R&W policy, the buyer in an M&A transaction recovers directly from an insurer for losses arising from certain breaches of the seller’s R&W in the purchase agreement. By shifting the risk of such losses from the seller to an insurer, a policy can limit the seller’s liability for certain rep breaches. The buyer retains the risk of receiving payment from the insurer for any claims submitted.

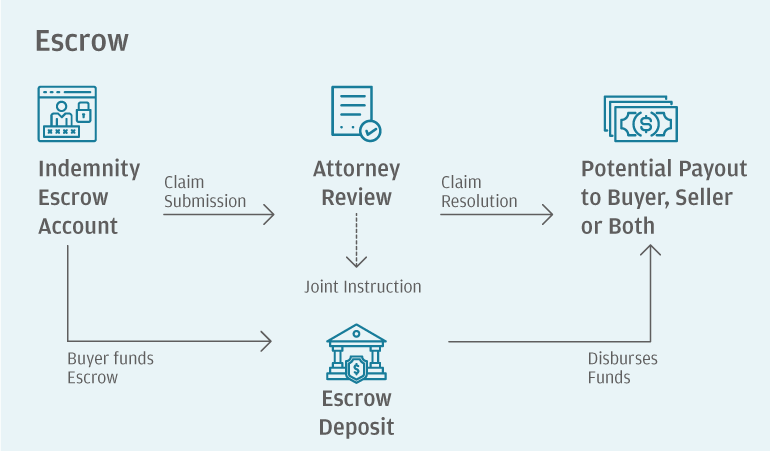

*Escrow agent not involved in the claim resolution

Claim coverage

For both escrows and R&W policies, claim coverage is particularly important for a buyer seeking to mitigate risk in its acquisition. In general, an escrow can provide a clear solution to resolve risks between the parties and may be customized to facilitate a comprehensive coverage model. Conversely, many R&W policies cover only specific, targeted areas.

Currently, in a typical R&W policy, known issues may be excluded, whether or not reported to the insurer or included in a due diligence memo. In addition, in many instances R&W policies will not cover breaches of covenants, forward-looking statements or purchase price adjustments. Depending on the specific policy, common indemnity claim types such as tax, litigation/product liability, collectability of accounts receivable, pension underfunding issues and environmental liabilities may require separate policies or increased premiums.

Claim payouts

Traditionally, claim payouts are not influenced by the escrow agent as it serves as a neutral third party, acting generally on joint instructions to release funds. Existing R&W insurance studies provide limited visibility on claim payouts and timing, though R&W providers have reported a rise in the frequency and severity of reported R&W claims.1 This calls into question whether or not certain R&W providers will face increased pressure to pay on claims and potentially to increase premium fees to ensure claim payouts or ultimately to reduce claim coverage.

Costs

R&W premiums vary based on the level of coverage but are generally a certain percentage of required coverage. On the other hand, escrow fees are nominal, and larger escrow deposits generally do not result in higher fees. Escrow will likely continue to be a less expensive risk mitigation tool regardless of whether claims increase over time.

Due diligence

When circumstances change, escrow does not require a separate due diligence workstream like R&W insurance does, and it will typically be quicker and simpler to execute a new escrow agreement versus an R&W policy. As a result, escrow can provide much-needed flexibility when quick turnaround is needed or to resolve last-minute negotiation issues that come up between the buyer and seller.

Choosing a mechanism for your deal

Most R&W policies only cover certain types of breaches for representations and warranties. Added coverage may be available, though it could be costly. Claims may be paid, but sometimes at the expense of increased legal fees and the extent of recovery. The ability to close within timeframes desired by buyers can also be impacted. On the other hand, many transactions, even those with R&W policies, involve some form of escrow to help cover and protect the gaps left by R&W polices. Escrow can offer flexibility, lower costs and broad security such as extending coverage through the “interim period” (time between signing and closing) via a good faith deposit.

Bottom line: Each transaction and its requirements are unique, and understanding the needs of your transaction—including what it will cost, how long it will take, the extent of its coverage provided, the certainty of enforceability—will drive towards a coverage model that makes the most sense for you.

J.P. Morgan Escrow

J.P. Morgan has breadth and depth of knowledge in areas ranging from M&A, litigation, debt capital markets, project finance account bank, real estate and bankruptcy. Our escrow solutions are supported by the financial strength of J.P. Morgan.

We have dedicated escrow account centers across the globe—in Chicago, Hong Kong, Houston, Korea, London, Luxembourg, Mumbai, New York, San Francisco, Sao Paulo, Shanghai, Singapore, Sydney and Toronto.

Connect with your J.P. Morgan representative to find the right solution for your business.

This material was prepared exclusively for the benefit and internal use of the JPMorgan client to whom it is directly addressed (including such client’s subsidiaries, the “Company”) in order to assist the Company in evaluating a possible transaction(s) and does not carry any right of disclosure to any other party. In preparing this material, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Company or which was otherwise reviewed by us. This material is for discussion purposes only and is incomplete without reference to the other briefings provided by JPMorgan. Neither this material nor any of its contents may be disclosed or used for any other purpose without the prior written consent of JPMorgan.

J.P. Morgan, JPMorgan, JPMorgan Chase and Chase are marketing names for certain businesses of JPMorgan Chase & Co. and its subsidiaries worldwide (collectively, “JPMC”). Products or services may be marketed and/or provided by commercial banks such as JPMorgan Chase Bank, N.A., securities or other non-banking affiliates or other JPMC entities. JPMC contact persons may be employees or officers of any of the foregoing entitles and the terms “J.P. Morgan”, “JPMorgan”, “JPMorgan Chase” and “Chase” if and as used herein include as applicable all such employees or officers and/or entities irrespective of marketing name(s) used. Nothing in this material is a solicitation by JPMC of any product or service which would be unlawful under applicable laws or regulations.

Investments or strategies discussed herein may not be suitable for all investors. Neither JPMorgan nor any of its directors, officers, employees or agents shall incur in any responsibility or liability whatsoever to the Company or any other party with respect to the contents of any matters referred herein, or discussed as a result of, this material. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice or investment recommendations. Please consult your own tax, legal, accounting or investment advisor concerning such matters.

Not all products and services are available in all geographic areas. Eligibility for particular products and services is subject to final determination by JPMC and or its affiliates/subsidiaries. This material does not constitute a commitment by any JPMC entity to extend or arrange credit or to provide any other products or services and JPMorgan reserves the right to withdraw at any time. All services are subject to applicable laws, regulations, and applicable approvals and notifications. The Company should examine the specific restrictions and limitations under the laws of its own jurisdiction that may be applicable to the Company due to its nature or to the products and services referred herein.

Notwithstanding anything to the contrary, the statements in this material are not intended to be legally binding. Any products, services, terms or other matters described herein (other than in respect of confidentiality) are subject to the terms of separate legally binding documentation and/or are subject to change without notice.

Changes to Interbank offered Rates (IBORs) and other Benchmark rates: Certain interest rate benchmarks are, or may in the future become, subject to ongoing international, national and other regulatory guidance, reform and proposals for reform. For more information, please consult: https:/lwww.jprnorgan.mm/global/disclosures/interbank_offered_rates.

JPMorgan Chase Bank, N.A. Member FDIC.

JPMorgan Chase Bank, N.A., organized under the laws of U.S.A. with limited liability.

References

“Transactional risk insurance 2024: Year in review”, Marsh, 2025.