Save time and earn cash back with Cashflow360, your one-stop shop for secure, automated digital payments.

Green Economy Banking

We serve companies that are advancing decarbonization across the globe through innovative business and technology solutions. Our role is to provide Green Economy companies with the financial expertise, services and long-term support they need to scale.

What we do

With JPMorgan Chase’s unmatched investment capacity, strong support model, and global scale, the Green Economy Banking team delivers the full suite of the firm’s financial products and advisory services to help fuel the growth of green businesses and the industry at large.

JPMorgan Chase’s sustainability efforts

Business has an important role to play in advancing the transition to a low-carbon economy. We are applying our capital, data, expertise and other resources to help address climate change and promote long-term, innovative solutions for a more sustainable future.

Our expertise

Commercial Banking’s Green Economy Banking team serves companies that are advancing decarbonization through transformative technologies. We provide sector-specific expertise across three coverage areas.

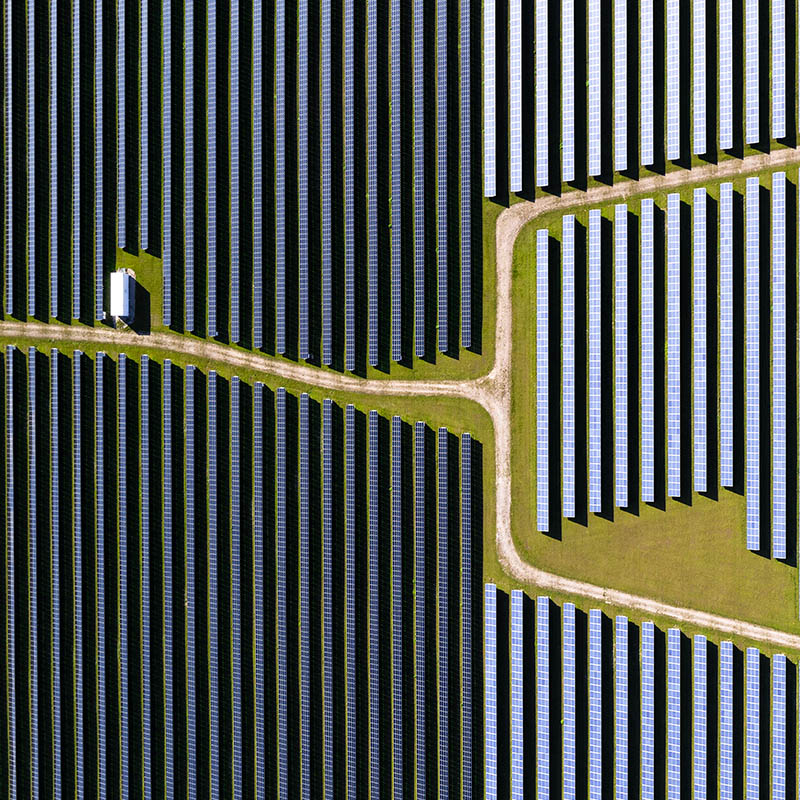

Renewable energy

This team supports companies involved in the generation and storage of power and fuels from renewable sources, as well as the equipment and service providers that support it.

Sustainable finance

This team supports financial firms providing capital or project financing to sustainability-focused companies, companies providing services like the exchange of carbon and renewable energy credits, or companies providing consumer financing for goods and services that accelerate the carbon transition.

Climate tech

The Climate Tech team serves companies that are advancing decarbonization through transformative technologies including EV manufacturing and charging, energy storage, agriculture and food technology, waste management and energy-efficient software.

Our Green Economy Banking leaders

We provide access to differentiated industry expertise and a comprehensive set of financial solutions to support our clients throughout every stage of growth.

More support for Green Economy companies

We're working to support the transition to a low-carbon economy by scaling green solutions, balancing environmental, social and economic needs, and managing our operational footprint.

J.P. Morgan’s center of excellence provides clients the data and firmwide expertise needed to navigate the challenges of transitioning to a low-carbon future.

J.P. Morgan Access® offers a suite of digital solutions to help manage your business’ treasury needs.

We offer ESG-focused products that seek to meet financial goals while also meeting client objectives for sustainable outcomes through our sustainable investing solutions.

Pursuing your vision for tomorrow begins with the right guidance. We have guided clients through market ups and downs for over 200 years.

Related insights

2:05 - Banking

Gameday Couture transforms the world of licensed fan gear for women

Jan 29, 2026

Meet Shawnna Feddersen, founder and CEO of Gameday Couture, a trailblazer who has disrupted the women’s sports apparel industry with innovative designs and strategic partnerships.

Watch video

0:30 - Banking

Montara: Innovative therapies for neurological diseases

Jan 28, 2026

See how J.P. Morgan Startup Banking helped Montara Therapeutics scale securely—so the team could focus on developing therapies for neurological diseases.

Watch videoMore resources

More resources

Client success stories

Hear firsthand how J.P. Morgan's products, solutions and insights help our clients achieve their business goals, now and in the future.

Director Advisory Services

Director Advisory Services (DAS) provides strategic, board-level advice to corporate clients and individuals on governance, board succession planning and board building.

ESG at J.P. Morgan

Learn about our approach to ESG and access the latest ESG research and insights. Discover how we are helping support a sustainable and inclusive economy for our clients and the communities we serve.

Global Research

Find industry-leading analysis and investment advice from J.P. Morgan’s Research team.

Our newsletters

Access economic and industry insights.

Our podcasts

Hear discussions on research, treasury and more.

Get in touch

Hide

Get in touch

Hide