What we do

Local businesses and organizations are at the heart of our communities. When they do well, we all do well. We’ve been working for more than 100 years to provide capital, expertise and financial solutions to spur business growth and make communities stronger. Want to learn more about our mission and our impact?

How we uplift communities

Our efforts to help power economic growth focus on several key areas: strengthening local and diverse businesses, supporting vital institutions, and developing and advancing our communities.

Affordable housing

We provide financing and services to developers and property owners to help keep rents affordable.

Community Development Financial Institutions (CDFIs)

We provide financing to CDFIs so they can support crucial community services.

Local and Diverse Businesses

Our support of local and diverse businesses is key to fostering opportunity and more vibrant communities everywhere.

Government

Innovative municipalities make life easier for their citizens. We help drive those improvements.

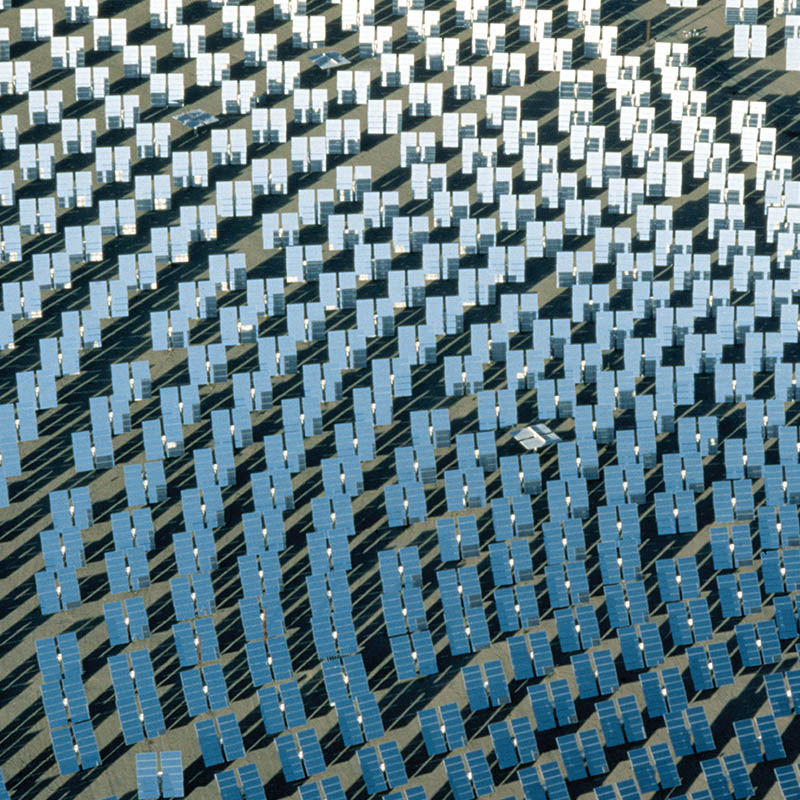

Green Economy Banking

We serve companies that are advancing decarbonization across the globe through innovative business and technology solutions.

Health care

From providers to researchers to startups, we help all of them navigate the health care sector.

Higher education

We support colleges and universities so they can operate more efficiently.

Minority Depository Institutions (MDIs)

We're channeling our investments and resources to help MDIs grow and positively impact our communities.

Midsize companies

We help guide their growth by providing access to capital and business opportunities.

Nonprofits

We’ve been supporting nonprofits for years—allowing them to do the work the world needs.

Related insights

Real Estate

Helping more Tampa families find shelter, stable housing—and beyond

Jul 10, 2025

Metropolitan Ministries significantly expanded its shelter capacity and permanent supportive housing to help families struggling amid Florida’s affordable housing crisis.

Read more

Real Estate

What a recession could mean for commercial real estate

Jun 24, 2025

Even a mild recession could impact each asset class differently. Leaders across the industry discuss how commercial real estate investors can prepare for an economic downturn.

Read moreMore resources

More resources

Private Business Advisory

Every business eventually faces a transition, so it’s crucial for owners to understand their options, whether it’s selling at the right time or retaining a legacy business across generations.

Chase Connect®

Manage multiple accounts and control cash flow—all from one dashboard, anywhere and anytime.

Global Research

Find industry-leading analysis and investment advice from J.P. Morgan’s Research team.

Our corporate impact

Find out how JPMorgan Chase is creating a more inclusive economy.

Our newsletters

Access economic and industry insights.

Our podcasts

Hear discussions on research, treasury and more.

Get in touch

Hide

Get in touch

Hide